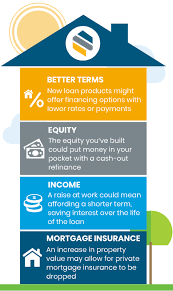

A cash-out refinance VA loan is a great way for veterans to access their home equity and use it to finance major expenses. This type of loan allows veterans to refinance their existing VA mortgage and take out cash from their home’s equity. The amount of cash that can be taken out depends on the value of the home and the amount of existing debt on the property.

The process for obtaining a cash-out refinance VA loan is relatively simple. First, you will need to apply with a lender that specializes in VA loans. The lender will review your credit score and other financial information, such as your income, debts, and assets. Once you are approved for the loan, you will need to provide documentation about your existing mortgage, including your current balance and interest rate.

Once all of the paperwork is in order, you will be able to close on the new loan and receive your cash-out funds. The funds can be used for any purpose you choose, such as paying off high-interest debt or making home improvements. However, it is important to remember that this type of loan does come with certain restrictions. First, there are limits on how much cash can be taken out; typically this is up to 90% of the appraised value of the home. Additionally, any funds taken out must be used within 60 days or they may become taxable income.

Overall, a cash-out refinance VA loan is an excellent tool for veterans looking to access their home equity and use it for major expenses or investments. With this type of loan, veterans can consolidate debt or make necessary improvements without having to take out additional loans or tap into savings accounts.

7 Tips for a Successful Cash Out Refinance VA Loan

- Understand the VA Cash Out Refinance Loan Rules: Before applying for a VA cash out refinance loan, make sure you understand all of the rules and regulations that come with this type of loan.

- Get Pre-Approved: Before you start shopping for a home, it’s important to get pre-approved for your loan so that you know exactly how much you can borrow and what your monthly payments will be.

- Compare Rates & Fees: Shopping around is one of the best ways to ensure that you get the best deal on your VA cash out refinance loan. Make sure to compare rates and fees from multiple lenders before making a decision.

- Calculate Your Costs: When refinancing, there are typically closing costs associated with the transaction which must be taken into consideration when calculating how much money you will save in the long run by refinancing your loan.

- Consider Your Credit Score: Your credit score plays an important role in determining whether or not you qualify for a VA cash out refinance loan as well as what interest rate and terms are offered to you by lenders.

- Apply Early: Once you have decided on a lender, make sure to apply early so that there is plenty of time for processing and approval before any deadlines set by lenders or other parties involved in the transaction such as real estate agents or appraisers who may need additional time to complete their tasks prior to closing day on the new loan agreement..

- Seek Professional Advice: If at any point during the process of obtaining your VA cash out refinance loan, if something doesn’t seem quite right or if there are questions that need answers, don’t hesitate to seek professional advice from an experienced mortgage broker or financial advisor who can help guide you through every step of this process

Understand the VA Cash Out Refinance Loan Rules: Before applying for a VA cash out refinance loan, make sure you understand all of the rules and regulations that come with this type of loan.

The VA Cash Out Refinance Loan is a great way to get money out of your home’s equity. This type of loan allows you to refinance your existing VA loan and take out cash for other expenses or debt consolidation. However, it is important to understand the rules and regulations that come with this type of loan before applying.

First, you must be a veteran or active duty military member in order to qualify for a VA cash out refinance loan. Additionally, you must have enough equity in your home to cover the costs of the loan and any additional fees associated with it. The amount of cash you can take out is also limited by the amount of equity you have in your home.

Another important rule to be aware of is that the cash from a VA cash out refinance loan cannot be used for any illegal activities or investments. The funds must be used for legitimate purposes such as paying off debts, making home improvements, or making investments in approved entities such as stocks and bonds.

Finally, it is important to remember that taking out a VA cash out refinance loan can have significant financial implications. Make sure you understand all the terms and conditions associated with this type of loan before signing any paperwork. It is also recommended that you speak with an experienced mortgage professional who can help guide you through the process and make sure you make informed decisions about your finances.

Get Pre-Approved: Before you start shopping for a home, it’s important to get pre-approved for your loan so that you know exactly how much you can borrow and what your monthly payments will be.

If you’re a veteran looking to take advantage of the VA loan program, a cash out refinance is an attractive option. With a cash out refinance, you can access the equity in your home to pay for home improvements, pay off debts or make other large purchases. But before you start shopping for a home, it’s important to get pre-approved for your loan so that you know exactly how much you can borrow and what your monthly payments will be.

Getting pre-approved is the first step in the loan process and it’s important to do this before you start looking for a home. This will give you an idea of what type of homes are within your budget and help you narrow down your search. During the pre-approval process, lenders will look at your credit score and income to determine how much they are willing to lend. The lender will also review any existing debts or liens on the property. Pre-approval also helps speed up the closing process once you find a home because all of the paperwork has already been completed.

A cash out refinance VA loan is a great way to access the equity in your home and make some improvements or pay off debt. Before you start shopping for a home, make sure that you get pre-approved so that you know exactly how much money you can borrow and what your monthly payments will be.

Compare Rates & Fees: Shopping around is one of the best ways to ensure that you get the best deal on your VA cash out refinance loan. Make sure to compare rates and fees from multiple lenders before making a decision.

When you are looking to refinance your VA loan, it is important to compare rates and fees from multiple lenders. Shopping around for the best deal can save you money in the long run and ensure that you get the best loan for your needs.

VA cash out refinance loans allow veterans to access their home equity and use it for a variety of purposes, such as home improvements or debt consolidation. Before deciding on a lender, make sure to compare rates and fees from different lenders. This will help you find the best deal on your loan and save you money in the long run.

When comparing rates and fees, make sure to look at all of the details, including closing costs, points, origination fees, and other associated costs. It is also important to consider how long it will take to recoup your costs through lower monthly payments after refinancing. By shopping around for the best deal on your VA cash out refinance loan, you can save money in the long run and get a loan that fits your needs.

Calculate Your Costs: When refinancing, there are typically closing costs associated with the transaction which must be taken into consideration when calculating how much money you will save in the long run by refinancing your loan.

Cash out refinancing a VA loan can be a great way to save money in the long run. However, before you make the decision to refinance it is important to calculate your costs associated with the transaction. Closing costs can vary depending on the lender and other factors, but typically include fees for origination, title insurance, appraisal, and other related expenses.

It is important to understand that closing costs are not necessarily a bad thing – they are just part of the cost of refinancing your loan. In order to determine if cash out refinancing your VA loan is worth it in the long run, you must factor in these closing costs when calculating how much money you will save.

By understanding what your closing costs will be before making a decision, you can ensure that cash out refinancing your VA loan will actually save you money in the long run. Be sure to compare different lenders and their associated closing costs when deciding whether or not to refinance your VA loan.

Consider Your Credit Score: Your credit score plays an important role in determining whether or not you qualify for a VA cash out refinance loan as well as what interest rate and terms are offered to you by lenders.

When considering a VA cash out refinance loan, it is important to consider your credit score. Your credit score plays a major role in determining whether or not you qualify for the loan, as well as what interest rate and terms are offered to you by lenders.

Having a good credit score is essential for getting the best terms on your loan. A good credit score is generally considered to be anything above 700, and the higher your score, the better the terms you can expect from lenders. If your credit score is below 700, you may still qualify for a loan but may have to pay higher interest rates or stricter terms.

It is important to review your credit report before applying for a VA cash out refinance loan so that you can make any necessary corrections or updates. This will ensure that lenders have accurate information about your financial history and that they are able to provide you with the best possible terms on your loan.

By taking the time to review and improve your credit score before applying for a VA cash out refinance loan, you can increase your chances of getting approved and getting the best possible terms on your loan.

Apply Early: Once you have decided on a lender, make sure to apply early so that there is plenty of time for processing and approval before any deadlines set by lenders or other parties involved in the transaction such as real estate agents or appraisers who may need additional time to complete their tasks prior to closing day on the new loan agreement..

Cash out refinance VA loans are a great way to access the equity in your home and use it for projects such as home improvements, debt consolidation, or to buy a new car. However, before you can take advantage of this loan option, it’s important to understand the process and apply early.

The first step is to decide on a lender who can provide the best terms for your loan. Once you have selected a lender, you should apply early in order to give them plenty of time for processing and approval. If there are deadlines set by lenders or other parties involved in the transaction such as real estate agents or appraisers, you want to make sure that they have plenty of time to complete their tasks prior to closing day on the new loan agreement.

After you have applied, it’s important that you stay in communication with your lender throughout the process so that any questions or concerns can be addressed quickly. You should also make sure that all documents requested by the lender are provided promptly. This will help ensure that your application is processed as quickly as possible and will reduce the chances of any delays or complications during closing day.

By taking these steps and applying early for your cash out refinance VA loan, you can ensure that everything runs smoothly and that you get access to the funds quickly.

Seek Professional Advice: If at any point during the process of obtaining your VA cash out refinance loan, if something doesn’t seem quite right or if there are questions that need answers, don’t hesitate to seek professional advice from an experienced mortgage broker or financial advisor who can help guide you through every step of this process

When it comes to obtaining a VA cash out refinance loan, it is important to seek professional advice if anything doesn’t seem quite right or if there are questions that need answers. An experienced mortgage broker or financial advisor can help guide you through every step of the process, ensuring that you make the best decision possible.

The VA cash out refinance loan process can be overwhelming and confusing, so having a knowledgeable professional to assist you is invaluable. They can provide guidance on everything from credit score requirements and interest rates to loan terms and closing costs. They will also explain the various risks associated with taking out a loan of this type and help you decide if it is the right choice for your financial situation.

Additionally, a professional can help you evaluate lenders and find the best deal for your specific needs. They can compare offers from different lenders and negotiate on your behalf to get you the best rate possible. Having an expert in your corner will give you peace of mind knowing that your finances are in good hands.

In conclusion, seeking professional advice when considering a VA cash out refinance loan is essential in order to make an informed decision. A knowledgeable mortgage broker or financial advisor will provide invaluable guidance throughout the entire process, helping ensure that you make the best decision for your current financial situation.