VA Pension Eligibility: A Guide for Veterans and Their Families

The Department of Veterans Affairs (VA) offers a pension program to provide financial assistance to eligible veterans and their families. This program, commonly known as VA Pension, is designed to help those who have served our country during times of war or in certain other circumstances.

To determine VA Pension eligibility, several factors are taken into consideration. Let’s explore the key requirements that veterans and their families should be aware of:

Service Requirements:

To qualify for VA Pension, veterans must have served at least 90 days of active duty with at least one day during a wartime period. However, if the service began after September 7, 1980, a minimum of 24 months or the full period for which the veteran was called to active duty is required.

Wartime Periods:

The VA recognizes specific wartime periods when determining eligibility for pension benefits. These periods include World War II, the Korean War, the Vietnam War, and the Gulf War.

Age and Disability:

Veterans must be at least 65 years old or permanently disabled to meet the age and disability requirements for VA Pension eligibility. Permanent disability can be service-related or non-service-related but should meet specific criteria set by the VA.

Income Limitations:

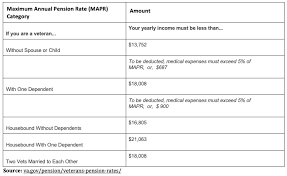

Income limitations are an essential aspect of determining eligibility for VA Pension benefits. The VA considers both countable income (such as earnings from employment) and deductible expenses (such as medical costs) when calculating income thresholds.

Net Worth:

The VA also evaluates net worth when assessing eligibility for pension benefits. While there is no fixed limit on net worth, it should generally be below a certain threshold determined by legislation.

It’s important to note that there are different types of pensions within the VA Pension program: Improved Pension (commonly referred to as “Aid and Attendance”) and Housebound Allowance. These additional benefits provide increased financial assistance to veterans who require regular aid and attendance or are housebound due to a disability.

To apply for VA Pension benefits, veterans or their surviving spouses need to complete the necessary application forms and provide supporting documentation, including military service records, medical evidence, and financial information.

Navigating the VA Pension eligibility process can be complex, but there are resources available to help. The VA’s website provides detailed information on eligibility criteria and application procedures. Additionally, veterans service organizations and accredited agents can offer guidance and assistance throughout the application process.

In conclusion, VA Pension eligibility is determined by various factors such as service requirements, age or disability status, income limitations, and net worth. Understanding these criteria is crucial for veterans and their families seeking financial assistance through the VA Pension program. By familiarizing themselves with the requirements and utilizing available resources, eligible individuals can access the support they deserve for their dedicated service to our nation.

8 Essential Tips for Understanding VA Pension Eligibility and Application Process

- Understand the different types of VA pension benefits. Eligibility criteria and benefit amounts vary depending on the type of pension you are eligible for.

- Make sure to meet all eligibility requirements, including length of service, disability status, financial need, and age or certain medical conditions.

- Research other programs that could supplement your VA pension such as Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or Medicaid/Medicare benefits.

- Learn about any special needs trusts that may be available to you as a veteran with a disability or long-term care needs.

- Gather all necessary documents for applying for a VA pension such as discharge papers, military service records, Social Security numbers, marriage certificates and birth certificates of dependents if applicable.

- Contact your local county Veterans Service Officer who can help guide you through the application process and provide assistance in finding additional resources if needed .

- Stay up to date on any changes in VA pension eligibility requirements by visiting the Department of Veteran Affairs website regularly .

- Be patient when applying for a VA pension as it can take several months to process an application and receive a decision from the Department of Veteran Affairs .

Understand the different types of VA pension benefits. Eligibility criteria and benefit amounts vary depending on the type of pension you are eligible for.

Understanding the Different Types of VA Pension Benefits

When it comes to VA Pension eligibility, it’s crucial to understand that there are different types of benefits available. Each type has its own set of eligibility criteria and benefit amounts. By familiarizing yourself with these distinctions, you can better navigate the application process and ensure you receive the appropriate financial assistance.

One common type of VA Pension benefit is the Improved Pension, often referred to as “Aid and Attendance.” This benefit is intended for veterans who require regular aid and attendance from another person or are housebound due to a disability. To be eligible for this specific pension, veterans must meet certain criteria related to their care needs and medical conditions.

Another type of VA Pension benefit is the Housebound Allowance. This benefit is designed for veterans who have a single permanent disability rated as 100% disabling or multiple disabilities with a combined rating of 100%, leaving them confined to their homes due to their disabilities.

It’s important to note that eligibility criteria and benefit amounts can vary depending on the type of pension you qualify for. For example, the income limits and net worth requirements may differ between different types of pensions. Additionally, the documentation required during the application process may vary based on the specific benefits you are seeking.

To ensure you receive accurate information regarding your eligibility and potential benefits, it’s advisable to consult official resources such as the Department of Veterans Affairs (VA) website or reach out to veterans service organizations. These sources can provide detailed information on each type of pension and guide you through understanding the specific requirements associated with each.

By taking the time to understand the different types of VA Pension benefits available, you can make informed decisions about which program suits your needs best. Being aware of eligibility criteria and benefit amounts will help streamline your application process and increase your chances of receiving appropriate financial support.

Remember, if you have any doubts or questions about your eligibility or which type of pension may be suitable for you, don’t hesitate to seek assistance from professionals who specialize in veterans’ benefits. They can provide personalized guidance and ensure you have the necessary information to make the most of the VA Pension program.

Make sure to meet all eligibility requirements, including length of service, disability status, financial need, and age or certain medical conditions.

Meeting All Eligibility Requirements: A Crucial Step for VA Pension Eligibility

When it comes to applying for VA Pension benefits, it is essential to ensure that you meet all the eligibility requirements set forth by the Department of Veterans Affairs. These requirements encompass various aspects, including length of service, disability status, financial need, and age or certain medical conditions. By carefully reviewing and fulfilling each criterion, you can increase your chances of qualifying for this valuable assistance.

Firstly, veterans must have served a minimum period of active duty during specific wartime periods to meet the service requirement. This typically entails at least 90 days of service with at least one day served during a recognized wartime period. However, exceptions may apply depending on when and where the veteran served.

Next, disability status plays a significant role in determining eligibility. Veterans must demonstrate either permanent disability or be at least 65 years old to fulfill this requirement. Permanent disability can be service-related or non-service-related but should meet specific criteria established by the VA.

Financial need is another crucial aspect considered in VA Pension eligibility. The VA evaluates both countable income and deductible expenses to determine if an applicant’s income falls within the allowable limits. It is important to understand how these calculations are made and gather all necessary financial documentation to support your application.

Lastly, age or certain medical conditions are taken into account when assessing eligibility. Veterans who are at least 65 years old automatically meet this requirement. Alternatively, veterans who are younger but have specific medical conditions may also qualify for pension benefits.

To ensure that you meet all eligibility requirements for VA Pension benefits:

- Review the specific criteria outlined by the VA: Familiarize yourself with the detailed guidelines provided by the Department of Veterans Affairs regarding length of service, disability status, financial need, and age or medical conditions.

- Gather all relevant documentation: Collect any necessary records that support your eligibility claims such as military service records, medical evidence, and financial information.

- Seek assistance if needed: If you find the eligibility requirements complex or have any questions, reach out to veterans service organizations or accredited agents who can provide guidance and support throughout the application process.

By making sure you meet all eligibility requirements, you increase your chances of successfully obtaining VA Pension benefits. This financial assistance can make a significant difference in improving your quality of life and easing any financial burdens that may arise from your service to our country.

Research other programs that could supplement your VA pension such as Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or Medicaid/Medicare benefits.

Exploring Supplemental Programs to Enhance Your VA Pension Eligibility

When determining your eligibility for VA Pension benefits, it’s essential to consider other programs that can supplement your financial support. These additional programs can provide further assistance and ensure that you receive the maximum benefits available to you. Let’s take a closer look at some of these supplemental programs.

One program to consider is Social Security Disability Insurance (SSDI). If you have a disability that prevents you from engaging in substantial gainful activity and have earned enough work credits, SSDI may be an option. It offers monthly cash benefits to individuals with disabilities, including veterans, based on their work history and contributions.

Supplemental Security Income (SSI) is another program worth exploring. SSI provides financial assistance to disabled individuals with limited income and resources. Eligibility for SSI is not dependent on work history but rather on financial need. This program can be particularly helpful for veterans who may not qualify for SSDI but still require additional financial support.

Medicaid and Medicare are healthcare programs that can also supplement your VA pension benefits. Medicaid provides medical coverage for individuals with limited income, while Medicare offers health insurance primarily for people aged 65 and older or those with certain disabilities. Both programs can alleviate the burden of healthcare expenses and ensure access to necessary medical services.

Researching these supplemental programs is crucial because they can enhance your overall financial stability and well-being. By combining VA Pension benefits with these additional resources, you can create a more comprehensive support system tailored to your specific needs.

To explore these programs further, visit the respective websites or contact local offices that administer these benefits. Additionally, reaching out to veterans service organizations or consulting with accredited agents who specialize in veteran benefits can provide valuable guidance throughout this process.

Remember, each program has its own eligibility criteria and application process, so it’s important to thoroughly understand the requirements before applying. Take advantage of available resources and seek assistance when needed to ensure you make the most informed decisions regarding your financial support.

By researching and utilizing supplemental programs like SSDI, SSI, Medicaid, and Medicare, you can enhance your VA Pension benefits and create a more robust safety net for yourself or your loved ones. These programs exist to provide additional assistance to those who have served our country, ensuring that you receive the comprehensive support you deserve.

Learn about any special needs trusts that may be available to you as a veteran with a disability or long-term care needs.

Learn About Special Needs Trusts: A Valuable Resource for Veterans with Disabilities or Long-Term Care Needs

For veterans with disabilities or long-term care needs, understanding all available financial resources is essential. One valuable tool that can provide financial support and peace of mind is a Special Needs Trust (SNT). If you are a veteran in this situation, it’s important to learn about SNTs and how they can benefit you.

A Special Needs Trust is a legal arrangement designed to protect the assets and financial well-being of individuals with disabilities. It allows funds to be set aside for their benefit without jeopardizing eligibility for government assistance programs, such as VA Pension benefits.

As a veteran, if you have a disability or require long-term care, establishing an SNT can be highly beneficial. Here are some key reasons why:

Preservation of Eligibility:

One of the primary advantages of an SNT is that it helps preserve your eligibility for government assistance programs. By placing funds into the trust, they are not considered as countable assets when determining eligibility for benefits like VA Pension. This ensures that you can receive the necessary financial aid while still having additional resources available through the trust.

Supplemental Support:

An SNT allows for supplemental support beyond what government programs provide. The trust funds can be used to cover various expenses not covered by public benefits, such as specialized medical care, therapies, adaptive equipment, education, housing modifications, transportation, and recreational activities. This provides flexibility in meeting your specific needs and enhancing your quality of life.

Asset Protection:

By placing assets into an SNT, they are protected from being counted towards Medicaid spend-down requirements or other means-tested programs. This protection ensures that your hard-earned savings and resources are safeguarded for your future needs while still allowing you to access necessary government assistance.

To take advantage of the benefits offered by an SNT, it’s important to consult with an attorney who specializes in estate planning and special needs trusts. They can guide you through the process of establishing the trust and ensure it complies with all legal requirements.

As a veteran, you may also want to explore resources specific to veterans, such as organizations that offer legal assistance or financial planning services tailored to your needs. These organizations can provide guidance on how to integrate the SNT into your overall financial plan and help maximize its benefits.

In conclusion, for veterans with disabilities or long-term care needs, learning about Special Needs Trusts is crucial. By establishing an SNT, you can preserve eligibility for government assistance programs while still having additional funds available to enhance your quality of life. Consult with professionals experienced in this field to ensure that you make informed decisions and secure a brighter future for yourself or your loved ones.

Gather all necessary documents for applying for a VA pension such as discharge papers, military service records, Social Security numbers, marriage certificates and birth certificates of dependents if applicable.

Gathering Essential Documents for VA Pension Eligibility: A Must-Do Step

When applying for a VA pension, it is crucial to gather all the necessary documents to ensure a smooth and efficient application process. These documents serve as evidence to support your eligibility and provide the Department of Veterans Affairs (VA) with the information they need to evaluate your case. Here are some essential documents you should gather:

- Discharge Papers: Your discharge papers, also known as DD-214 or separation documents, verify your military service and type of discharge. This document is vital in establishing your eligibility for VA benefits.

- Military Service Records: Gathering your military service records will help provide additional details about your service, including dates of enlistment and discharge, duty assignments, and any awards or commendations received.

- Social Security Numbers: Ensure you have the Social Security numbers of yourself and any dependents you may have. This information is necessary for identification purposes throughout the application process.

- Marriage Certificates: If you are married, be sure to obtain a copy of your marriage certificate. This document verifies your marital status and allows the VA to consider benefits for your spouse.

- Birth Certificates of Dependents: If you have dependent children, gather their birth certificates as well. These documents establish their relationship to you and determine their eligibility for certain benefits.

By gathering these essential documents beforehand, you can streamline the application process and avoid delays caused by missing or incomplete information. It is recommended to keep these documents in a safe place or make copies so that they are readily available when needed.

Remember that each individual’s situation may vary, so it’s always wise to consult with a veterans service organization or an accredited agent who can guide you through the specific requirements based on your circumstances.

Taking the time to collect all necessary documents demonstrates preparedness and helps ensure that your application for a VA pension receives prompt attention from the VA. By providing the required information upfront, you can increase your chances of a successful and timely outcome.

In summary, gathering documents such as discharge papers, military service records, Social Security numbers, marriage certificates, and birth certificates of dependents (if applicable) is an essential step in applying for a VA pension. Being organized and thorough in your document collection will contribute to a smoother application process and expedite the evaluation of your eligibility for VA benefits.

Contact your local county Veterans Service Officer who can help guide you through the application process and provide assistance in finding additional resources if needed .

Seeking Assistance: Contact Your Local County Veterans Service Officer for VA Pension Eligibility

When it comes to applying for VA Pension benefits, navigating the process can sometimes feel overwhelming. However, veterans and their families should know that they don’t have to face it alone. One valuable resource available to them is their local County Veterans Service Officer (CVSO).

A County Veterans Service Officer is a trained professional who specializes in assisting veterans and their families with various aspects of accessing benefits and services. They are well-versed in the intricacies of VA programs, including VA Pension eligibility.

If you are considering applying for VA Pension benefits or have questions about your eligibility, reaching out to your local CVSO can be immensely helpful. These officers have a deep understanding of the application process and can guide you through each step, ensuring that you complete the necessary paperwork correctly.

One of the primary roles of a CVSO is to provide personalized assistance. They will take the time to listen to your specific circumstances and help determine if you meet the eligibility criteria for VA Pension benefits. They can review your military service records, assess your income and financial situation, and provide guidance on gathering any required documentation.

Furthermore, CVSOs are well-connected within their communities and have access to a wealth of resources. If additional support or services are needed beyond what is offered through the VA Pension program itself, they can help connect you with local organizations or agencies that may be able to assist you further.

By contacting your local CVSO, you not only gain expert guidance but also benefit from their commitment to serving veterans and their families. These officers are dedicated professionals who understand the challenges faced by those who have served our country and are passionate about helping them access the support they deserve.

To find your nearest County Veterans Service Officer, you can visit your county’s official website or reach out to your state’s Department of Veterans Affairs. They will provide you with contact information and details on how to schedule an appointment.

Remember, you don’t have to navigate the VA Pension eligibility process alone. Reach out to your local County Veterans Service Officer today, and let their expertise and support guide you through the application process.

Stay up to date on any changes in VA pension eligibility requirements by visiting the Department of Veteran Affairs website regularly .

Staying Informed: Keeping Up with VA Pension Eligibility Changes

If you or a loved one are considering applying for VA Pension benefits, it is essential to stay up to date on any changes in eligibility requirements. The Department of Veterans Affairs (VA) periodically updates its guidelines and criteria, and being aware of these changes can help ensure that you have the most accurate and current information.

One of the best ways to stay informed is by visiting the official Department of Veterans Affairs website regularly. The VA’s website serves as a comprehensive resource for veterans and their families, providing valuable information on various benefits and programs, including VA Pension.

By frequently checking the VA’s website, you can access the latest updates on eligibility requirements, application procedures, and any changes that may have occurred. The website offers detailed explanations of the eligibility criteria for different types of pensions, such as Improved Pension (Aid and Attendance) and Housebound Allowance.

In addition to eligibility requirements, the VA website provides helpful resources like forms, FAQs, and contact information for further assistance. It also highlights any news or announcements related to VA benefits that may impact your pension eligibility.

By staying informed about changes in VA pension eligibility requirements, you can ensure that your application is accurate and up to date when you decide to apply. This proactive approach helps avoid potential delays or misunderstandings during the application process.

Apart from visiting the VA’s website regularly, consider signing up for email updates or newsletters provided by the Department of Veterans Affairs. These subscriptions often deliver important information directly to your inbox, ensuring that you don’t miss out on any crucial updates.

Additionally, reaching out to local veterans service organizations or contacting accredited agents who specialize in VA benefits can provide further guidance on staying updated with changes in eligibility criteria. These professionals are well-versed in navigating the complexities of VA benefits and can offer valuable insights tailored to your specific situation.

Remember that keeping yourself informed about changes in VA pension eligibility requirements is an ongoing process. By staying up to date, you can make informed decisions and have peace of mind knowing that you are taking full advantage of the benefits you rightfully deserve.

So, make it a habit to visit the Department of Veterans Affairs website regularly, explore the available resources, and stay connected with reputable organizations that can assist you along the way. Your dedication and service to our nation deserve the utmost support, and staying informed is a crucial step towards accessing the benefits you’ve earned.

Be patient when applying for a VA pension as it can take several months to process an application and receive a decision from the Department of Veteran Affairs .

The Importance of Patience in Applying for a VA Pension

When it comes to applying for a VA pension, it’s essential to remember that patience is key. The process of applying and receiving a decision from the Department of Veterans Affairs (VA) can often take several months. While waiting for a decision may be frustrating, understanding the reasons behind the timeline can help ease any concerns.

The VA pension application process involves various steps, including gathering and submitting necessary documents, such as military service records, medical evidence, and financial information. Once the application is submitted, it goes through a thorough review by VA officials who carefully evaluate eligibility based on specific criteria.

The length of time it takes to process an application can vary depending on factors such as the complexity of the case, the volume of applications being processed at any given time, and any additional information or documentation required. It’s important to recognize that each application is unique and must be thoroughly reviewed to ensure accuracy and fairness.

While waiting for a decision, it’s crucial to remain patient and avoid unnecessary stress. Remember that the VA is committed to providing proper consideration to every applicant. In some cases, additional information or clarification may be requested during the review process. This should not be seen as a setback but rather as an opportunity to provide further support for your application.

During this waiting period, it can be helpful to stay informed about the progress of your application by regularly checking its status through the VA’s online portal or by contacting their helpline. This will give you peace of mind and keep you updated on any developments regarding your case.

It’s also worth noting that if you have any urgent financial needs while waiting for your VA pension decision, there may be other resources available to assist you temporarily. Local veterans service organizations or state agencies might offer emergency financial aid programs specifically designed to support veterans in need.

In conclusion, patience is crucial when applying for a VA pension. While it may take several months to process an application and receive a decision from the VA, understanding the complexities involved can help alleviate frustration. Remember that the VA is dedicated to ensuring fair and accurate evaluations of each application. By staying informed, remaining patient, and utilizing available resources, you can navigate the process with confidence, knowing that your application is receiving the attention it deserves.