The VA Loan Guaranty: Helping Veterans Achieve Homeownership

For many veterans, owning a home is an important part of the American dream. However, for some, the process of obtaining a mortgage can be daunting. That’s where the VA Loan Guaranty program comes in.

The VA Loan Guaranty program was established in 1944 as part of the GI Bill of Rights. Its purpose is to help veterans and their families achieve homeownership by providing them with access to affordable mortgage financing. The program is administered by the Department of Veterans Affairs (VA) and has helped millions of veterans obtain home loans since its inception.

One of the key benefits of the VA Loan Guaranty program is that it allows veterans to obtain a home loan with no down payment. This can be a significant advantage for those who may not have saved up enough money for a down payment or who would prefer to use their savings for other purposes, such as home improvements or paying off debt.

In addition to no down payment, VA loans also offer competitive interest rates and do not require private mortgage insurance (PMI). This can result in significant savings over the life of the loan compared to other types of mortgages.

Another advantage of the VA Loan Guaranty program is that it provides flexibility when it comes to credit requirements. While lenders still evaluate creditworthiness, they are often more willing to work with veterans who may have less than perfect credit histories.

To be eligible for a VA loan guaranty, veterans must meet certain service requirements. Generally, veterans who have served at least 90 consecutive days on active duty during wartime or 181 days during peacetime are eligible for the program. Additionally, National Guard and Reserve members may be eligible after serving six years.

It’s important to note that while the VA does not lend money directly, it does guarantee a portion of each loan made through the program. This means that if a borrower defaults on their loan, the VA will reimburse the lender for a portion of the loss. This guarantee helps to make veterans a more attractive lending risk, which can lead to better loan terms and lower interest rates.

In conclusion, the VA Loan Guaranty program is an important resource for veterans and their families who are looking to achieve homeownership. Its benefits include no down payment, competitive interest rates, and flexible credit requirements. If you’re a veteran who is interested in obtaining a home loan, be sure to explore your options through the VA Loan Guaranty program.

Answers to Common Questions About VA Loan Guaranty Benefits

- What is a VA loan guaranty?

- What is VA mortgage guaranty benefits?

- What is the maximum VA loan guaranty?

- Does the VA guarantee 100% of the loan?

What is a VA loan guaranty?

A VA loan guaranty is a benefit provided by the Department of Veterans Affairs (VA) to help eligible veterans, active-duty service members, and their surviving spouses obtain home loans. The VA does not lend money directly, but instead guarantees a portion of each loan made through the program. This guarantee helps to make veterans a more attractive lending risk, which can lead to better loan terms and lower interest rates. Some of the key benefits of a VA loan guaranty include no down payment requirement, competitive interest rates, and flexible credit requirements. To be eligible for a VA loan guaranty, veterans must meet certain service requirements and apply through an approved lender.

What is VA mortgage guaranty benefits?

The VA mortgage guaranty benefit is a program that helps veterans and their families obtain affordable mortgage financing for purchasing or refinancing a home. The program is administered by the Department of Veterans Affairs (VA) and provides a guarantee to lenders that the VA will reimburse them for a portion of the loan in the event that the borrower defaults.

One of the biggest benefits of the VA mortgage guaranty program is that it allows eligible veterans to obtain a home loan with no down payment. This can be a significant advantage for those who may not have saved up enough money for a down payment or who would prefer to use their savings for other purposes, such as home improvements or paying off debt.

In addition to no down payment, VA loans also offer competitive interest rates and do not require private mortgage insurance (PMI). This can result in significant savings over the life of the loan compared to other types of mortgages.

Another advantage of the VA mortgage guaranty program is that it provides flexibility when it comes to credit requirements. While lenders still evaluate creditworthiness, they are often more willing to work with veterans who may have less than perfect credit histories.

To be eligible for a VA mortgage guaranty, veterans must meet certain service requirements. Generally, veterans who have served at least 90 consecutive days on active duty during wartime or 181 days during peacetime are eligible for the program. Additionally, National Guard and Reserve members may be eligible after serving six years.

It’s important to note that while the VA does not lend money directly, it does guarantee a portion of each loan made through the program. This means that if a borrower defaults on their loan, the VA will reimburse the lender for a portion of the loss. This guarantee helps to make veterans a more attractive lending risk, which can lead to better loan terms and lower interest rates.

In conclusion, the VA mortgage guaranty benefit is an important resource for veterans and their families who are looking to obtain affordable mortgage financing for purchasing or refinancing a home. Its benefits include no down payment, competitive interest rates, and flexible credit requirements. If you’re a veteran who is interested in obtaining a home loan, be sure to explore your options through the VA mortgage guaranty program.

What is the maximum VA loan guaranty?

The maximum VA loan guaranty varies depending on the location of the property being purchased. In most areas of the United States, the maximum guaranty amount for a VA loan is 25% of the conforming loan limit, which is currently set at $548,250 for 2021. This means that the VA will guarantee up to $137,063 of a veteran’s home loan in most parts of the country.

However, in certain high-cost areas where housing prices are significantly higher than the national average, the maximum guaranty amount may be higher. In these areas, known as high-cost counties or “high balance” areas, the VA will guarantee up to 25% of the conforming loan limit plus any amount over that limit.

For example, in Honolulu County in Hawaii, where housing prices are among the highest in the country, the conforming loan limit is $822,375 for 2021. This means that the maximum guaranty amount for a VA loan in Honolulu County is $205,593 (25% of $822,375).

It’s important to note that while the VA guarantees a portion of each loan made through its program, it does not lend money directly. Veterans must still apply for and qualify for a mortgage through an approved lender in order to obtain a VA-guaranteed home loan.

Does the VA guarantee 100% of the loan?

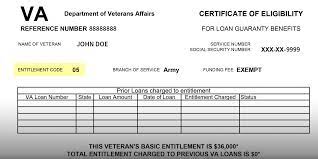

The VA Loan Guaranty program does not guarantee 100% of the loan amount. Instead, it guarantees up to a certain percentage of the loan, which can vary depending on the size of the loan and other factors.

For most loans, the VA guarantees up to 25% of the loan amount, with a maximum guarantee amount of $36,000. However, for loans over $144,000, the VA may guarantee up to 25% of the conforming loan limit for that county.

It’s important to note that while the VA guarantee can help veterans obtain better loan terms and lower interest rates, it does not mean that veterans are automatically approved for a loan. Lenders still evaluate creditworthiness and other factors when determining whether to approve a loan application.

In addition to the VA guarantee, some lenders may require borrowers to make a down payment or pay an upfront funding fee. However, even with these additional costs, VA loans can still be an attractive option for veterans who are looking to achieve homeownership with favorable loan terms and lower costs compared to other types of mortgages.