The VA Home Loan Certificate of Eligibility: Your Key to Affordable Homeownership

For veterans and active duty military personnel, the dream of owning a home can become a reality with the help of the VA Home Loan program. One crucial document that plays a significant role in this process is the VA Home Loan Certificate of Eligibility (COE). This certificate serves as proof that you meet the requirements to obtain a VA-backed home loan, making it an essential step in securing affordable homeownership.

The COE is issued by the Department of Veterans Affairs (VA) and acts as evidence that you are eligible for a VA home loan benefit. It outlines your entitlement amount, which determines how much loan guaranty the VA will provide. By guaranteeing a portion of your mortgage, the VA helps lenders offer more favorable terms, such as lower interest rates and reduced down payments.

To obtain your COE, you can apply through various methods. The most convenient way is through an online application on the eBenefits portal or by using the VA’s Automated Certificate of Eligibility (ACE) system. These options offer quick results and simplify the process for eligible veterans and service members.

To be eligible for a COE, certain criteria must be met. Generally, veterans who served at least 90 consecutive days during wartime or 181 days during peacetime are eligible. National Guard or Reserve members may also qualify after serving for at least six years unless called to active duty sooner.

Spouses of service members who died in the line of duty or as a result of a service-related disability may also be eligible for this benefit. Surviving spouses should check their eligibility status with the VA to determine if they qualify for a COE.

It’s important to note that while obtaining your COE is an essential step towards obtaining a VA-backed home loan, it does not guarantee loan approval. Lenders will still evaluate your creditworthiness and ability to repay the loan.

Once you have your COE, you can start exploring VA-approved lenders to find the best loan terms for your needs. With the VA’s backing, these lenders are more willing to offer competitive interest rates and flexible financing options. Additionally, VA loans often eliminate the need for private mortgage insurance (PMI), which can save borrowers a significant amount of money each month.

The VA Home Loan program has helped millions of veterans and service members achieve their homeownership goals. By providing access to affordable financing and favorable terms, it offers a unique opportunity for those who have served our country to establish stability and build wealth through homeownership.

If you’re a veteran or active duty military personnel dreaming of owning a home, don’t overlook the importance of obtaining your VA Home Loan Certificate of Eligibility. It’s the key that unlocks the door to affordable homeownership and sets you on the path towards achieving your housing goals. Contact the Department of Veterans Affairs or visit their website to learn more about eligibility requirements and how to obtain your COE today.

Frequently Asked Questions about VA Home Loan Certificate of Eligibility

- How do I apply for a VA Home Loan Certificate of Eligibility?

- What documents are required to obtain a VA Home Loan Certificate of Eligibility?

- How long does it take to receive a VA Home Loan Certificate of Eligibility?

- What is the difference between a VA Home Loan and other types of home loans?

- Are there any restrictions on using a VA Home Loan Certificate of Eligibility?

- Is there an expiration date for my VA Home Loan Certificate of Eligibility?

How do I apply for a VA Home Loan Certificate of Eligibility?

Applying for a VA Home Loan Certificate of Eligibility (COE) is a straightforward process. There are a few different methods you can use to apply, depending on your preference and eligibility status. Here are the steps to apply for a COE:

- Determine your eligibility: Before applying for a COE, make sure you meet the criteria set by the Department of Veterans Affairs (VA). Generally, this includes serving a minimum number of days in active duty or meeting specific requirements as a surviving spouse. Check the VA’s website or contact them directly to confirm your eligibility.

- Gather necessary documentation: To support your application, you will need certain documents. These may include your discharge or separation papers (DD214), service records, National Guard or Reserve records, and marriage certificates (if applicable). Having these documents readily available will help streamline the application process.

- Apply online through eBenefits: The most convenient way to apply for a COE is through the VA’s eBenefits portal (www.ebenefits.va.gov). Create an account if you don’t already have one and navigate to the housing section where you can find the application form for the COE. Follow the instructions provided and submit all required information and supporting documents electronically.

- Use the Automated Certificate of Eligibility (ACE) system: Another online option is using the VA’s Automated Certificate of Eligibility (ACE) system. This system allows lenders to access and generate COEs on behalf of borrowers quickly. If your lender has access to ACE, they can assist you with obtaining your COE efficiently.

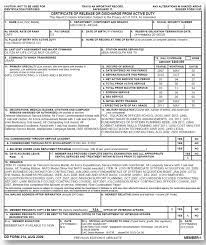

- Apply by mail: If you prefer not to apply online, you can complete VA Form 26-1880, Request for a Certificate of Eligibility, and mail it along with any necessary supporting documents to the appropriate regional VA loan center based on your state of residence. The address for each regional office can be found on the VA’s website.

- Work with a VA-approved lender: If you’re in the process of securing a VA home loan, your chosen lender can often help you obtain your COE. Many lenders have access to the ACE system or can assist you in completing the necessary paperwork.

Once your application is submitted, it may take some time for the VA to process and issue your COE. If you apply online through eBenefits or ACE, you may receive an instant determination of eligibility. If applying by mail, it typically takes a few weeks to receive your COE by mail.

Remember that obtaining a COE is just one step in the VA home loan process. You will still need to meet additional requirements set by lenders, such as creditworthiness and income verification, to secure your loan. Working with a knowledgeable lender experienced in VA loans can help guide you through the entire process.

If you have any questions or need assistance during the application process, reach out to the Department of Veterans Affairs directly for guidance and support.

What documents are required to obtain a VA Home Loan Certificate of Eligibility?

To obtain a VA Home Loan Certificate of Eligibility (COE), you will need to provide specific documents that verify your eligibility for the VA home loan program. The required documents may vary based on your military status and service history. Here are some common documents that may be necessary:

- Proof of Military Service: This can include a copy of your DD Form 214 (Certificate of Release or Discharge from Active Duty) or NGB Form 22 (National Guard Report of Separation and Record of Service). Active duty service members can provide a current statement of service signed by their commanding officer.

- Reservists and National Guard Members: If you are currently serving in the Reserves or National Guard, you will need to submit evidence of your service such as copies of retirement points statements, discharge orders, or annual retirement points statements.

- Active Duty Personnel: If you are an active duty member, you will need to provide a statement of service signed by your commanding officer that includes information about your current active duty status, length of service, and any time lost.

- Surviving Spouses: If you are a surviving spouse applying for a COE based on the death of a service member, you will need to provide documentation such as the DD Form 1300 (Report of Casualty) or other official military documentation that verifies the cause and circumstances of the service member’s death.

- Prior VA Loan Users: If you have previously used your VA home loan benefit, you may need to provide documentation showing that your previous loan has been paid off or discharged.

It’s important to note that these documents represent general requirements, but additional documentation may be requested depending on individual circumstances. The Department of Veterans Affairs provides detailed information regarding specific eligibility requirements and required documents on their official website.

To apply for a COE, veterans can use the eBenefits portal or submit an application through their lender who can assist with the process. The VA also offers an Automated Certificate of Eligibility (ACE) system for faster online verification.

Obtaining your VA Home Loan Certificate of Eligibility is a crucial step towards accessing the benefits of the VA home loan program. By gathering and submitting the necessary documents, you can move closer to achieving your homeownership goals with favorable loan terms and benefits designed to support veterans and their families.

How long does it take to receive a VA Home Loan Certificate of Eligibility?

The timeframe to receive a VA Home Loan Certificate of Eligibility (COE) can vary depending on the method you choose to apply and the current processing times at the Department of Veterans Affairs (VA).

If you apply online through the eBenefits portal or use the VA’s Automated Certificate of Eligibility (ACE) system, you may receive your COE within minutes. These online options provide quick results and are often the most efficient way to obtain your certificate.

On the other hand, if you choose to apply by mail, it may take several weeks for your application to be processed and for you to receive your COE. Processing times can be influenced by factors such as workload volume and seasonal fluctuations.

To expedite the process, it is advisable to ensure that all required documents are included with your application. This includes proof of military service, such as DD Form 214 or Statement of Service, as well as any necessary supporting documentation for surviving spouses or National Guard/Reserve members.

If you need your COE urgently or have any specific concerns about timing, it is recommended that you contact the VA directly or consult with a VA-approved lender who can provide guidance and assistance throughout the process.

Remember that while obtaining your COE is an important step towards securing a VA-backed home loan, it does not guarantee loan approval. Lenders will still evaluate your creditworthiness and financial situation before finalizing loan terms.

Overall, while processing times can vary, utilizing online methods like eBenefits or ACE often yield quicker results for obtaining your VA Home Loan Certificate of Eligibility.

What is the difference between a VA Home Loan and other types of home loans?

The VA Home Loan program stands out from other types of home loans in several significant ways. Here are some key differences:

- No Down Payment: One of the most notable advantages of a VA Home Loan is that eligible borrowers can finance the entire purchase price of a home without having to make a down payment. This is a stark contrast to conventional loans, which often require a down payment ranging from 3% to 20% of the home’s purchase price.

- Competitive Interest Rates: VA Home Loans typically offer competitive interest rates compared to other loan options. The Department of Veterans Affairs guarantees a portion of the loan, which reduces the risk for lenders and allows them to offer more favorable rates.

- No Private Mortgage Insurance (PMI): Unlike many conventional loans, VA Home Loans do not require borrowers to pay for private mortgage insurance (PMI). PMI is typically required when borrowers make a down payment below 20% on conventional loans and can add significant costs to monthly mortgage payments.

- Flexible Credit Requirements: While lenders still consider creditworthiness when evaluating VA Home Loan applications, the program tends to have more flexible credit requirements compared to conventional loans. This can be beneficial for veterans or active duty military personnel who may have had financial challenges in the past.

- Limited Closing Costs: The VA has specific guidelines regarding which fees and costs borrowers are allowed to pay, limiting the amount they are responsible for at closing. This can help reduce upfront expenses when purchasing a home.

- Assumable Loans: Another unique feature of VA Home Loans is that they are assumable, meaning that if you sell your home, the buyer may be able to take over your existing loan terms instead of obtaining new financing. This feature can be attractive in certain situations where interest rates have risen since you obtained your original loan.

It’s important to note that while VA Home Loans offer numerous advantages, there are specific eligibility requirements that must be met. These requirements include serving a certain period of active duty, meeting minimum credit standards, and obtaining a Certificate of Eligibility (COE) from the Department of Veterans Affairs.

In summary, VA Home Loans provide eligible veterans and active duty military personnel with unique benefits such as no down payment, competitive interest rates, no PMI requirement, flexible credit requirements, limited closing costs, and assumable loans. These features make VA Home Loans an appealing option for those who have served our country and are looking to achieve homeownership.

Are there any restrictions on using a VA Home Loan Certificate of Eligibility?

While the VA Home Loan Certificate of Eligibility (COE) is a valuable document that opens doors to affordable homeownership, there are certain restrictions and guidelines associated with its use. These restrictions aim to ensure that the benefits provided by the VA Home Loan program are used appropriately and effectively. Here are some important points to consider:

- Intended Property Use: The VA home loan benefit is primarily designed for purchasing or refinancing primary residences. This means that the property you intend to finance with a VA loan should be your main place of residence. It cannot be used for investment properties, vacation homes, or purely rental purposes.

- Property Eligibility: The property you wish to purchase must meet certain requirements set by the Department of Veterans Affairs. These requirements include factors such as the property’s condition, safety standards, and adherence to local zoning regulations. It’s essential to ensure that the property you’re interested in qualifies for a VA loan before proceeding.

- Occupancy Requirement: When using a VA home loan, you must certify that you intend to occupy the property as your primary residence within a reasonable time after closing on the loan. Generally, this means you should plan to move into the property within 60 days after closing.

- Funding Fee: The VA charges a funding fee for most VA home loans, which helps sustain the program and keep it available for future generations of veterans and service members. The funding fee amount varies depending on factors such as your military category, down payment amount (if any), and whether it’s your first or subsequent use of the benefit.

- Creditworthiness: While obtaining a COE establishes your eligibility for a VA-backed home loan, it does not guarantee automatic approval from lenders. Lenders will still assess your creditworthiness based on factors such as credit history, income stability, and debt-to-income ratio.

- Loan Limits: The VA sets limits on how much they will guarantee on a VA loan, which can vary depending on your location. These limits represent the maximum loan amount that the VA will back, but they do not necessarily dictate how much you can borrow. Lenders may have their own guidelines regarding loan amounts based on factors like your income and creditworthiness.

It’s important to consult with a knowledgeable VA-approved lender who can guide you through the specific restrictions and guidelines associated with using a VA Home Loan Certificate of Eligibility. They can help ensure that you understand the limitations and requirements of the program, allowing you to make informed decisions throughout the homebuying process.

Remember, the VA Home Loan program is designed to provide affordable homeownership opportunities for veterans and active duty military personnel. By adhering to the program’s restrictions and guidelines, you can make the most of this valuable benefit and achieve your homeownership goals.

Is there an expiration date for my VA Home Loan Certificate of Eligibility?

The VA Home Loan Certificate of Eligibility (COE) does not have an expiration date. Once you obtain your COE, it remains valid indefinitely, as long as there are no changes to your eligibility status.

However, it’s important to note that the COE may need to be updated if there are any changes in your circumstances. For example, if you used your VA home loan benefit in the past and paid off the loan, you can request a new COE to restore your entitlement for future use.

Additionally, if there are any updates or corrections needed on your COE, such as a change in your marital status or military service history, you should contact the Department of Veterans Affairs to ensure that your information is accurate and up to date.

While the COE itself does not expire, it’s always a good idea to keep a copy of this important document in a safe place. Lenders may require a current copy of your COE when applying for a VA-backed home loan or refinancing an existing mortgage.

If you have any questions or concerns about the status or validity of your COE, it’s recommended that you reach out to the Department of Veterans Affairs directly. They can provide personalized assistance and guidance based on your specific situation.