VA Pension Benefits: Providing Support for Our Veterans

When it comes to supporting our veterans, the United States Department of Veterans Affairs (VA) offers a range of benefits to ensure that those who have served our country receive the care and assistance they deserve. One such benefit is the VA Pension, a program designed to provide financial support to eligible veterans and their families.

The VA Pension benefit is specifically aimed at veterans who have limited or no income and are considered to be in financial need. It provides a tax-free monthly payment that can help cover essential living expenses such as housing, food, and medical costs. This benefit can make a significant difference in the lives of veterans who may be struggling financially.

Eligibility for the VA Pension is based on several factors including the veteran’s age, service history, disability status, and income level. To qualify, veterans must have served at least 90 days of active duty with at least one day during a wartime period (although there are exceptions for certain circumstances). Additionally, veterans must meet income and asset limits set by the VA.

One important aspect of the VA Pension benefit is that it also extends support to surviving spouses and dependent children of deceased veterans. This ensures that even after a veteran has passed away, their loved ones can still receive financial assistance to help them through difficult times.

Applying for VA Pension benefits may seem like a complex process, but fortunately, there are resources available to assist veterans and their families in navigating through it. The VA provides detailed information on its website about eligibility requirements and how to apply. Additionally, local VA offices have trained staff members who can offer guidance and support throughout the application process.

It’s important for veterans and their families to be aware of all the benefits they may be entitled to receive. The VA Pension is just one example of how our nation honors its commitment to those who have served in our armed forces. By providing financial assistance through this program, we are ensuring that our veterans can live with dignity and receive the care they need.

In conclusion, the VA Pension benefit is a vital resource for veterans and their families who are facing financial hardships. It offers a lifeline of support, helping to alleviate some of the burdens that veterans may encounter. If you or someone you know is a veteran in need, it is crucial to explore the options available through the VA Pension program. Let us continue to honor and support those who have selflessly served our country.

7 Essential Tips for Maximizing Your VA Pension Benefits

- Know your eligibility requirements

- Understand the different types of benefits

- Find out if you qualify for any additional benefits

- File your claim early

- Keep track of all documentation

- Stay up-to-date on changes

- Utilize resources available through the VA

Know your eligibility requirements

Know Your Eligibility Requirements for VA Pension Benefits

When it comes to accessing VA Pension benefits, one of the most important steps is understanding your eligibility requirements. By familiarizing yourself with the criteria set by the United States Department of Veterans Affairs (VA), you can determine if you qualify for this valuable financial support.

Eligibility for VA Pension benefits is based on various factors, including your military service history, disability status, age, and income level. To be eligible, you must have served at least 90 days of active duty with at least one day during a wartime period. However, certain exceptions apply in special circumstances.

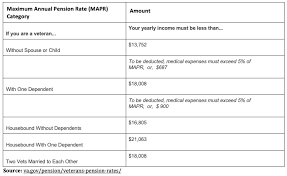

Income and asset limits are also considered when determining eligibility. The VA takes into account your household income from all sources to assess if you meet the financial need criteria. Additionally, your net worth (including property and investments) should fall below a specified threshold.

To ensure you have accurate information about your eligibility requirements, it is recommended to visit the official VA website or consult with a local VA office. These resources provide detailed guidelines and can help answer any specific questions you may have.

Understanding your eligibility requirements is crucial as it allows you to determine if you qualify for VA Pension benefits. By knowing these requirements in advance, you can gather the necessary documentation and evidence to support your application.

Applying for VA Pension benefits can be a complex process, but by being well-informed about your eligibility requirements, you can navigate through it more efficiently. It’s essential to take advantage of the available resources and seek guidance from knowledgeable professionals who can assist you throughout the application process.

By knowing your eligibility requirements for VA Pension benefits, you are taking an important step towards accessing the financial support that our nation provides to honor those who have served in our armed forces. Remember to stay informed and reach out for assistance when needed so that you can receive the benefits that you rightfully deserve.

Understand the different types of benefits

Understanding the Different Types of VA Pension Benefits

When it comes to VA Pension benefits, it’s essential to have a clear understanding of the different types of benefits available. This knowledge can help veterans and their families make informed decisions and ensure they receive the support they need.

- Improved Pension: The Improved Pension benefit is designed for veterans who are 65 years or older, or those who have a permanent and total disability. This benefit provides additional financial assistance to eligible veterans who require aid and attendance or are housebound.

- Survivors Pension: The Survivors Pension benefit is aimed at surviving spouses and dependent children of deceased veterans. To qualify, the veteran must have served during a period of war, and the surviving spouse must meet certain income and net worth criteria. This benefit offers financial assistance to help with daily living expenses.

- Special Monthly Pension: The Special Monthly Pension (SMP) is available to veterans or surviving spouses who require higher levels of care due to disabilities or certain medical conditions. SMP provides additional financial support beyond the standard pension amount, making it crucial for those with specific healthcare needs.

- Aid and Attendance: Aid and Attendance (A&A) is an additional benefit that can be added to both Improved Pension and Survivors Pension programs. A&A is intended for individuals who require assistance with daily living activities, such as bathing, dressing, or eating. This benefit provides extra funds to help cover the costs associated with caregiving services.

- Housebound Allowance: Similar to Aid and Attendance, the Housebound Allowance is an add-on benefit for veterans whose disabilities confine them to their homes most of the time due to their health conditions. It offers additional financial support on top of the regular pension amount.

Understanding these different types of VA Pension benefits can greatly impact a veteran’s quality of life by ensuring they receive appropriate financial assistance based on their unique circumstances. It’s crucial for veterans and their families to explore all the options available and determine which benefits they may be eligible for.

To access these benefits, veterans and their families can reach out to their local VA office or visit the official VA website for detailed information and guidance. It’s important to remember that each benefit has specific eligibility criteria, so seeking assistance from professionals who specialize in VA benefits can be beneficial.

By understanding the various types of VA Pension benefits, veterans and their families can make informed decisions about the support they need. Let us continue to honor our veterans by ensuring they receive the benefits they deserve for their dedicated service to our country.

Find out if you qualify for any additional benefits

VA Pension Benefits: Find Out If You Qualify for Additional Support

When it comes to VA Pension benefits, it’s essential for veterans and their families to explore all the available options. While the VA Pension program provides valuable financial assistance, it’s important to remember that there may be additional benefits you could qualify for.

The first step is to determine your eligibility for the VA Pension benefit itself. Consider factors such as your service history, income level, and disability status. If you meet the requirements, you can start receiving monthly payments to help cover your living expenses.

However, don’t stop there. Take the time to investigate if you qualify for any other benefits offered by the VA. There are various programs and resources designed to provide support in different areas of veterans’ lives.

For example, if you have a service-connected disability or injury, you may be eligible for disability compensation. This benefit provides financial assistance based on the severity of your condition and its impact on your ability to work or perform daily activities.

Another potential avenue is healthcare benefits. The VA offers comprehensive medical services to eligible veterans, including access to doctors, specialists, medications, and hospital care. By exploring this option, you can ensure that your healthcare needs are met without straining your finances.

Education and training opportunities are also available through programs like the GI Bill. Whether you’re looking to pursue a degree or acquire new skills for a civilian career, these educational benefits can open doors and help you achieve your goals.

Other potential benefits include home loans, life insurance coverage, vocational rehabilitation services, and assistance with burial expenses.

To find out if you qualify for additional benefits beyond VA Pension, reach out to your local VA office or visit their website. Trained professionals can guide you through the application process and provide personalized advice based on your circumstances.

Remember that these benefits exist because our nation recognizes the sacrifices made by veterans like yourself. By taking advantage of all available resources, you can ensure that you receive the support you deserve.

In conclusion, while the VA Pension benefit is a valuable form of financial assistance, it’s crucial to explore if you qualify for any additional benefits. By doing so, you can access a range of programs and resources that are designed to support veterans in various aspects of their lives. Take the time to investigate and reach out for assistance – it’s an investment in your well-being and future success.

File your claim early

Filing Your Claim Early: Maximizing VA Pension Benefits

When it comes to accessing VA Pension benefits, one of the most important tips to keep in mind is to file your claim as early as possible. By doing so, you can maximize your chances of receiving the financial support you deserve in a timely manner.

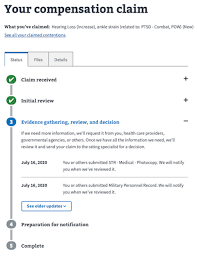

The VA Pension program provides essential financial assistance to eligible veterans and their families. However, the application process can sometimes be lengthy due to the necessary documentation and evaluation procedures. That’s why it’s crucial to start the process early.

By filing your claim early, you give yourself ample time to gather all the required documents and information needed for a successful application. This includes military service records, medical records, financial statements, and any other supporting evidence that may be necessary to demonstrate your eligibility.

Additionally, filing early allows you to address any potential issues or discrepancies that may arise during the application process. It gives you the opportunity to seek assistance from VA representatives or other organizations specializing in veteran benefits, ensuring that your claim is accurate and complete.

Another advantage of filing early is that it helps expedite the review and decision-making process by VA officials. While processing times can vary depending on various factors, submitting your claim ahead of time increases the likelihood of receiving a prompt response and avoiding unnecessary delays.

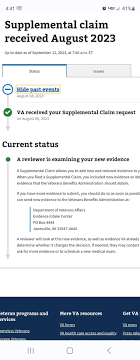

Furthermore, by filing early, you can start receiving your benefits sooner. The VA Pension benefit is typically awarded retroactively from the date of application rather than from when approval is granted. This means that every day spent waiting for approval is a day without potential financial support.

In conclusion, filing your claim for VA Pension benefits as early as possible is a smart strategy for maximizing your chances of receiving timely assistance. By starting the process promptly, gathering all necessary documentation, addressing any issues proactively, and expediting review timescales – you position yourself for a smoother experience overall.

Remember that every day counts when it comes to securing much-needed financial support. If you or a loved one is eligible for VA Pension benefits, don’t delay in taking the necessary steps to file your claim. By doing so, you are setting yourself up for a higher likelihood of success and ensuring that you receive the support you deserve without unnecessary delays.

Keep track of all documentation

When it comes to navigating the VA Pension benefit process, one essential tip is to keep track of all documentation. The application process can be complex, and having organized records will make it easier for you to provide the necessary information and evidence required to support your claim.

Maintaining a file or folder specifically dedicated to your VA Pension benefits will help you stay organized. Keep copies of important documents such as your military service records, discharge papers, medical records, and financial statements. These documents will serve as evidence of your eligibility and financial need.

Additionally, make sure to keep a record of any correspondence or communication you have with the VA. This includes letters, emails, and phone call logs. Having a clear record of all interactions can be invaluable if any issues or discrepancies arise during the application process.

By keeping track of all documentation related to your VA Pension benefits, you are ensuring that you have everything readily available when needed. It helps streamline the application process and reduces the chances of delays or complications.

Remember that accuracy is crucial when submitting documentation. Double-check that all information is complete and up-to-date before including it in your application. If you are unsure about any specific requirements or forms needed, reach out to the VA for guidance.

In conclusion, staying organized by keeping track of all documentation is an essential tip when applying for VA Pension benefits. By doing so, you are taking proactive steps to ensure a smooth and efficient process. Your preparedness will not only save time but also increase the chances of a successful outcome in receiving the support you deserve as a veteran.

Stay up-to-date on changes

When it comes to VA Pension benefits, staying up-to-date on changes is crucial for veterans and their families. The Department of Veterans Affairs periodically updates its policies and regulations, which can have a direct impact on eligibility requirements and benefit amounts. By staying informed about these changes, veterans can ensure they are receiving the maximum benefits they are entitled to.

One way to stay updated is by regularly visiting the official VA website. The website provides a wealth of information regarding VA Pension benefits, including any recent updates or revisions. It’s important to review these updates and understand how they may affect your eligibility or the amount of financial assistance you receive.

Additionally, subscribing to newsletters or email updates from veteran support organizations can be beneficial. These organizations often provide timely information about changes in VA policies and regulations. They may also offer resources and guidance on how to navigate through any new requirements.

Attending informational seminars or workshops conducted by veteran service organizations or local VA offices is another great way to stay informed. These events often cover important topics related to VA benefits, including updates on pension programs. By attending these sessions, veterans can ask questions directly to experts in the field and gain a better understanding of any recent changes.

Lastly, maintaining open communication with your local VA office is essential. They are there to assist you and answer any questions you may have regarding your benefits. If you have concerns about changes in policies or need clarification on certain aspects of the program, don’t hesitate to reach out for assistance.

Staying up-to-date on changes in VA Pension benefits ensures that veterans and their families receive the support they deserve. By being proactive in seeking information and understanding how policy revisions may impact eligibility or benefit amounts, veterans can make informed decisions about their financial well-being.

Remember: knowledge is power! Stay informed, stay connected, and make the most out of the valuable resources available through VA Pension benefits.

Utilize resources available through the VA

When it comes to accessing VA Pension benefits, it’s essential for veterans and their families to utilize the resources available through the Department of Veterans Affairs (VA). These resources are designed to make the application process smoother and ensure that eligible individuals receive the assistance they deserve.

The VA offers a wealth of information on its website, including eligibility criteria, application forms, and step-by-step guides. By taking the time to explore these resources, veterans can gain a better understanding of their entitlements and how to apply for them. The website also provides contact information for local VA offices where veterans can seek further assistance.

Additionally, reaching out to local VA offices can be incredibly beneficial. These offices have trained staff members who specialize in helping veterans navigate the application process. They can provide personalized guidance, answer questions, and address any concerns that may arise. By tapping into this expertise, veterans can ensure that they are making informed decisions regarding their benefits.

Another valuable resource is veteran service organizations (VSOs). These organizations are dedicated to supporting veterans and their families. VSOs often have knowledgeable staff or volunteers who can provide assistance with VA Pension benefits applications. They can help gather necessary documentation, review forms for accuracy, and offer guidance throughout the entire process.

It’s important to remember that applying for VA Pension benefits may involve gathering various documents such as military service records, financial information, and medical records. The VA provides detailed checklists outlining the required documentation. By carefully reviewing these lists and utilizing available resources like VSOs or local VA offices, veterans can ensure they have all the necessary paperwork ready when submitting their application.

In conclusion, when it comes to accessing VA Pension benefits, utilizing available resources is crucial. The Department of Veterans Affairs website offers comprehensive information and forms while local VA offices provide personalized assistance. Veteran service organizations are also valuable allies in navigating through the application process. By taking advantage of these resources, veterans can maximize their chances of receiving the financial support they deserve.