Emergency Loans for Veterans: A Lifeline for Those Who Have Served

As a veteran, you have likely faced many difficult challenges throughout your life. But one of the most difficult challenges you may encounter is finding financial assistance during times of need. Fortunately, there are emergency loans available to veterans that can provide a lifeline in times of crisis.

Emergency loans for veterans are designed to help those who have served in the military cover unexpected expenses and financial emergencies that arise. These loans are typically short-term and offer more flexible terms and conditions than traditional forms of financing. They also come with lower interest rates and longer repayment periods than other types of loans, making them an ideal option for veterans who may not have access to other forms of financing.

The U.S. Department of Veterans Affairs (VA) offers a variety of emergency loan programs specifically designed for veterans in need. These include the VA Home Loan Program, which provides low-interest mortgages to qualified veterans; the VA Home Improvement Loan Program, which helps veterans make necessary repairs or improvements to their homes; and the VA Emergency Assistance Loan Program, which helps veterans cover expenses related to medical bills, rent or mortgage payments, food, utilities, or other necessities.

In addition to these VA-sponsored programs, there are also private lenders who offer emergency loans specifically tailored to veterans’ needs. These lenders typically offer more flexible terms and conditions than traditional banks and credit unions, making them an attractive option for those who may not qualify for traditional financing options due to bad credit or insufficient income. Furthermore, many private lenders understand the unique financial challenges faced by those who have served in the military and are willing to work with borrowers on an individual basis to ensure they receive the best possible loan terms and conditions.

No matter what your financial situation may be as a veteran, it is important that you know there are resources available to help you during times of need. Emergency loans for veterans can provide a lifeline when you find yourself in an unexpected financial bind—and give you peace of mind knowing that help is out there when you need it most.

Nine Tips for Veterans on Emergency Loans

- Take advantage of the VA Home Loan Guaranty Program – this program guarantees loans up to $424,100 for eligible veterans.

- Research all your options – there are many lenders who offer emergency loans specifically tailored to veterans’ needs.

- Understand the requirements – make sure you meet all eligibility criteria before applying for a loan.

- Compare interest rates and fees – shop around for the best deal when it comes to interest rates and other fees associated with the loan.

- Consider a credit union loan – some credit unions may offer better terms than banks or other traditional lenders when it comes to emergency loans for veterans.

- Look into military relief societies – organizations such as The American Legion or Veterans of Foreign Wars may provide low-interest loan options or grants that can help in an emergency situation.

- Seek out additional benefits from Veteran Affairs (VA) – if you have served in the military, you may be eligible for additional benefits from VA such as compensation, pensions, health care, education assistance and more that could help cover any costs associated with an emergency loan

- Utilize online resources – there are many websites available that provide information on emergency loans specifically tailored to veterans’ needs

- Seek advice from financial advisors – speaking with a financial advisor can help ensure you understand all your options and make informed decisions about taking out an emergency loan

Take advantage of the VA Home Loan Guaranty Program – this program guarantees loans up to $424,100 for eligible veterans.

For veterans looking for financial assistance, the VA Home Loan Guaranty Program is a great option. This program, managed by the Department of Veterans Affairs (VA), guarantees loans up to $424,100 for eligible veterans. The loan can be used to purchase a home or refinance an existing loan.

The VA Home Loan Guaranty Program offers many advantages over traditional loans, such as lower interest rates and no down payment requirements. Additionally, veterans may be eligible for closing cost assistance and other incentives depending on their specific situation.

In order to qualify for the program, veterans must have served at least 90 days of active duty during wartime or 181 days in peacetime. They must also provide proof of income and meet other eligibility requirements set by the VA.

The VA Home Loan Guaranty Program is an invaluable resource for veterans in need of financial assistance. With its low interest rates and no down payment requirement, it is an excellent way to purchase a home or refinance an existing loan. For more information on how to apply, visit the VA website today!

Research all your options – there are many lenders who offer emergency loans specifically tailored to veterans’ needs.

As a veteran, you may find yourself in need of emergency funds at some point. Fortunately, there are many lenders who offer emergency loans specifically tailored to veterans’ needs. It is important to research all your options when considering an emergency loan, as each lender offers different terms and conditions that can affect the overall cost of the loan.

When researching lenders, look for ones that specialize in veteran loans. These lenders understand the unique needs of veterans and can provide more flexible terms and lower interest rates than traditional lenders. Additionally, some lenders may offer additional benefits such as discounts on fees or interest rates for veterans.

Be sure to compare all the details of each loan option before making a decision. Consider factors such as repayment periods, fees, interest rates, and any other additional costs associated with the loan. Also take into account any special features or benefits that may be available to you as a veteran.

By researching all your options and taking advantage of any special benefits available to you as a veteran, you can ensure that you get the best deal on your emergency loan.

Understand the requirements – make sure you meet all eligibility criteria before applying for a loan.

Veterans have access to a variety of emergency loan options to help them manage their finances during tough times. However, before applying for any of these loans, it is important for veterans to understand the requirements and make sure they meet all eligibility criteria.

The U.S. Department of Veterans Affairs provides emergency loans for veterans who are facing financial hardship due to unexpected expenses or loss of income. These loans are available in amounts up to $25,000 and can be used for a variety of purposes including rent payments, medical bills, vehicle repairs, and more.

To be eligible for an emergency loan from the VA, veterans must meet certain criteria. This includes being an active-duty member or veteran of the U.S. Armed Forces, having a good credit history and sufficient income to repay the loan, and meeting certain other requirements depending on the type of loan requested. Additionally, some lenders may require additional information such as proof of military service or proof of residency in the state where the loan is being requested.

It is important for veterans to carefully review all eligibility requirements before applying for an emergency loan from the VA or any other lender. By understanding the requirements upfront, veterans can ensure they are taking advantage of all available resources and that they are well-prepared when it comes time to apply for a loan.

Compare interest rates and fees – shop around for the best deal when it comes to interest rates and other fees associated with the loan.

When it comes to emergency loans for veterans, it is important to compare interest rates and fees. Shopping around for the best deal can save veterans money in the long run and help them get back on their feet.

Interest rates vary from lender to lender, so it is important to research different lenders before making a decision. It is also important to look at any fees associated with the loan, such as origination fees or prepayment penalties. These can add up quickly and increase the overall cost of the loan.

It is important for veterans to remember that emergency loans are intended to be short-term solutions and should not be used as a long-term financing option. Taking time to compare interest rates and fees can help veterans find the best deal and ensure they are not paying more than necessary.

Consider a credit union loan – some credit unions may offer better terms than banks or other traditional lenders when it comes to emergency loans for veterans.

For veterans in need of emergency funds, a credit union loan may be the best option. Credit unions are not-for-profit financial institutions that typically offer more competitive rates and terms than banks or other traditional lenders. This is especially true when it comes to emergency loans for veterans.

Credit unions are often willing to work with veterans who have bad credit or a limited income, making them an ideal choice for those in need of financial assistance. Credit unions may also offer special discounts on interest rates and fees for veterans, as well as additional services like free financial counseling.

When considering a credit union loan for an emergency loan for veterans, it is important to compare the terms and conditions of different lenders. Make sure to read the fine print and ask questions about any fees or charges that may apply. It is also important to understand the repayment process and any potential penalties for late payments.

Overall, credit unions can be an excellent option for veterans looking for emergency loans. With competitive rates, flexible terms, and special discounts available to veterans, they can provide much-needed financial support in times of need.

Look into military relief societies – organizations such as The American Legion or Veterans of Foreign Wars may provide low-interest loan options or grants that can help in an emergency situation.

Veterans are often faced with financial difficulties due to the unique circumstances of their service. For those in need of emergency funds, military relief societies may be able to provide some assistance. Organizations such as The American Legion and Veterans of Foreign Wars (VFW) offer low-interest loan options and grants that can help veterans in an emergency situation.

These organizations are dedicated to helping veterans and their families, providing them with the resources they need to be successful. The American Legion, for example, offers a variety of services including emergency financial assistance, support for transitioning veterans, and educational opportunities. The VFW also provides financial assistance through its Emergency Relief Program which can provide grants or loans to help cover expenses such as housing costs or medical bills.

In addition to these organizations, there are other resources available for veterans seeking emergency funds. The Department of Veterans Affairs (VA) offers a variety of programs designed to provide financial assistance for veterans in need. These include grants for home improvements, education assistance, and job training programs.

For those facing an unexpected financial hardship, exploring military relief societies is a great first step towards securing the necessary funds. With the right resources and support, veterans can find the help they need during difficult times.

Seek out additional benefits from Veteran Affairs (VA) – if you have served in the military, you may be eligible for additional benefits from VA such as compensation, pensions, health care, education assistance and more that could help cover any costs associated with an emergency loan

As a veteran, you may be eligible for additional benefits from Veteran Affairs (VA) that could help you cover the cost of an emergency loan. These benefits include compensation, pensions, health care, education assistance and more.

If you are a veteran who is facing financial difficulty due to an emergency situation, it is important to seek out these additional benefits from VA. You may be able to use them to help cover the cost of your loan and avoid getting into deeper financial trouble.

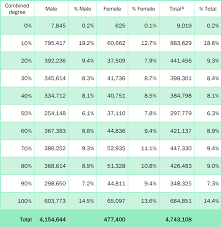

The VA provides a wide range of services for veterans in need, including home loan guaranty, disability compensation and vocational rehabilitation. It also offers programs such as the Dependents Educational Assistance Program which provides educational assistance to the dependents of veterans who have died or were disabled while serving in the military.

If you are a veteran in need of an emergency loan, it is important to explore all available options and resources that can provide financial assistance. Taking advantage of any additional benefits from VA can help make this process easier and ensure that you get the help you need in times of crisis.

Utilize online resources – there are many websites available that provide information on emergency loans specifically tailored to veterans’ needs

For veterans in need of emergency financial assistance, there are many online resources available that provide information on loans tailored specifically to their needs. These loans can be used for a variety of purposes, such as medical bills, home repairs, car repairs, and more.

The U.S. Department of Veterans Affairs (VA) provides a variety of loan programs to help veterans access the funds they need in times of crisis. These include VA-backed home loans, business loans, and grants for veterans with disabilities or low incomes. Additionally, the VA also offers emergency assistance grants to help cover basic living expenses such as rent and utilities.

In addition to the VA’s resources, there are also numerous private lenders offering emergency loans specifically designed for veterans. These include organizations such as Veterans United Home Loans and Military Loan Services which specialize in providing financing options tailored to the unique needs of veterans.

No matter what type of emergency loan you may need as a veteran, it is important to do your research and find out what options are available to you. Utilizing online resources is a great way to find out about the various loan programs available to veterans and determine which one is best suited for your individual situation.

Seek advice from financial advisors – speaking with a financial advisor can help ensure you understand all your options and make informed decisions about taking out an emergency loan

Veterans often face unique financial challenges, and an emergency loan can be a helpful solution for those in need of quick access to funds. However, it’s important to understand all the options available to you and make an informed decision about taking out an emergency loan. That’s why seeking advice from a financial advisor is so important.

A financial advisor can provide valuable insight into the different types of emergency loans available, such as VA loans or special grants. They can also help you understand the terms and conditions of each loan, such as interest rates, repayment terms, and any fees associated with the loan. They can also provide advice on budgeting and saving strategies that could help you avoid taking out an emergency loan in the future.

Finally, a financial advisor can help you assess your current financial situation and determine whether taking out an emergency loan is right for you. They can review your income and expenses to ensure that you have enough money left over after paying back the loan to cover your other financial obligations.

Taking out an emergency loan is often a necessary step for veterans in need of quick access to funds, but it should not be taken lightly. Seeking advice from a qualified financial advisor can help ensure that you make informed decisions about taking out an emergency loan and understand all the options available to you.