The Benefits of VA Mortgage Loans for Veterans

VA mortgage loans offer a range of benefits specifically designed to help veterans achieve the dream of homeownership. These loans are provided by private lenders but are guaranteed by the U.S. Department of Veterans Affairs, making them an attractive option for those who have served in the military.

Key Benefits of VA Mortgage Loans:

- No Down Payment: One of the most significant advantages of VA loans is that eligible veterans can purchase a home without having to make a down payment, making homeownership more accessible.

- Lower Interest Rates: VA loans typically offer lower interest rates compared to conventional mortgages, helping veterans save money over the life of the loan.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA loans do not require borrowers to pay for private mortgage insurance, further reducing monthly payments.

- Flexible Credit Requirements: VA loans are known for their more lenient credit requirements, making it easier for veterans with less-than-perfect credit to qualify.

- Assistance in Case of Financial Hardship: The VA offers support and assistance programs to help veterans who may face financial difficulties in repaying their mortgage.

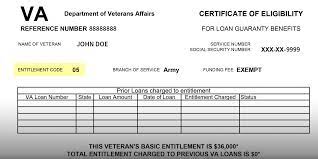

Eligibility Requirements:

To qualify for a VA mortgage loan, individuals must meet specific eligibility criteria based on their military service. Generally, veterans, active-duty service members, National Guard members, and surviving spouses may be eligible for a VA loan.

Conclusion:

VA mortgage loans provide valuable benefits that can make homeownership more achievable for veterans. If you are a veteran considering buying a home, exploring the advantages of a VA loan could be a smart financial decision. Contact your local VA office or lender to learn more about how you can benefit from this unique home loan program.

9 Advantages of VA Mortgage Loans for Veterans: Affordable, Flexible, and Hassle-Free

- No down payment required for eligible veterans.

- Lower interest rates compared to conventional mortgages.

- No private mortgage insurance (PMI) needed, reducing monthly costs.

- Flexible credit requirements make it easier to qualify.

- Assistance programs available in case of financial hardship.

- Ability to finance the funding fee into the loan amount.

- No prepayment penalties for paying off the loan early.

- VA loans can be assumable, allowing future buyers to take over the loan.

- Streamlined refinancing options available through VA Interest Rate Reduction Refinance Loan (IRRRL).

5 Drawbacks of VA Mortgage Loans: What to Consider Before Applying

- Limited to certain property types

- Funding fee

- Appraisal requirements

- Property condition standards

- Potential occupancy requirements

No down payment required for eligible veterans.

One significant advantage of VA mortgage loans is that eligible veterans are not required to make a down payment when purchasing a home. This benefit can make homeownership more accessible and affordable for veterans who may not have substantial savings for a traditional down payment. By eliminating the need for a down payment, VA loans help veterans achieve their dream of owning a home without the financial burden of a large upfront payment, making it easier to transition to civilian life and secure stable housing for themselves and their families.

Lower interest rates compared to conventional mortgages.

One significant advantage of VA mortgage loans is the lower interest rates they offer compared to conventional mortgages. This benefit can result in substantial savings over the life of the loan for eligible veterans. By securing a VA loan with lower interest rates, veterans can enjoy more affordable monthly payments and potentially pay off their mortgage sooner, making homeownership a more financially feasible and rewarding option for those who have served in the military.

No private mortgage insurance (PMI) needed, reducing monthly costs.

One significant advantage of VA mortgage loans is the absence of the requirement for private mortgage insurance (PMI). This benefit helps to lower monthly costs for veterans and active-duty military personnel, as they are not burdened with additional PMI payments that are typically necessary with conventional loans. By eliminating the need for PMI, VA loans make homeownership more affordable and accessible for those who have served in the military, allowing them to save money over the life of the loan.

Flexible credit requirements make it easier to qualify.

The flexible credit requirements of VA mortgage loans offer a significant advantage, making it easier for veterans to qualify for homeownership. Unlike conventional mortgages that may have strict credit score criteria, VA loans take into account the unique circumstances of military service and provide more leniency in credit assessments. This flexibility allows veterans with varying credit histories to access financing options that might otherwise be out of reach, empowering them to achieve their goal of owning a home.

Assistance programs available in case of financial hardship.

One significant advantage of VA mortgage loans is the availability of assistance programs in case of financial hardship. The U.S. Department of Veterans Affairs offers support to veterans who may encounter difficulties in repaying their mortgage. These programs provide valuable resources and guidance to help veterans navigate challenging financial situations and avoid foreclosure, ensuring that those who have served our country receive the necessary assistance to maintain their homes and financial stability.

Ability to finance the funding fee into the loan amount.

One key advantage of VA mortgage loans is the ability to finance the funding fee into the loan amount. This feature allows eligible veterans to include the upfront funding fee, typically required for VA loans, into the total loan balance instead of paying it out of pocket at closing. By financing the funding fee, veterans can preserve their savings and still take advantage of all the benefits that come with a VA loan, making homeownership more accessible and affordable for those who have served our country.

No prepayment penalties for paying off the loan early.

One significant advantage of VA mortgage loans is the absence of prepayment penalties for paying off the loan early. This feature allows veterans to save money on interest by making extra payments or paying off their loan ahead of schedule without incurring any additional fees. The flexibility to pay off the loan early can help veterans reduce their overall debt burden and achieve financial freedom sooner, making VA loans an attractive option for those looking to save on long-term interest costs.

VA loans can be assumable, allowing future buyers to take over the loan.

One significant advantage of VA mortgage loans is that they are assumable, meaning that future buyers have the option to take over the existing loan. This feature can be beneficial for sellers looking to attract potential buyers, as it allows for a smoother transition of homeownership without the need for new financing arrangements. Additionally, assumable VA loans can be an attractive selling point in a competitive real estate market, offering flexibility and convenience to both sellers and buyers alike.

Streamlined refinancing options available through VA Interest Rate Reduction Refinance Loan (IRRRL).

A notable benefit of VA mortgage loans is the availability of streamlined refinancing options through the VA Interest Rate Reduction Refinance Loan (IRRRL). This program allows eligible veterans to refinance their existing VA loan to secure a lower interest rate with minimal paperwork and underwriting requirements. The IRRRL simplifies the refinancing process, making it easier for veterans to take advantage of lower interest rates and potentially reduce their monthly mortgage payments, providing valuable savings over time.

Limited to certain property types

One drawback of VA mortgage loans is that they are limited to certain property types. Veterans seeking to use a VA loan may find restrictions on the types of properties that qualify for financing. Typically, VA loans are intended for primary residences, meaning investment properties or vacation homes may not be eligible. Additionally, some condominiums may not meet the VA’s approval requirements, limiting the options for veterans looking to purchase a home using this loan program. It is important for veterans to be aware of these limitations when considering a VA mortgage loan and to explore alternative financing options if their desired property type does not align with VA loan guidelines.

Funding fee

One notable drawback of VA mortgage loans is the funding fee that is typically required. This fee can increase the upfront costs associated with obtaining the loan, potentially adding to the financial burden for veterans seeking homeownership. While the funding fee helps offset the cost of the VA loan program for taxpayers, it is important for veterans to factor this additional expense into their budget when considering a VA loan.

Appraisal requirements

One drawback of VA mortgage loans is the stricter appraisal requirements they often entail, which can impact the home buying process. Unlike conventional loans, VA loans may have more stringent appraisal standards, which could result in a more thorough evaluation of the property’s condition and value. This can sometimes lead to delays or complications during the home buying process, as meeting these appraisal requirements may require additional time and effort from both the buyer and seller. It’s essential for prospective VA loan borrowers to be aware of these appraisal requirements and prepare accordingly to navigate this potential challenge effectively.

Property condition standards

One potential drawback of VA mortgage loans is the requirement for the property being purchased to meet specific minimum property condition standards established by the Department of Veterans Affairs. This can limit the options available to veterans, as not all properties may meet these standards. Additionally, meeting these requirements may add additional time and costs to the home buying process, as repairs or improvements may be necessary to bring the property up to standard. It is essential for veterans considering a VA loan to be aware of these property condition standards and factor them into their decision-making process when selecting a home.

Potential occupancy requirements

One con of VA mortgage loans is the potential occupancy requirements imposed on borrowers. VA loans typically mandate that borrowers must occupy the purchased property as their primary residence within a specific time frame. This requirement may limit flexibility for veterans who may have plans to rent out the property or use it as a second home. Failure to meet these occupancy requirements could result in penalties or even the loan being called due in full, posing a challenge for veterans who may need to relocate for work or other reasons in the future.