Understanding the Basic Entitlement for VA Loan

For veterans and active duty service members, the VA loan program offers a valuable opportunity to secure financing for a home purchase. One of the key components of the VA loan program is the concept of entitlement, which plays a crucial role in determining how much a borrower can borrow without a down payment.

What is Entitlement?

Entitlement is essentially the amount that the Department of Veterans Affairs (VA) guarantees to repay to a lender in the event that a borrower defaults on their loan. There are two types of entitlement: basic and bonus.

Basic Entitlement

The basic entitlement for a VA loan is currently set at $36,000. This means that the VA will guarantee up to 25% of a loan amount up to $144,000. For loans above this amount, lenders typically require a down payment equal to 25% of the difference between the loan amount and $144,000.

How Basic Entitlement Works

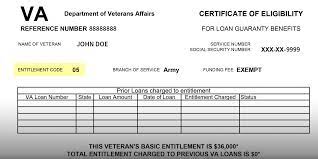

When a borrower applies for a VA loan, their lender will request a Certificate of Eligibility (COE) from the VA. The COE will indicate how much entitlement the borrower has available. If the borrower has not used any entitlement before, they will have access to their full $36,000 basic entitlement.

Benefits of Basic Entitlement

- No Down Payment: With sufficient basic entitlement, borrowers can secure a VA loan without making a down payment.

- No Private Mortgage Insurance (PMI): VA loans do not require PMI, saving borrowers money on monthly payments.

- Favorable Terms: VA loans often come with competitive interest rates and flexible qualification requirements.

In conclusion, understanding the basic entitlement for VA loans is essential for veterans and service members looking to utilize this valuable benefit. By leveraging their entitlement effectively, borrowers can access affordable financing options for purchasing their dream home.

Understanding VA Loan Basic Entitlement: Top 8 FAQs Unveiled

- What is basic entitlement for a VA loan?

- How much is the basic entitlement amount set at?

- What is the difference between basic entitlement and bonus entitlement?

- How does basic entitlement affect the loan amount I can qualify for?

- Do I need to make a down payment if I have sufficient basic entitlement?

- Can my basic entitlement be used multiple times?

- What are the benefits of having access to my full $36,000 basic entitlement?

- How do I determine how much of my basic entitlement I have already used?

What is basic entitlement for a VA loan?

The basic entitlement for a VA loan refers to the initial amount of guarantee that the Department of Veterans Affairs (VA) provides to lenders on behalf of eligible veterans and service members. Currently set at $36,000, this entitlement allows borrowers to secure a VA loan with favorable terms, including the possibility of financing a home purchase without a down payment. Understanding and maximizing one’s basic entitlement is crucial for veterans seeking to utilize this valuable benefit and navigate the process of obtaining a VA loan successfully.

How much is the basic entitlement amount set at?

The basic entitlement amount for a VA loan is set at $36,000. This means that the Department of Veterans Affairs (VA) guarantees up to 25% of a loan amount up to $144,000. For loans exceeding this amount, lenders typically require a down payment equal to 25% of the difference between the loan amount and $144,000. Understanding this basic entitlement amount is crucial for veterans and active duty service members seeking to utilize their VA loan benefits effectively and secure financing for a home purchase.

What is the difference between basic entitlement and bonus entitlement?

When it comes to VA loans, a common question that often arises is: What is the difference between basic entitlement and bonus entitlement? The basic entitlement for a VA loan represents the initial amount of guarantee provided by the Department of Veterans Affairs, typically set at $36,000. On the other hand, bonus entitlement is an additional layer of guarantee that allows borrowers to secure larger loan amounts without a down payment. Bonus entitlement kicks in when borrowers exceed the basic entitlement limit and can be used to finance more expensive properties. Understanding the distinction between basic and bonus entitlement is crucial for veterans and service members seeking to maximize their benefits under the VA loan program.

How does basic entitlement affect the loan amount I can qualify for?

The basic entitlement for a VA loan directly impacts the loan amount that a borrower can qualify for. Since the VA guarantees up to 25% of the loan amount, the $36,000 basic entitlement allows borrowers to secure a loan of up to $144,000 without needing a down payment. For loans exceeding this amount, lenders may require a down payment equal to 25% of the difference between the loan amount and $144,000. Understanding how basic entitlement influences the maximum loan amount is crucial for veterans and service members seeking to make the most of their VA loan benefit and achieve their homeownership goals.

Do I need to make a down payment if I have sufficient basic entitlement?

One frequently asked question regarding the basic entitlement for a VA loan is whether a down payment is required if the borrower has sufficient basic entitlement. The answer is no, borrowers with enough basic entitlement can secure a VA loan without making a down payment. The basic entitlement, set at $36,000, allows eligible veterans and service members to access financing for a home purchase without the need for a down payment. This benefit of the VA loan program provides an opportunity for borrowers to achieve homeownership with more flexibility and affordability compared to traditional mortgage options.

Can my basic entitlement be used multiple times?

Yes, your basic entitlement for a VA loan can be used multiple times, but not simultaneously. If you have paid off a previous VA loan and sold the property, you can have your entitlement restored in full or in part to use again for a new VA loan. However, you can only have one VA loan at a time unless you have paid off your previous loan and disposed of the property. Understanding how your basic entitlement can be reused is important for veterans and service members looking to take advantage of the benefits offered by the VA loan program.

What are the benefits of having access to my full $36,000 basic entitlement?

Having access to your full $36,000 basic entitlement for a VA loan comes with several key benefits. One major advantage is the ability to secure a home loan without the need for a down payment, which can significantly reduce upfront costs for borrowers. Additionally, having access to the full basic entitlement allows borrowers to avoid private mortgage insurance (PMI), resulting in lower monthly payments compared to conventional loans. Furthermore, leveraging the full entitlement can lead to more favorable loan terms, including competitive interest rates and flexible qualification requirements. Overall, maximizing your basic entitlement can help veterans and service members achieve their homeownership goals with greater affordability and financial flexibility.

How do I determine how much of my basic entitlement I have already used?

To determine how much of your basic entitlement for a VA loan you have already used, you can request a Certificate of Eligibility (COE) from the Department of Veterans Affairs (VA). The COE will specify the amount of entitlement you have remaining based on any previous VA loans you may have used. By reviewing your COE, you can easily track your basic entitlement usage and understand how much guarantee the VA provides for your current or future loan applications.