National Guard VA Loan Eligibility: A Path to Homeownership for Service Members

The National Guard plays a vital role in our nation’s defense, providing support during emergencies and serving alongside active duty military personnel. In recognition of their service, the Department of Veterans Affairs (VA) offers special home loan benefits to National Guard members. These benefits, known as VA loans, provide an opportunity for eligible service members to achieve the dream of homeownership.

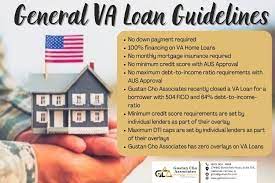

VA loans are backed by the VA and offered by private lenders, making them an attractive option for National Guard members who want to buy a home or refinance an existing mortgage. The eligibility criteria for National Guard members are similar to those for active duty military personnel and veterans.

To be eligible for a VA loan as a National Guard member, you must meet certain requirements. Firstly, you must have completed at least six years of honorable service in the National Guard or Reserve. However, if you were discharged due to a service-related disability before completing six years of service, you may still be eligible.

Secondly, you need to obtain a Certificate of Eligibility (COE) from the VA. The COE serves as proof that you meet the necessary requirements for a VA loan. It can be obtained online through the eBenefits portal or by submitting an application form (VA Form 26-1880) to your nearest VA regional office.

Once you have established your eligibility and obtained your COE, you can start exploring the benefits of a VA loan. One significant advantage is that no down payment is required in most cases. This can make homeownership more accessible and help save thousands of dollars upfront compared to traditional mortgages.

Another benefit is that VA loans often have lower interest rates than conventional loans. This can result in substantial savings over the life of the loan. Additionally, there is no requirement for private mortgage insurance (PMI), further reducing monthly costs.

The flexibility of VA loans also extends to credit requirements. While a good credit score is generally beneficial, the VA loan program is known for being more forgiving when it comes to credit history. This can be especially helpful for National Guard members who may have faced financial challenges due to deployments or other military obligations.

It’s important to note that VA loans can only be used for primary residences, not investment properties or vacation homes. However, they can be used to purchase single-family homes, condominiums, and even multi-unit properties (up to four units) as long as one unit will serve as the borrower’s primary residence.

As with any loan program, it’s advisable to shop around and compare offers from different lenders. While the VA guarantees a portion of the loan, interest rates and fees can vary among lenders. Taking the time to research and obtain multiple quotes will ensure that you secure the best possible terms for your VA loan.

In conclusion, VA loans provide an excellent opportunity for National Guard members to achieve homeownership. The benefits of no down payment, competitive interest rates, and flexible credit requirements make these loans an attractive option. If you are a National Guard member considering buying a home or refinancing your current mortgage, exploring the benefits of a VA loan may be well worth your while. Contact your nearest VA regional office or speak with a knowledgeable lender who specializes in VA loans to get started on your path towards homeownership today.

8 Pros of National Guard VA Loan Eligibility: Access to Low-Interest Rates, No Down Payment, No PMI, Flexible Loan Terms, Multiple Use of VA Loan Entitlement, Roll-in of VA Funding Fee, Refund Option for Funding Fee

- Access to low-interest rates that are competitive with conventional loans.

- No down payment required, which can help veterans save money in the long run.

- No private mortgage insurance (PMI) is needed, which can save veterans hundreds of dollars per month on their mortgage payments.

- Flexible loan terms, including adjustable rate mortgages (ARMs) and fixed-rate mortgages (FRMs).

- Ability to use VA loan entitlement multiple times, allowing veterans to purchase multiple homes with no down payment or PMI requirements each time they qualify for a loan.

- The VA funding fee can be rolled into the loan amount so that it does not have to be paid out of pocket at closing time by the veteran borrower(s).

- Borrowers may be eligible for a one-time refund of the VA funding fee if they sell or refinance their home within a certain timeframe after purchase using a VA loan program benefit such as Interest Rate Reduction Refinancing Loans (IRRRLs).

- National Guard members who have served at least six years in any component of the U.S Armed Forces may qualify for full eligibility status without having to meet additional service requirements like active duty personnel must do

4 Important Considerations for National Guard VA Loan Eligibility

- You must have completed at least six years of service in the National Guard to be eligible for a VA loan.

- Your active duty service must have been satisfactory and you must have received an honorable discharge from the National Guard to qualify for a VA loan.

- You may not be eligible for a VA loan if you are currently serving in the National Guard or if you are on active duty with another branch of the military.

- The maximum loan amount available through a VA loan is determined by your length of service and other factors, so it may not be enough to cover all of your needs when buying a home or refinancing an existing mortgage.

Access to low-interest rates that are competitive with conventional loans.

Access to Low-Interest Rates: A Major Advantage of National Guard VA Loan Eligibility

When it comes to purchasing a home, one of the most critical factors to consider is the interest rate on your mortgage. The good news for National Guard members is that they have access to low-interest rates through the VA loan program. In fact, these rates are often competitive with conventional loans, making them an attractive option for service members looking to achieve homeownership.

The Department of Veterans Affairs (VA) guarantees a portion of VA loans, which gives lenders added security and allows them to offer lower interest rates. This guarantee reduces the risk for lenders, resulting in more favorable terms for borrowers. As a National Guard member, this means you can take advantage of interest rates that are on par with or even lower than those offered by traditional mortgages.

By securing a low-interest rate through a VA loan, National Guard members can save thousands of dollars over the life of their mortgage. Even a small difference in interest rates can have a significant impact on monthly payments and overall savings. These savings can be especially beneficial for service members who may have other financial obligations or are looking to make the most of their military benefits.

In addition to competitive interest rates, another advantage of VA loans is that they do not require private mortgage insurance (PMI). PMI is typically required for conventional loans with down payments less than 20% of the home’s purchase price. By eliminating this requirement, National Guard members can further reduce their monthly costs and potentially afford a higher-priced home.

It’s important to note that while low-interest rates are available through VA loans, individual rates may still vary among lenders. It’s always recommended to shop around and compare offers from different lenders to ensure you secure the best possible terms for your VA loan. Take advantage of online resources or consult with mortgage professionals who specialize in VA loans to find the most competitive interest rate available.

In conclusion, access to low-interest rates is a significant advantage of National Guard VA loan eligibility. By leveraging the VA’s guarantee, service members can secure mortgage rates that are on par with or even lower than conventional loans. These competitive rates can lead to substantial savings over the life of the loan and make homeownership more affordable for National Guard members. If you’re considering buying a home, exploring the benefits of a VA loan and taking advantage of low-interest rates could be a wise financial decision.

No down payment required, which can help veterans save money in the long run.

No Down Payment Required: A Money-Saving Advantage of National Guard VA Loan Eligibility

For veterans and National Guard members dreaming of homeownership, the prospect of saving up for a substantial down payment can often be a major hurdle. However, one significant advantage of National Guard VA loan eligibility is the exemption from making a down payment in most cases. This benefit can provide substantial long-term savings for those looking to purchase a home.

Traditionally, when purchasing a home, lenders often require a down payment of around 20% of the total purchase price. For many veterans and National Guard members, this upfront cost can be difficult to afford, delaying their dreams of owning a home.

Fortunately, with VA loans available to eligible National Guard members, no down payment is required in most situations. This means that veterans and National Guard members can secure financing for their homes without having to save up a significant sum of money upfront.

The absence of a down payment requirement has several advantages. Firstly, it allows veterans and National Guard members to become homeowners sooner rather than later. By eliminating the need for an extensive savings period dedicated solely to amassing a down payment, individuals can enter the housing market faster and start building equity in their own property.

Moreover, not having to make a down payment results in immediate financial relief. Saving thousands or even tens of thousands of dollars that would have otherwise gone towards a down payment allows veterans and National Guard members to allocate those funds towards other important expenses or investments.

Additionally, by not tying up their savings in a down payment, individuals have more financial flexibility and security. They can keep their savings intact as an emergency fund or use it for other purposes such as home improvements or unexpected expenses that may arise after purchasing the property.

Furthermore, saving on the initial down payment also impacts the overall affordability of homeownership. With lower upfront costs, monthly mortgage payments are often more manageable for veterans and National Guard members. This financial relief can alleviate stress and provide a more comfortable budget for other essential needs and future plans.

In summary, the ability for National Guard members to secure a VA loan without making a down payment is a significant advantage. By eliminating this upfront cost, veterans and National Guard members can save money in the long run, enter the housing market sooner, and enjoy greater financial flexibility. If you are a National Guard member considering homeownership, exploring the benefits of a VA loan can be an excellent way to achieve your dreams while maximizing your savings potential.

No private mortgage insurance (PMI) is needed, which can save veterans hundreds of dollars per month on their mortgage payments.

National Guard VA Loan Eligibility: No PMI, Saving Veterans Hundreds of Dollars

One of the significant advantages of National Guard VA loan eligibility is the exemption from private mortgage insurance (PMI). This exemption can result in substantial savings for veterans, potentially saving them hundreds of dollars per month on their mortgage payments.

Private mortgage insurance is typically required for conventional loans when the borrower puts less than 20% down payment on a home. PMI serves as protection for lenders in case borrowers default on their loans. However, it adds an additional monthly cost to the mortgage payment, increasing the overall financial burden.

For National Guard members who qualify for a VA loan, the need for PMI is eliminated. This means that they can enjoy lower monthly mortgage payments compared to their counterparts with conventional loans. The savings can add up significantly over time and provide veterans with more financial flexibility.

By not having to pay PMI, veterans can allocate those funds towards other important expenses or savings goals. It allows them to have more disposable income each month or contribute towards building equity in their homes faster.

The absence of PMI also means that veterans may be able to afford a higher-priced home or qualify for a larger loan amount. With conventional loans, lenders often factor in the cost of PMI when assessing a borrower’s debt-to-income ratio. Without this added expense, veterans may have more purchasing power and options when it comes to buying a home.

Furthermore, not having to pay PMI throughout the life of the loan can save veterans thousands of dollars over time. These savings can be used towards other financial goals such as paying off debt, investing, or saving for retirement.

It’s important to note that while VA loans do not require PMI, they do have a funding fee. The funding fee helps offset the costs of administering the VA loan program and varies depending on factors such as military category, down payment amount (if any), and whether it is the first or subsequent use of a VA loan benefit. However, even with the funding fee factored in, the overall cost savings of not having PMI can still be substantial.

In conclusion, the exemption from private mortgage insurance is a significant pro of National Guard VA loan eligibility. By not having to pay PMI, veterans can save hundreds of dollars per month on their mortgage payments. This allows them to have more financial flexibility, potentially afford a higher-priced home, and save money over the life of the loan. If you are a National Guard member considering homeownership, exploring the benefits of a VA loan and its exemption from PMI can be a game-changer for your financial well-being.

Flexible loan terms, including adjustable rate mortgages (ARMs) and fixed-rate mortgages (FRMs).

Flexible Loan Terms: A Key Advantage of National Guard VA Loan Eligibility

When it comes to securing a mortgage, flexibility is often a crucial factor for many homebuyers. One significant advantage of National Guard VA loan eligibility is the availability of flexible loan terms, including both adjustable rate mortgages (ARMs) and fixed-rate mortgages (FRMs).

With an adjustable rate mortgage, the interest rate is initially fixed for a certain period, typically ranging from 3 to 10 years. After the initial fixed-rate period ends, the interest rate adjusts periodically based on market conditions. This flexibility can be beneficial for National Guard members who anticipate changes in their financial situation or plan to sell their home within a few years.

The advantage of an ARM lies in its lower initial interest rates compared to fixed-rate mortgages. This can result in lower monthly payments during the initial fixed-rate period, allowing borrowers to save money or allocate funds towards other financial goals. However, it’s important to carefully consider and understand how the interest rate may adjust over time before choosing an ARM.

On the other hand, fixed-rate mortgages provide stability and predictability. With a fixed-rate mortgage, the interest rate remains constant throughout the entire loan term, usually ranging from 15 to 30 years. This means that your monthly principal and interest payments will remain unchanged over time.

For National Guard members seeking long-term stability or those who prefer knowing exactly what their mortgage payments will be each month, a fixed-rate mortgage is an excellent choice. It provides peace of mind and allows for better budgeting and financial planning.

The availability of both ARMs and FRMs under the National Guard VA loan program gives borrowers the freedom to choose the option that best suits their individual needs and circumstances. Whether you prioritize short-term savings or long-term stability, there is a loan term available for you.

It’s worth noting that while ARMs offer lower initial rates, they do come with some level of uncertainty due to potential rate adjustments. It’s essential to carefully evaluate your financial situation, future plans, and risk tolerance before deciding on an adjustable rate mortgage.

To make an informed decision, it is advisable to consult with a knowledgeable lender who specializes in VA loans. They can provide guidance on the pros and cons of both ARMs and FRMs, helping you choose the loan term that aligns with your goals and financial situation.

In conclusion, the flexibility of loan terms, including adjustable rate mortgages (ARMs) and fixed-rate mortgages (FRMs), is a significant advantage of National Guard VA loan eligibility. Whether you prefer the lower initial rates of an ARM or the stability of a fixed-rate mortgage, these options cater to different needs and circumstances. By understanding your financial goals and consulting with experts in VA loans, you can select the loan term that best fits your unique situation and pave the way towards successful homeownership.

Ability to use VA loan entitlement multiple times, allowing veterans to purchase multiple homes with no down payment or PMI requirements each time they qualify for a loan.

The National Guard VA loan eligibility offers a remarkable advantage to veterans: the ability to use their VA loan entitlement multiple times. This means that veterans can purchase multiple homes without having to worry about a down payment or private mortgage insurance (PMI) each time they qualify for a loan.

Traditionally, when purchasing a home, a down payment is required, often making homeownership out of reach for many individuals. However, with the National Guard VA loan eligibility, veterans can bypass this financial burden. They can utilize their VA loan entitlement repeatedly, allowing them to invest in multiple properties without the need for a substantial upfront payment.

Furthermore, the absence of PMI requirements is another significant benefit of utilizing the VA loan entitlement multiple times. PMI is typically mandatory for conventional loans when the down payment is less than 20% of the home’s value. By eliminating this requirement, veterans can save a substantial amount of money in monthly mortgage payments.

This pro of National Guard VA loan eligibility opens up opportunities for veterans to build wealth through real estate investments. They can purchase additional homes as investment properties or even acquire properties for family members without having to worry about financial barriers such as down payments and PMI.

The flexibility provided by the ability to use their VA loan entitlement multiple times empowers veterans to explore various real estate options and diversify their investment portfolios. Whether it’s expanding their rental property business or providing housing solutions for loved ones, veterans can leverage this benefit to achieve their financial goals.

It’s important to note that each time veterans utilize their VA loan entitlement, they must meet certain eligibility criteria and adhere to specific guidelines set by the Department of Veterans Affairs. However, with proper planning and understanding of these requirements, veterans can take advantage of this incredible opportunity repeatedly.

In conclusion, the ability to use the VA loan entitlement multiple times is a tremendous advantage for veterans considering purchasing multiple homes. The elimination of down payment and PMI requirements each time they qualify for a loan allows veterans to embark on real estate ventures and secure additional properties without the usual financial burdens. This benefit not only opens doors for investment opportunities but also provides the potential for long-term financial stability and wealth-building for veterans and their families.

The VA funding fee can be rolled into the loan amount so that it does not have to be paid out of pocket at closing time by the veteran borrower(s).

The VA Funding Fee: A Convenient Benefit of National Guard VA Loan Eligibility

One of the significant advantages of National Guard VA loan eligibility is the ability to roll the VA funding fee into the loan amount. This means that veterans and National Guard members do not have to pay this fee out of pocket at closing time, providing a convenient and accessible option for financing a home.

The VA funding fee is a one-time payment required by the Department of Veterans Affairs to help sustain the VA loan program. It serves as a way to offset costs and ensure its continued availability to future veterans. The fee percentage varies depending on factors such as military category, down payment amount, and whether it’s a first-time or subsequent use of the VA loan benefit.

By allowing borrowers to include this fee in their loan amount, the financial burden at closing time is significantly reduced. This can be especially beneficial for National Guard members who may have limited funds available or prefer not to deplete their savings for upfront costs.

Rolling the funding fee into the loan amount also offers convenience and flexibility. Rather than having to come up with a separate payment for this fee, it becomes part of the overall mortgage balance. This simplifies the process and allows borrowers to focus on other aspects of homeownership without worrying about additional expenses upfront.

Additionally, including the funding fee in the loan amount does not impact eligibility or affect other benefits associated with VA loans. It remains an attractive option for National Guard members who wish to take advantage of low-interest rates, no down payment requirements, and other favorable terms that make homeownership more accessible.

It’s important to note that rolling the funding fee into the loan amount will increase the overall mortgage balance and potentially result in slightly higher monthly payments. However, considering that this cost is spread out over the life of the loan, it can be manageable for many borrowers.

In conclusion, being able to roll the VA funding fee into the loan amount is a significant pro of National Guard VA loan eligibility. This benefit allows veterans and National Guard members to finance their homes without having to pay the fee out of pocket at closing. It provides convenience, accessibility, and flexibility, making the path to homeownership smoother and more affordable. If you are a National Guard member considering a VA loan, exploring this option can help you achieve your homeownership goals while preserving your financial resources.

Borrowers may be eligible for a one-time refund of the VA funding fee if they sell or refinance their home within a certain timeframe after purchase using a VA loan program benefit such as Interest Rate Reduction Refinancing Loans (IRRRLs).

A Perk of National Guard VA Loan Eligibility: Refund of the VA Funding Fee

For National Guard members who qualify for a VA loan, there is an additional benefit that can provide some financial relief. Borrowers may be eligible for a one-time refund of the VA funding fee if they sell or refinance their home within a certain timeframe after purchasing it using a VA loan program benefit.

The VA funding fee is a mandatory fee charged by the Department of Veterans Affairs to help offset the costs of administering the VA loan program. It is typically rolled into the loan amount and paid over time. However, if borrowers sell their home or choose to refinance within a specific period, they may be entitled to receive a refund of this fee.

This refund option can be particularly advantageous for National Guard members who anticipate selling their homes due to relocation or refinancing to take advantage of better interest rates or terms. It provides an opportunity to recoup some of the initial costs associated with obtaining a VA loan.

It’s important to note that not all borrowers will qualify for this refund. The eligibility criteria and specific timeframes vary depending on the type of loan and circumstances. For example, borrowers who obtained their VA loans through Interest Rate Reduction Refinancing Loans (IRRRLs) may be eligible for this refund option within 36 months from the date of their original loan.

To apply for the refund, borrowers must submit a completed application form (VA Form 26-8923) to their regional VA office. The form requires details about the original loan and proof of sale or refinance. It’s advisable to consult with your lender or reach out to your local VA office for guidance on eligibility requirements and submission procedures.

Receiving a refund on your VA funding fee can provide some financial relief when selling or refinancing your home within the designated timeframe. It’s an added perk that recognizes the unique circumstances faced by National Guard members who may need to relocate or take advantage of better loan options in the future.

If you are a National Guard member considering a VA loan, it’s essential to explore all the benefits and advantages available to you. The potential refund of the VA funding fee is just one of many reasons why this loan program can be a valuable resource for achieving homeownership. Consult with your lender or reach out to the VA for more information on how this benefit can work for you.

National Guard members who have served at least six years in any component of the U.S Armed Forces may qualify for full eligibility status without having to meet additional service requirements like active duty personnel must do

National Guard VA Loan Eligibility: Streamlined Benefits for Dedicated Service Members

One of the significant advantages of National Guard VA loan eligibility is that members who have served at least six years in any component of the U.S Armed Forces may qualify for full eligibility status without having to meet additional service requirements like active duty personnel must do. This streamlined process recognizes the dedication and commitment of National Guard members, making it easier for them to access the benefits they deserve.

Traditionally, active duty personnel are required to meet specific service length requirements to become fully eligible for VA loans. However, National Guard members who have completed a minimum of six years of honorable service in any branch or component of the U.S Armed Forces are exempt from these additional requirements. This means that they can enjoy full eligibility status as long as they meet this service threshold.

This pro of National Guard VA loan eligibility opens doors for more service members to take advantage of the benefits offered through the VA loan program. It acknowledges the unique nature of National Guard service, where individuals often balance civilian careers and military obligations. By recognizing their commitment and sacrifice, this streamlined process ensures that these dedicated individuals have equal access to homeownership opportunities.

With full eligibility status, National Guard members can benefit from features such as no down payment requirements, competitive interest rates, and flexible credit guidelines when applying for a VA loan. These benefits can be invaluable in helping them achieve their dream of owning a home or refinancing an existing mortgage.

The streamlined eligibility process also saves time and effort for National Guard members who are considering applying for a VA loan. They do not have to navigate additional complexities or wait longer periods before becoming fully eligible. Instead, they can focus on exploring their options and taking advantage of the benefits available to them through this program.

It’s important to note that while National Guard members with at least six years of service may qualify for full eligibility status, other criteria such as obtaining a Certificate of Eligibility (COE) from the VA still apply. However, this streamlined process ensures that National Guard members can access the benefits they have earned without additional service requirements.

In conclusion, National Guard VA loan eligibility offers a significant advantage to service members who have dedicated at least six years of their lives to any component of the U.S Armed Forces. By exempting them from additional service requirements, this streamlined process acknowledges their commitment and makes it easier for them to access the benefits of VA loans. If you are a National Guard member considering homeownership or refinancing, explore the advantages of VA loans and take advantage of this pro that recognizes your service and sacrifice.

You must have completed at least six years of service in the National Guard to be eligible for a VA loan.

The Challenge of Six Years of Service: National Guard VA Loan Eligibility

While the Department of Veterans Affairs (VA) offers valuable home loan benefits to National Guard members through VA loans, there is one requirement that can pose a challenge for some individuals. To be eligible for a VA loan as a National Guard member, you must have completed at least six years of honorable service in the National Guard or Reserve.

This requirement can present difficulties for those who have served for a shorter period or are unable to fulfill the full six years due to various circumstances. It may exclude newer National Guard members who are eager to take advantage of the benefits and opportunities provided by VA loans.

There are situations where service members may be discharged before completing six years due to reasons beyond their control, such as medical issues or family obligations. These individuals, despite their commitment and dedication to serving their country, may find themselves ineligible for a VA loan solely based on this time requirement.

Additionally, some National Guard members may face challenges in meeting the six-year requirement due to frequent deployments or activations. These individuals may not accumulate enough continuous service time within the National Guard to reach the eligibility threshold. It can be frustrating for them to miss out on the benefits of VA loans after sacrificing their time and energy in service.

Although this con exists within the eligibility criteria, it is important to understand that it aims to ensure that those who receive these benefits have demonstrated a certain level of commitment and longevity in their service. The intention is to protect against potential abuse of the program and maintain its integrity.

If you find yourself unable to meet the six-year service requirement, it doesn’t mean all hope is lost. There are alternative loan options available through traditional lenders that cater specifically to military personnel and veterans. These lenders often offer competitive interest rates and favorable terms that can still make homeownership achievable.

It’s crucial to explore all available avenues when seeking financing options for your home purchase or refinancing needs. Researching and consulting with experienced lenders who specialize in serving the military community can provide valuable insights into alternative loan programs that may suit your circumstances.

In conclusion, the six-year service requirement for National Guard VA loan eligibility can pose a challenge for some individuals. It may exclude those who have served for a shorter period or faced circumstances that prevented them from reaching the required timeframe. However, it’s important to remember that there are other loan options available that cater specifically to military personnel and veterans. By exploring these alternatives, you can still pursue your dream of homeownership and find a loan program that fits your needs.

Your active duty service must have been satisfactory and you must have received an honorable discharge from the National Guard to qualify for a VA loan.

A Consideration: Satisfactory Active Duty Service and Honorable Discharge for National Guard VA Loan Eligibility

When exploring the eligibility requirements for a VA loan as a National Guard member, one important consideration is the requirement of satisfactory active duty service and an honorable discharge. While this criterion may be seen as a potential con for some individuals, it is crucial to understand the reasoning behind this requirement.

The Department of Veterans Affairs (VA) has established these criteria to ensure that those who benefit from VA loans have demonstrated their commitment and dedication during their time in service. Satisfactory active duty service indicates that the applicant fulfilled their responsibilities and obligations while serving in the National Guard.

Similarly, an honorable discharge signifies that the individual completed their service with integrity, adhering to military standards and demonstrating good conduct throughout their tenure. This requirement ensures that those who receive VA loan benefits have exhibited qualities of professionalism, discipline, and reliability.

While it is understandable that not all National Guard members may meet these specific criteria due to various circumstances, it is crucial to remember that eligibility requirements are put in place to maintain the integrity of the VA loan program. These requirements help protect the interests of veterans and ensure that benefits are provided to those who have demonstrated their commitment to serving our country.

If you find yourself ineligible for a VA loan due to not meeting these specific criteria, there are still other mortgage options available through conventional lenders. It’s essential to explore alternative routes such as traditional mortgages or programs specifically designed for non-veterans.

In conclusion, while satisfactory active duty service and an honorable discharge from the National Guard are prerequisites for VA loan eligibility, they serve as important indicators of a candidate’s dedication and commitment during their military service. These requirements help maintain the integrity of the program by ensuring benefits are extended to those who have demonstrated their loyalty and adherence to military standards. If you do not meet these criteria, remember that there are other mortgage options available that can help you achieve your homeownership goals.

You may not be eligible for a VA loan if you are currently serving in the National Guard or if you are on active duty with another branch of the military.

Limitations of National Guard VA Loan Eligibility: Active Duty Restrictions

While the VA loan program offers numerous benefits to National Guard members, it’s important to be aware of certain limitations that may affect eligibility. One particular restriction is that you may not qualify for a VA loan if you are currently serving in the National Guard or if you are on active duty with another branch of the military.

The rationale behind this restriction is to prevent double-dipping or receiving multiple housing-related benefits simultaneously. The VA loan program aims to provide support primarily to veterans and those who have completed their service. Therefore, if you are currently serving in the National Guard or on active duty with another branch, you may need to explore alternative financing options for your home purchase.

However, it’s worth noting that this limitation does not apply once you have completed your service. Once you transition from active duty or complete your National Guard service, you become eligible for a VA loan as long as you meet the other eligibility requirements.

If you find yourself in this situation where you are currently serving in the National Guard or on active duty with another branch, there are still alternative paths to homeownership available. Conventional loans and other government-backed loan programs, such as FHA loans, may offer viable options with competitive terms and benefits.

It’s recommended to consult with mortgage lenders who specialize in military home financing to explore all available options based on your specific circumstances. They can guide you through different loan programs and help determine the best fit for your homeownership goals.

While it can be disappointing not to immediately qualify for a VA loan while actively serving in the National Guard or another branch of the military, it’s essential to remember that there are still opportunities for homeownership through other means. By understanding these limitations and exploring alternative financing options, you can take steps towards achieving your goal of owning a home even while actively serving our nation.

The maximum loan amount available through a VA loan is determined by your length of service and other factors, so it may not be enough to cover all of your needs when buying a home or refinancing an existing mortgage.

Considerations of National Guard VA Loan Eligibility: Loan Amount Limitations

While VA loans offer numerous benefits to National Guard members, it’s important to be aware of certain limitations that come with this program. One significant consideration is the maximum loan amount available through a VA loan, which may not always cover all your needs when buying a home or refinancing an existing mortgage.

The maximum loan amount for a VA loan is determined by various factors, including your length of service, entitlement, and the conforming loan limits set by the Federal Housing Finance Agency (FHFA). The VA sets a basic entitlement limit of $36,000, which guarantees up to 25% of the loan amount. However, this doesn’t necessarily mean you’re limited to a $144,000 loan since the VA also allows for additional entitlements in certain cases.

The specific loan amount you qualify for will depend on your eligibility and the property’s location. In areas with higher costs of living and higher conforming loan limits set by the FHFA, you may be able to secure a larger loan. However, in areas where housing prices are lower or where conforming loan limits are relatively low, there may be restrictions on how much you can borrow.

It’s crucial to carefully assess your financial needs and determine if the maximum loan amount available through a VA loan will adequately cover your home buying or refinancing requirements. If you’re looking to purchase a property that exceeds the maximum allowable limit or requires substantial renovations or repairs, you may need to explore alternative financing options or consider adjusting your budget and expectations accordingly.

It’s worth noting that while there may be limitations on the maximum loan amount, there are still advantages to utilizing a VA loan. These benefits include no down payment requirements (in most cases), competitive interest rates, and more lenient credit requirements compared to conventional loans. Additionally, VA loans do not require private mortgage insurance (PMI), which can save borrowers money on monthly payments.

To ensure you make an informed decision, it’s recommended to consult with a knowledgeable lender who specializes in VA loans. They can assess your specific situation, provide guidance on loan limits, and help you explore alternative financing options if needed.

In conclusion, while the maximum loan amount available through a VA loan may not cover all your needs when buying a home or refinancing an existing mortgage, it’s important to weigh this con against the numerous benefits offered by the program. By carefully evaluating your financial requirements and working with a trusted lender, you can make the most of your VA loan eligibility and find a suitable solution for your homeownership goals.