VA Non-Service Connected Pension: A Lifeline for Veterans in Need

The Department of Veterans Affairs (VA) offers a wide range of benefits to honor and support the men and women who have served in the armed forces. While most people are familiar with benefits such as disability compensation and healthcare, there is another critical program that aims to provide financial assistance to veterans who are facing economic hardships – the VA Non-Service Connected Pension.

The Non-Service Connected Pension is a needs-based program designed to provide a monthly payment to wartime veterans with limited income, who are permanently and totally disabled, or over the age of 65. Unlike other VA benefits, this pension does not require proof of a service-connected disability. It serves as a lifeline for veterans who may not qualify for other forms of financial assistance.

One of the key eligibility requirements for this pension is that the veteran must have served at least 90 days of active duty, with at least one day during a period of war. The specific periods of war recognized by the VA include World War II, the Korean War, the Vietnam War, and the Gulf War. Additionally, veterans must have been discharged under conditions other than dishonorable.

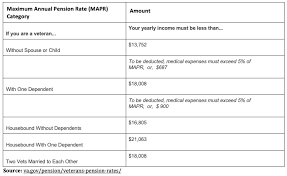

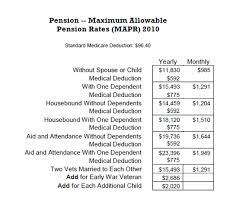

Financial need is also a crucial factor in determining eligibility for this pension. The VA considers both income and assets when evaluating an applicant’s financial situation. Although there are no specific income limits set by the VA, they do take into account factors such as medical expenses and household size when making their determination.

For veterans who meet these eligibility criteria, the Non-Service Connected Pension can provide much-needed financial support. The monthly payment amount varies depending on factors such as income level and whether or not the veteran has dependents. It can be used to cover essential living expenses such as rent or mortgage payments, utility bills, medical costs, and even long-term care expenses.

Applying for this pension can be a complex process, but assistance is available. Veterans can seek guidance from accredited VA claims agents or attorneys who specialize in veterans’ benefits. These professionals can help ensure that all necessary documentation is submitted and provide guidance throughout the application process.

It’s important to note that the Non-Service Connected Pension is separate from other VA benefits, such as disability compensation. Veterans who believe they may be eligible for both programs should explore their options and determine which benefits are most suitable for their circumstances.

The VA Non-Service Connected Pension serves as a crucial safety net for veterans who find themselves in financial distress. It provides support to those who have served our nation and ensures that they receive the assistance they need during challenging times. If you or a loved one are a wartime veteran facing financial difficulties, consider exploring this program to see if it can provide the support you deserve.

6 Essential Tips for VA Non-Service Connected Pension: Eligibility, Documentation, Supplemental Aid, Income Tracking, Rule Updates, and Expert Assistance

- Understand the eligibility requirements for VA Non-Service Connected Pension.

- Make sure you have all the necessary documents and information to apply for the pension.

- Look into other types of aid that may be available to supplement your pension, such as Social Security or Supplemental Security Income (SSI).

- Keep track of any changes in your income or assets that could affect your eligibility for the pension.

- Stay up-to-date on any changes in VA Non-Service Connected Pension rules and regulations that could impact your benefits or eligibility status.

- Contact a financial advisor or an accredited Veterans Service Officer if you need assistance with applying for or managing your VA Non-Service Connected Pension benefits.

Understand the eligibility requirements for VA Non-Service Connected Pension.

Understanding the Eligibility Requirements for VA Non-Service Connected Pension

The VA Non-Service Connected Pension is a valuable program that provides financial assistance to wartime veterans who are facing economic hardships. However, like any other benefit, it is essential to understand the eligibility requirements before applying. By familiarizing yourself with these requirements, you can determine if you qualify and ensure a smoother application process.

First and foremost, to be eligible for the Non-Service Connected Pension, you must be a veteran who has served at least 90 days of active duty, with at least one day during a period of war. The recognized periods of war include World War II, the Korean War, the Vietnam War, and the Gulf War. Additionally, veterans must have received a discharge under conditions other than dishonorable.

Financial need is another crucial factor in determining eligibility. The VA evaluates both income and assets when assessing an applicant’s financial situation. While there are no specific income limits set by the VA for this pension, they do consider factors such as medical expenses and household size when making their determination.

It’s important to note that age can also play a role in eligibility. Veterans who are over the age of 65 automatically meet one of the criteria for this pension. However, younger veterans may still qualify if they are permanently and totally disabled.

To apply for the Non-Service Connected Pension, you will need to gather supporting documentation such as military service records, proof of income and assets, medical records (if applicable), and discharge paperwork. It can be helpful to consult with an accredited VA claims agent or attorney who specializes in veterans’ benefits to ensure that all necessary documentation is submitted correctly.

Understanding these eligibility requirements will help you determine if you qualify for the VA Non-Service Connected Pension. By being well-informed about the criteria and gathering all necessary documentation, you can increase your chances of successfully obtaining this valuable financial assistance. If you or a loved one are a wartime veteran facing economic challenges, take the time to explore this program and see if it can provide the support you need.

Make sure you have all the necessary documents and information to apply for the pension.

Applying for the VA Non-Service Connected Pension can be a complex process, but being prepared with all the necessary documents and information can make it much smoother. Here are some key steps to ensure you have everything you need when applying for this important benefit.

First and foremost, gather all your personal identification documents. This includes your Social Security number, birth certificate, and any military service records you may have. These documents will help establish your identity and verify your eligibility for the pension.

Next, compile any financial information that will be required during the application process. This includes documentation of your income, such as pay stubs or tax returns. Additionally, gather records of any assets you own, such as bank statements or property deeds. Providing a clear picture of your financial situation will help the VA assess your eligibility for the pension.

If you have any medical conditions that contribute to your disability or impact your ability to work, gather relevant medical records as well. This may include doctor’s reports, hospitalization records, or medication prescriptions. These documents will help support your claim and provide evidence of your disability.

It’s also important to have information about any dependents you may have. This includes their names, dates of birth, and Social Security numbers. Dependents can affect the amount of pension payment you may be eligible to receive.

Lastly, consider seeking assistance from accredited VA claims agents or attorneys who specialize in veterans’ benefits. They can guide you through the application process and ensure that all necessary documents are included in your submission.

By having all the necessary documents and information ready when applying for the VA Non-Service Connected Pension, you can streamline the process and increase your chances of a successful application. Remember to keep copies of all submitted documents for future reference.

Taking these steps will help ensure that you are well-prepared when applying for this critical benefit that provides financial support to veterans facing economic hardships. Don’t hesitate to reach out to professionals or organizations that can assist you throughout the application process.

Look into other types of aid that may be available to supplement your pension, such as Social Security or Supplemental Security Income (SSI).

Maximizing Your VA Non-Service Connected Pension: Exploring Additional Aid Options

If you are a veteran receiving the VA Non-Service Connected Pension, it’s essential to make the most of the financial support available to you. While the pension provides crucial assistance, it’s worth exploring other avenues for additional aid that can help further improve your financial situation. One such option is looking into programs like Social Security or Supplemental Security Income (SSI).

Social Security benefits are not exclusive to retirees or individuals with work history. Disabled veterans can also qualify for Social Security Disability Insurance (SSDI) benefits if they meet certain criteria. SSDI provides monthly payments to individuals who have a severe disability that prevents them from engaging in substantial gainful activity.

To be eligible for SSDI, veterans must have worked and paid Social Security taxes for a specific period, accumulating enough work credits. The severity and duration of the disability are also taken into consideration during the application process. Veterans can apply for SSDI benefits through the Social Security Administration website or by visiting their local Social Security office.

Supplemental Security Income (SSI) is another potential source of aid that veterans can explore. SSI is a needs-based program administered by the Social Security Administration, providing cash assistance to individuals with limited income and resources who are aged, blind, or disabled.

To qualify for SSI, veterans must meet specific income and asset limits set by the program. The disability requirements for SSI are generally similar to those of SSDI. Veterans receiving the VA Non-Service Connected Pension may still be eligible for SSI if they meet the necessary criteria.

Exploring these additional aid options can help supplement your VA Non-Service Connected Pension and provide further financial stability. It’s important to note that each program has its own eligibility requirements and application processes, so it’s advisable to consult with professionals or organizations specializing in veterans’ benefits to navigate these systems effectively.

Remember, maximizing your financial support is crucial to ensure you have the resources needed to meet your needs and improve your quality of life. By exploring programs like Social Security or SSI, you can potentially access additional aid that complements your VA Non-Service Connected Pension and provides a more comprehensive safety net.

Take the time to research and understand the eligibility requirements for these programs, and consider seeking assistance from professionals who can guide you through the application process. As a veteran who has served our country, it’s important to explore all available options to secure the support you deserve.

Keep track of any changes in your income or assets that could affect your eligibility for the pension.

Maintaining Eligibility for VA Non-Service Connected Pension: Keep Track of Changes

For veterans relying on the VA Non-Service Connected Pension as a vital source of financial support, it is crucial to understand that changes in income or assets can impact eligibility for this program. Staying vigilant and keeping track of any fluctuations in your financial situation is key to ensuring continued access to this important benefit.

The VA Non-Service Connected Pension is a needs-based program, meaning that it takes into account the income and assets of applicants when determining eligibility. As such, any significant changes in these areas can affect your qualification for the pension.

To safeguard your eligibility, it’s important to regularly monitor and document any changes in your income or assets. If you experience an increase in income due to a new job, promotion, or other factors, it’s essential to report these changes to the VA. Similarly, if there are any reductions in income due to job loss or retirement, inform the VA promptly.

Changes in assets should also be closely monitored. This includes any significant increase or decrease in savings accounts, investments, property ownership, or other valuable possessions. Even inheriting money or property can have an impact on your eligibility for the pension.

By keeping track of these changes and promptly reporting them to the VA, you can ensure that your eligibility for the Non-Service Connected Pension remains accurate and up-to-date. Failure to report changes may result in overpayments or even potential penalties.

It’s worth noting that reporting these changes doesn’t automatically mean you will lose access to the pension. The VA will review each case individually and reassess eligibility based on updated information. However, failure to report changes could lead to complications down the line and potentially jeopardize your benefits.

To make this process easier, consider maintaining organized records of your financial documents. Keep copies of pay stubs, bank statements, tax returns, and other relevant paperwork as proof of any reported changes. This will not only assist you in accurately reporting changes to the VA but also serve as a valuable resource for any future inquiries or reviews.

In conclusion, staying proactive and informed about your financial situation is crucial when it comes to maintaining eligibility for the VA Non-Service Connected Pension. By diligently tracking and reporting any changes in income or assets, you can ensure that you continue to receive the support you deserve as a veteran. Remember, keeping the VA informed is vital in order to maintain a smooth and uninterrupted flow of benefits.

Stay up-to-date on any changes in VA Non-Service Connected Pension rules and regulations that could impact your benefits or eligibility status.

Staying Informed: Key to Maximizing VA Non-Service Connected Pension Benefits

For veterans who rely on the VA Non-Service Connected Pension program, it is crucial to stay up-to-date on any changes in rules and regulations that could affect their benefits or eligibility status. Being informed about these updates can help veterans maximize their benefits and ensure they receive the support they deserve.

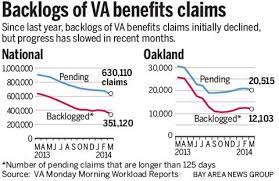

The VA periodically reviews and updates its policies, guidelines, and requirements for various benefits programs, including the Non-Service Connected Pension. These changes can impact eligibility criteria, income limits, asset thresholds, and other important factors that determine a veteran’s qualification for this pension.

By staying informed about these changes, veterans can make necessary adjustments to their financial planning and ensure they meet the updated criteria. It also allows them to take advantage of any new opportunities or benefits that may become available as a result of these modifications.

One way to stay informed is by regularly visiting the official VA website or subscribing to their newsletters or email updates. The VA provides valuable resources and information regarding changes in policies and procedures. By keeping an eye on these official sources, veterans can be confident that they are receiving accurate and reliable information.

Additionally, seeking guidance from accredited VA claims agents or attorneys who specialize in veterans’ benefits is highly recommended. These professionals are well-versed in the intricacies of the Non-Service Connected Pension program and can provide valuable insights into any recent changes that may impact veterans’ benefits.

It’s also important for veterans to proactively communicate with their local VA office or representatives. They can inquire about any recent updates or changes in policies specific to their region. Building a relationship with VA personnel can provide direct access to accurate information tailored to individual circumstances.

Being proactive in staying informed about changes in rules and regulations ensures that veterans are prepared for any potential shifts in their eligibility status or benefit amount. It empowers them to make informed decisions regarding their finances and plan accordingly.

In conclusion, staying up-to-date on any changes in VA Non-Service Connected Pension rules and regulations is essential for veterans who rely on this program for financial support. By staying informed through official VA channels, seeking professional guidance, and maintaining open communication with VA representatives, veterans can navigate the ever-evolving landscape of benefits and maximize their entitlements.

Contact a financial advisor or an accredited Veterans Service Officer if you need assistance with applying for or managing your VA Non-Service Connected Pension benefits.

Seeking Assistance: Navigating the VA Non-Service Connected Pension with Expert Guidance

Applying for and managing VA benefits can sometimes be a complex and overwhelming process. If you are a veteran in need of financial support through the Non-Service Connected Pension, reaching out to a financial advisor or an accredited Veterans Service Officer can make a significant difference in ensuring a smooth and successful experience.

These professionals have the knowledge and expertise to guide you through the intricacies of the application process. They understand the eligibility requirements, documentation needed, and can help you gather all the necessary information to present a strong case to the Department of Veterans Affairs (VA).

A financial advisor can provide valuable insights into managing your finances while considering your VA benefits. They can help you understand how these benefits may impact your overall financial picture, including taxes, investments, and estate planning. Their expertise ensures that you maximize the benefits available to you while making informed decisions about your financial future.

On the other hand, an accredited Veterans Service Officer specializes in assisting veterans with their VA claims and benefits. These officers are trained by veterans organizations and have extensive knowledge of VA programs. They can offer personalized guidance throughout the application process, ensuring that you meet all requirements and submit all necessary documentation accurately.

Working with a financial advisor or an accredited Veterans Service Officer offers peace of mind during what can be a stressful time. Their experience in navigating VA processes helps streamline your application, potentially reducing processing times and increasing your chances of receiving approval for the Non-Service Connected Pension.

Remember, seeking assistance does not mean relinquishing control over your benefits; it simply means accessing expert advice to enhance your understanding and increase your chances of success. These professionals are there to support you every step of the way, providing clarity on complex matters related to your VA benefits.

If you find yourself needing assistance with applying for or managing your VA Non-Service Connected Pension benefits, consider contacting a financial advisor or an accredited Veterans Service Officer. Their expertise and guidance can make a significant difference, ensuring that you receive the financial support you deserve as a veteran who has served our nation with honor.