The Veterans Benefits Banking Program: Supporting Those Who Served

For many veterans, transitioning back to civilian life can be challenging, especially when it comes to managing their finances. To address this issue, the Veterans Benefits Banking Program was established to provide specialized banking services tailored to the unique needs of veterans.

One of the key features of the program is its focus on offering financial products and services that cater specifically to veterans. This includes low or no-fee checking and savings accounts, competitive interest rates on loans, and personalized financial advice from professionals experienced in working with military personnel.

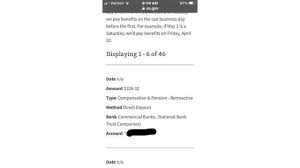

Furthermore, the Veterans Benefits Banking Program aims to simplify the process of accessing and utilizing veterans benefits. By partnering with government agencies and veteran service organizations, participating banks are able to streamline the application and approval process for benefits such as disability compensation, education assistance, and housing support.

Another important aspect of the program is its commitment to financial education for veterans. Through workshops, seminars, and online resources, veterans can learn valuable skills such as budgeting, saving for retirement, and managing debt effectively.

In conclusion, the Veterans Benefits Banking Program plays a crucial role in supporting those who have served our country. By providing tailored banking services, facilitating access to benefits, and offering financial education opportunities, the program helps veterans navigate their financial journey with confidence and security.

Maximizing Financial Freedom: Top 5 Advantages of the Veterans Benefits Banking Program

- Tailored financial products and services designed specifically for veterans’ needs.

- Low or no-fee checking and savings accounts to help veterans save money.

- Competitive interest rates on loans to support veterans in achieving their financial goals.

- Streamlined access to veterans benefits, such as disability compensation and education assistance.

- Financial education opportunities to empower veterans with essential money management skills.

Five Potential Downsides of the Veterans Benefits Banking Program (VBBP) to Consider

- Limited availability of participating banks may restrict access for some veterans.

- Some veterans may find the eligibility criteria for certain benefits restrictive or difficult to meet.

- The program may not offer as competitive interest rates on certain financial products compared to mainstream banks.

- Veterans who prefer online banking or mobile app services may find the technology offerings of participating banks lacking.

- Changes in government policies or funding could potentially impact the sustainability and scope of the program.

Tailored financial products and services designed specifically for veterans’ needs.

The Veterans Benefits Banking Program stands out for its tailored financial products and services that are specifically designed to meet the unique needs of veterans. By offering specialized banking solutions such as low or no-fee accounts, competitive loan rates, and personalized financial advice from experts familiar with military life, the program ensures that veterans receive the support they deserve. This tailored approach not only addresses the financial challenges veterans may face during their transition to civilian life but also empowers them to make informed decisions about their money management, ultimately promoting their financial well-being and security.

Low or no-fee checking and savings accounts to help veterans save money.

One significant advantage of the Veterans Benefits Banking Program is the provision of low or no-fee checking and savings accounts specifically designed to assist veterans in saving money. By offering these financial products with reduced fees or no fees at all, the program enables veterans to manage their finances more efficiently and allocate their resources towards savings and long-term financial goals. This benefit not only helps veterans save money but also promotes financial stability and security, empowering them to build a strong foundation for their post-military life.

Competitive interest rates on loans to support veterans in achieving their financial goals.

The Veterans Benefits Banking Program offers competitive interest rates on loans to support veterans in achieving their financial goals. By providing access to affordable financing options, veterans can pursue endeavors such as starting a business, buying a home, or furthering their education without being burdened by high-interest charges. This pro of the program not only empowers veterans to reach their financial aspirations but also recognizes and honors their service by offering favorable terms that facilitate their path to success.

Streamlined access to veterans benefits, such as disability compensation and education assistance.

One significant advantage of the Veterans Benefits Banking Program is its streamlined access to essential benefits for veterans, including disability compensation and education assistance. By partnering with government agencies and veteran service organizations, participating banks are able to expedite the application and approval process for these benefits, ensuring that veterans receive the support they deserve in a timely manner. This streamlined approach not only reduces bureaucratic hurdles but also provides veterans with much-needed financial assistance more efficiently, allowing them to focus on their well-being and future opportunities.

Financial education opportunities to empower veterans with essential money management skills.

One significant advantage of the Veterans Benefits Banking Program is its focus on providing financial education opportunities to empower veterans with essential money management skills. By offering workshops, seminars, and online resources, the program equips veterans with the knowledge and tools needed to make informed financial decisions. This proactive approach not only helps veterans effectively manage their finances but also enhances their overall financial well-being, ensuring they have the skills to navigate their financial futures confidently.

Limited availability of participating banks may restrict access for some veterans.

One significant drawback of the Veterans Benefits Banking Program is the limited availability of participating banks, which may restrict access for some veterans. With only a select number of financial institutions offering specialized services tailored to veterans, many individuals may find it challenging to access the benefits and support provided by the program. This lack of widespread availability could potentially hinder veterans in remote areas or those with limited transportation options from fully benefiting from the program’s resources and expertise. Efforts to expand the network of participating banks could help address this issue and ensure that all veterans have equal access to the valuable services offered by the Veterans Benefits Banking Program.

Some veterans may find the eligibility criteria for certain benefits restrictive or difficult to meet.

Some veterans may encounter a significant drawback of the Veterans Benefits Banking Program when they discover that the eligibility criteria for certain benefits are restrictive or challenging to fulfill. This limitation can be frustrating for veterans who may have served their country but do not meet the specific requirements set forth by the program. As a result, these veterans may feel excluded or disadvantaged, unable to access the full range of benefits and services offered through the program. It is essential for policymakers and program administrators to consider ways to address these eligibility barriers and ensure that all veterans have equitable access to the support they deserve.

The program may not offer as competitive interest rates on certain financial products compared to mainstream banks.

One potential drawback of the Veterans Benefits Banking Program is that it may not always provide as competitive interest rates on certain financial products when compared to mainstream banks. While the program focuses on tailoring its services to meet the unique needs of veterans, this specialization may result in slightly higher interest rates on loans or lower interest rates on savings accounts than what could be found at traditional financial institutions. Veterans considering utilizing the program should carefully weigh this con against the program’s other benefits to determine if it aligns with their financial goals and needs.

Veterans who prefer online banking or mobile app services may find the technology offerings of participating banks lacking.

One drawback of the Veterans Benefits Banking Program is that veterans who prefer online banking or mobile app services may find the technology offerings of participating banks lacking. In today’s digital age, many individuals rely on the convenience and accessibility of online and mobile banking to manage their finances efficiently. However, some participating banks may not have robust online or mobile banking platforms, which can be a limitation for veterans who value these technological features. This gap in technology offerings could potentially hinder veterans’ ability to fully utilize and benefit from the banking program’s services.

Changes in government policies or funding could potentially impact the sustainability and scope of the program.

One significant con of the Veterans Benefits Banking Program is the vulnerability to changes in government policies or funding. As government priorities and budgets fluctuate, there is a risk that the program’s sustainability and scope could be affected. Reductions in funding or shifts in policy direction may lead to limitations on the services offered, eligibility criteria changes, or even the discontinuation of the program altogether. This uncertainty creates challenges for both veterans relying on the program for financial support and banks participating in providing specialized services. It underscores the importance of ongoing advocacy efforts to safeguard and strengthen programs that are vital for supporting our veterans.