VA Disability Loan: What You Need to Know

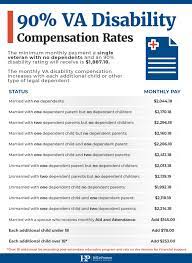

If you are a veteran who has been injured or disabled during your service, you may be eligible for disability benefits from the Department of Veterans Affairs (VA). While these benefits can provide much-needed financial assistance, they may not always be enough to cover all of your expenses. That’s where a VA disability loan can help.

What is a VA Disability Loan?

A VA disability loan is a personal loan that is specifically designed for veterans who receive VA disability compensation. These loans are offered by some banks and credit unions and are intended to help veterans bridge the gap between their disability payments and their expenses.

Unlike other types of loans, VA disability loans do not require collateral or a down payment. Instead, lenders will consider your income and credit history when deciding whether to approve your loan application. If approved, you can use the funds for any purpose, such as paying off debt or covering medical expenses.

How to Apply for a VA Disability Loan

To apply for a VA disability loan, you will need to find a lender that offers these types of loans. It’s important to do your research and compare rates and terms from multiple lenders before making a decision.

When applying for the loan, you will need to provide documentation of your VA disability compensation and income. The lender will also review your credit history and may require additional information such as bank statements or proof of employment.

Benefits of a VA Disability Loan

One of the main benefits of a VA disability loan is that it can provide immediate financial relief when you need it most. If you have unexpected expenses or are struggling to make ends meet on your disability payments alone, a loan can help cover those costs.

Another benefit is that VA disability loans typically have lower interest rates than other types of personal loans. This means that you could potentially save money on interest charges over time.

Additionally, taking out a personal loan and making timely payments can help improve your credit score. This can be especially beneficial if you plan to apply for other types of credit in the future.

Conclusion

If you are a veteran who receives VA disability compensation, a disability loan may be a good option to help cover your expenses. However, it’s important to carefully consider the terms and conditions of the loan and ensure that you can make timely payments before applying. As always, it’s best to consult with a financial advisor or counselor before making any major financial decisions.

Frequently Asked Questions About VA Disability Loans: Loan Amounts, Borrowing from Disability, and Lump Sum Options

- How much will the VA give me for a loan?

- Can I borrow from my VA disability?

- Can you get a lump sum for VA disability?

How much will the VA give me for a loan?

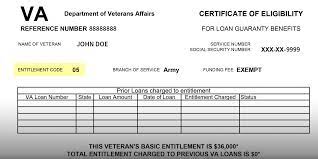

The Department of Veterans Affairs (VA) does not offer loans directly to veterans. However, some banks and credit unions offer VA disability loans specifically for veterans who receive VA disability compensation.

The amount you can borrow will depend on the lender and your individual financial situation. Lenders will typically consider your income, credit history, and other factors when deciding how much to lend you.

It’s important to note that VA disability loans are personal loans and are not guaranteed by the VA. The interest rates and terms of the loan will vary depending on the lender.

Before applying for a VA disability loan, it’s important to do your research and compare rates and terms from multiple lenders. You should also ensure that you can make timely payments on the loan before accepting any offers.

Can I borrow from my VA disability?

No, you cannot borrow from your VA disability compensation payments. VA disability compensation is a tax-free benefit that is intended to provide financial assistance to veterans who have been injured or disabled during their service. The purpose of this benefit is to help cover the costs associated with the veteran’s disability, such as medical bills or lost income.

While there are some programs that offer loans to veterans, such as the VA home loan program or personal loans for veterans, these loans are not directly tied to your VA disability compensation payments. Instead, they are based on factors such as your credit history and income.

It’s important to note that misusing your VA disability compensation payments can result in serious consequences, including loss of benefits and legal action. If you are struggling financially, there are resources available to help, such as financial counseling services provided by the VA or non-profit organizations.

Can you get a lump sum for VA disability?

Yes, it is possible to receive a lump sum payment for VA disability compensation under certain circumstances. The VA may offer a lump sum payment to eligible veterans who are owed past due benefits, also known as retroactive benefits.

Retroactive benefits are payments for the period of time between the date the veteran filed their claim and the date the VA grants their claim. These payments can go back several years, depending on how long it took for the VA to process the claim.

If a veteran is granted retroactive benefits, they may have the option to receive them in a lump sum payment instead of monthly installments. This can be beneficial for veterans who need immediate financial assistance or want to pay off debts.

However, it’s important to note that receiving a lump sum payment may affect other government benefits such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). It’s recommended that veterans consult with a financial advisor or counselor before deciding whether to receive a lump sum payment or monthly installments.

It’s also worth noting that not all veterans who apply for disability compensation will be eligible for retroactive benefits or a lump sum payment. Eligibility depends on factors such as when the claim was filed and when it was approved by the VA.