VA Disability Direct Deposit: Ensuring Timely and Secure Payments for Veterans

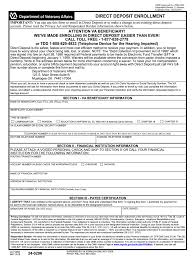

For veterans receiving disability benefits from the Department of Veterans Affairs (VA), direct deposit offers a convenient and reliable way to receive payments. Direct deposit eliminates the need for paper checks, ensuring that veterans receive their benefits in a timely manner without the risk of lost or stolen checks.

Enrolling in VA disability direct deposit is a simple process that can be done online through the VA website or by contacting the VA directly. By providing your bank account information, you can have your monthly disability payments deposited directly into your account.

There are several benefits to opting for direct deposit for your VA disability payments. Firstly, direct deposit ensures that you receive your payments on time, even in cases of holidays or natural disasters that may disrupt mail delivery. Additionally, direct deposit is a secure method of payment, reducing the risk of identity theft or fraud associated with paper checks.

Furthermore, direct deposit is a more environmentally friendly option compared to paper checks, as it reduces paper waste and helps conserve resources. By enrolling in VA disability direct deposit, veterans can contribute to sustainability efforts while enjoying the convenience of electronic payments.

In conclusion, VA disability direct deposit offers veterans a secure and efficient way to receive their benefits. By enrolling in direct deposit, veterans can ensure that their payments are delivered on time and securely deposited into their bank accounts. For veterans looking to streamline their payment process and reduce the risk of payment delays or losses, enrolling in VA disability direct deposit is highly recommended.

5 Essential Tips for Managing Your VA Disability Direct Deposit

- Ensure your direct deposit information is accurate and up to date with the VA.

- Contact the VA directly if you encounter any issues with your direct deposit.

- Monitor your bank account regularly to confirm that the correct amount has been deposited by the VA.

- Be cautious of providing your bank account information to unauthorized individuals or organizations.

- Consider setting up alerts with your bank to receive notifications about deposits from the VA.

Ensure your direct deposit information is accurate and up to date with the VA.

It is crucial to ensure that your direct deposit information is accurate and up to date with the VA when receiving disability benefits. By regularly verifying and updating your bank account details with the VA, you can avoid any potential issues or delays in receiving your payments. Keeping your direct deposit information current ensures that your benefits are deposited into the correct account and helps maintain a smooth and uninterrupted payment process.

Contact the VA directly if you encounter any issues with your direct deposit.

If you encounter any issues with your VA disability direct deposit, it is important to contact the VA directly for assistance. Whether you are experiencing delays in receiving your payments or have concerns about the security of your direct deposit, reaching out to the VA can help resolve any issues promptly. By communicating directly with the VA, you can ensure that your disability benefits are processed efficiently and that any problems with your direct deposit are addressed in a timely manner.

Monitor your bank account regularly to confirm that the correct amount has been deposited by the VA.

It is essential to monitor your bank account regularly after enrolling in VA disability direct deposit to confirm that the correct amount has been deposited by the VA. By reviewing your account statements frequently, you can quickly identify any discrepancies or errors in the payment amounts. This proactive approach ensures that you receive the full and accurate benefits owed to you, allowing you to address any issues promptly with the VA if needed. Regular monitoring of your bank account adds an extra layer of security and peace of mind, helping you stay informed about your VA disability payments.

Be cautious of providing your bank account information to unauthorized individuals or organizations.

It is crucial to exercise caution when sharing your bank account information for VA disability direct deposit with unauthorized individuals or organizations. Protecting your personal and financial information is essential to prevent identity theft and fraud. Ensure that you only provide your bank account details through secure channels, such as the official VA website or directly to the VA. Be wary of unsolicited requests for your banking information and always verify the legitimacy of any organization before sharing sensitive data. By staying vigilant and only sharing your bank account information with trusted sources, you can safeguard your funds and personal information effectively.

Consider setting up alerts with your bank to receive notifications about deposits from the VA.

Consider setting up alerts with your bank to receive notifications about deposits from the VA. By setting up alerts, you can stay informed about when your VA disability payments are deposited into your account. This proactive approach allows you to track your payments and ensure that they are processed correctly and on time. Setting up alerts provides an added layer of security and peace of mind, giving you confidence that your benefits are being received as expected.