The VA Home Loan: A Great Resource for Veterans

As a veteran, you may be eligible to take advantage of a great benefit offered by the U.S. Department of Veterans Affairs (VA): the VA home loan. This program has helped millions of veterans and their families achieve the dream of homeownership, and it can do the same for you.

One of the biggest advantages of the VA home loan is that it does not require a down payment. This can be a huge help for veterans who may struggle to save up for a down payment on a home. Additionally, there is no private mortgage insurance (PMI) requirement with a VA loan, which can save borrowers hundreds or even thousands of dollars per year.

Another benefit of the VA home loan is that it offers competitive interest rates. The interest rates on VA loans are often lower than those on conventional loans, which can save veterans money over the life of their loan.

The VA home loan program also has more lenient credit requirements than many other types of loans. While lenders will still look at your credit score and history, they may be more willing to work with you if you have less-than-perfect credit.

It’s important to note that while there is no maximum loan amount for VA loans, there are limits on how much the VA will guarantee. In most cases, this limit is $548,250 in 2021 (although it can be higher in certain high-cost areas). However, if you need to borrow more than this amount, you may still be able to do so by putting down a larger down payment.

To qualify for a VA home loan, you must meet certain eligibility requirements. Generally speaking, you must have served at least 90 consecutive days on active duty during wartime or 181 days during peacetime (or have served at least six years in the National Guard or Reserves), and have been honorably discharged. Spouses of veterans who died in service or as a result of a service-connected disability may also be eligible for a VA home loan.

If you’re interested in using a VA home loan to buy or refinance a home, there are many lenders who offer these loans. However, it’s important to shop around and compare rates and fees from multiple lenders to ensure that you’re getting the best deal possible.

In conclusion, the VA home loan program is an excellent resource for veterans who want to achieve the dream of homeownership. With no down payment requirement, competitive interest rates, and more lenient credit requirements than many other types of loans, it’s definitely worth exploring if you’re a veteran looking to buy or refinance a home.

Answers to Common Questions About VA Home Loans

- Is it easy to get approved for VA home loan?

- How much will I get approved for with a VA loan?

- How much does the VA pay for a home loan?

- What is a VA loan on a house?

Is it easy to get approved for VA home loan?

While the VA home loan program can be a great resource for eligible veterans, it’s important to note that approval for a VA home loan is not guaranteed. Like with any type of loan, there are certain requirements that must be met in order to qualify.

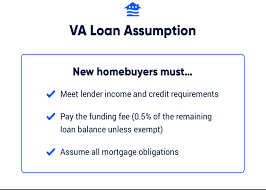

To be eligible for a VA home loan, you must have served at least 90 consecutive days on active duty during wartime or 181 days during peacetime (or have served at least six years in the National Guard or Reserves), and have been honorably discharged. Additionally, you must meet certain credit and income requirements set by the lender.

While the credit requirements for VA loans are generally more lenient than those for conventional loans, lenders will still look at your credit score and history when deciding whether to approve your loan application. If you have poor credit, it may be more difficult to get approved for a VA loan.

It’s also important to note that while the VA does not require a down payment or private mortgage insurance (PMI) for its loans, individual lenders may have their own requirements. Some lenders may require a down payment or PMI if your credit score is below a certain threshold.

In summary, getting approved for a VA home loan is not automatic, but it can be easier than getting approved for other types of loans. As with any type of loan, it’s important to shop around and compare rates and fees from multiple lenders to ensure that you’re getting the best deal possible.

How much will I get approved for with a VA loan?

The amount you can get approved for with a VA loan depends on several factors, including your income, credit score, debt-to-income ratio, and the appraised value of the home you want to buy.

While there is no maximum loan amount for VA loans, there are limits on how much the VA will guarantee. In most cases, this limit is $548,250 in 2021 (although it can be higher in certain high-cost areas). However, if you need to borrow more than this amount, you may still be able to do so by putting down a larger down payment.

It’s important to note that even if you are approved for a certain loan amount, it’s up to the lender to determine how much they are willing to lend you based on their own underwriting guidelines. Additionally, just because you can get approved for a certain loan amount doesn’t necessarily mean that it’s a good idea to borrow that much. You should carefully consider your budget and financial goals before deciding how much to borrow.

To get an idea of how much you may be able to get approved for with a VA loan, it’s best to speak with a lender who specializes in VA loans. They can take into account your specific financial situation and help you understand your options.

How much does the VA pay for a home loan?

The VA doesn’t actually provide the funds for a home loan. Instead, they guarantee a portion of the loan to the lender, which allows the lender to offer more favorable terms to the borrower.

The amount that the VA guarantees varies depending on a few factors, including the size of the loan and whether or not you’ve used your VA home loan benefit before. In most cases, the VA will guarantee up to 25% of a home loan up to $548,250 in 2021 (although it can be higher in certain high-cost areas).

It’s important to note that while the VA guarantees a portion of the loan, you’ll still need to work with a lender to secure financing for your home purchase or refinance. The actual amount that you’ll be able to borrow will depend on your income, credit score, and other factors.

What is a VA loan on a house?

A VA loan on a house is a mortgage loan that is guaranteed by the U.S. Department of Veterans Affairs (VA) and is designed to help veterans, active-duty military personnel, and certain surviving spouses purchase or refinance a home.

The VA loan program was established in 1944 as part of the Servicemen’s Readjustment Act, also known as the GI Bill of Rights. The purpose of the program was to help returning veterans buy homes with no down payment and at lower interest rates.

One of the most significant advantages of a VA loan on a house is that it does not require a down payment. This means that eligible borrowers can purchase a home without having to save up for a large down payment, which can be a significant barrier to homeownership for many people.

In addition to not requiring a down payment, VA loans also have more relaxed credit requirements compared to other types of loans. This means that borrowers with less-than-perfect credit may still be able to qualify for a VA loan.

Another advantage of VA loans is that they do not require private mortgage insurance (PMI), which can add hundreds or even thousands of dollars to your monthly mortgage payment.

To be eligible for a VA loan on a house, you must meet certain requirements. Generally speaking, you must have served at least 90 consecutive days on active duty during wartime or 181 days during peacetime (or have served at least six years in the National Guard or Reserves), and have been honorably discharged. Spouses of veterans who died in service or as a result of a service-connected disability may also be eligible for a VA loan.

If you’re interested in obtaining a VA loan on a house, you’ll need to apply through an approved lender who participates in the VA Home Loan Program. The lender will review your application and determine whether you meet the eligibility requirements for the program.

In conclusion, if you’re a veteran, active-duty military personnel, or a surviving spouse, a VA loan on a house can be an excellent way to achieve the dream of homeownership. With no down payment requirement, more relaxed credit requirements, and no PMI requirement, it’s definitely worth exploring if you’re in the market for a new home or looking to refinance your current mortgage.