VA FHA Loan: A Powerful Financing Option for Veterans

For veterans and active duty military personnel, obtaining a home loan can sometimes be a challenging process. However, the combination of VA (Veterans Affairs) and FHA (Federal Housing Administration) loans offers a powerful financing option that can make homeownership more attainable. In this article, we will explore the benefits of the VA FHA loan program and how it can help veterans achieve their dream of owning a home.

The VA FHA loan is a unique program that combines the advantages of both VA and FHA loans. The Department of Veterans Affairs guarantees a portion of the loan, while the Federal Housing Administration insures it against default. This collaboration allows lenders to offer favorable terms and conditions to eligible veterans and active duty military personnel.

One significant advantage of the VA FHA loan is that it requires no down payment or a minimal down payment compared to conventional loans. This feature makes homeownership more accessible for veterans who may not have saved up enough money for a substantial down payment. Additionally, this type of loan does not require private mortgage insurance (PMI), which can save borrowers hundreds of dollars each month.

Another benefit is that VA FHA loans have more flexible qualification requirements than traditional mortgages. The credit score requirements are generally lower, allowing veterans with less-than-perfect credit histories to still qualify for favorable terms. Additionally, there are no prepayment penalties, allowing borrowers to pay off their mortgage early without incurring any additional fees.

The VA FHA loan program also offers competitive interest rates, making it an attractive option for veterans looking to secure affordable financing for their homes. These low rates can significantly reduce monthly mortgage payments over the life of the loan, providing long-term financial relief.

Furthermore, VA FHA loans provide additional assistance through specialized programs such as energy-efficient mortgages (EEMs). EEMs allow borrowers to finance energy-efficient upgrades into their home purchase or refinance loans. This feature helps veterans save money on utility bills while also reducing their environmental footprint.

To qualify for a VA FHA loan, veterans must meet certain eligibility criteria, including having served a minimum period of active duty or being a current member of the military. The specific requirements can vary, so it is advisable to consult with a knowledgeable lender or mortgage professional who specializes in VA FHA loans.

In conclusion, the VA FHA loan program offers an excellent financing option for veterans and active duty military personnel. With its no down payment or minimal down payment requirement, flexible qualification standards, competitive interest rates, and additional assistance programs, it provides a pathway to homeownership that may otherwise be out of reach for many veterans. If you are a veteran dreaming of owning your own home, consider exploring the benefits of the VA FHA loan program and take advantage of this powerful financing option.

Common Questions about VA and FHA Loans Answered

- What is the difference between FHA and VA loans?

- What are FHA VA loans?

- Can you go FHA to VA?

- Is VA more strict than FHA?

What is the difference between FHA and VA loans?

FHA (Federal Housing Administration) loans and VA (Veterans Affairs) loans are both government-backed loan programs designed to help individuals obtain financing for homeownership. While they share some similarities, there are key differences between the two.

- Eligibility: FHA loans are available to a wide range of borrowers, including first-time homebuyers and individuals with lower credit scores. On the other hand, VA loans are exclusively available to eligible veterans, active duty military personnel, and surviving spouses.

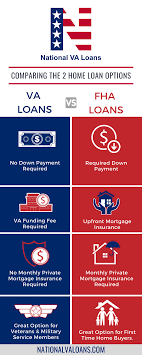

- Down Payment: FHA loans typically require a minimum down payment of 3.5% of the purchase price. This down payment can be sourced from the borrower’s savings or a gift from a family member. In contrast, VA loans offer the benefit of no down payment requirement for most borrowers, making it an attractive option for those who may not have substantial savings for a down payment.

- Mortgage Insurance: FHA loans require borrowers to pay mortgage insurance premiums (MIP) throughout the life of the loan. This insurance protects lenders in case of borrower default. In contrast, VA loans do not require mortgage insurance, eliminating this additional cost for borrowers.

- Credit Score Requirements: FHA loans generally have more lenient credit score requirements compared to conventional mortgages. Borrowers with credit scores as low as 580 may qualify for an FHA loan with a 3.5% down payment. VA loans also have flexible credit requirements but tend to have higher average credit scores among borrowers.

- Loan Limits: Both FHA and VA loan programs have limits on how much you can borrow based on your location’s median home prices. However, these limits differ between the two programs and can change annually.

- Funding Fee vs Upfront Mortgage Insurance Premium (UFMIP): VA loans require a funding fee that helps offset program costs and replace mortgage insurance premiums found in other loan types like FHA loans or conventional mortgages with less than 20% down payment. FHA loans, on the other hand, require an upfront mortgage insurance premium (UFMIP) that is typically financed into the loan amount.

It’s important to note that while both FHA and VA loans offer favorable terms and benefits, borrowers should carefully consider their specific circumstances and eligibility requirements when deciding which loan program is most suitable for their needs. Consulting with a knowledgeable lender or mortgage professional can provide valuable guidance in determining the best financing option.

What are FHA VA loans?

FHA VA loans, also known as VA FHA loans or VA/FHA combination loans, are a type of mortgage financing that combines the benefits of both FHA (Federal Housing Administration) and VA (Veterans Affairs) loan programs. These loans are designed to assist veterans, active duty military personnel, and their families in obtaining affordable home financing.

The FHA VA loan program allows eligible veterans to take advantage of the favorable terms offered by both the FHA and VA loan programs. The Department of Veterans Affairs guarantees a portion of the loan, while the Federal Housing Administration insures it against default. This collaboration enables lenders to provide more flexible qualification criteria and favorable terms for borrowers.

One key benefit of FHA VA loans is that they often require little to no down payment. While traditional mortgages typically require a significant down payment, FHA VA loans allow eligible borrowers to purchase a home with either no down payment or a minimal one. This feature makes homeownership more accessible for veterans who may not have saved up enough money for a substantial down payment.

Another advantage is that FHA VA loans do not require private mortgage insurance (PMI). PMI is typically required for conventional loans when borrowers make a down payment below 20% of the home’s purchase price. By eliminating the need for PMI, borrowers can save on monthly mortgage payments.

FHA VA loans also offer competitive interest rates. The interest rates on these loans are often lower compared to conventional mortgages, which can result in significant savings over the life of the loan. Lower interest rates translate into reduced monthly mortgage payments and long-term financial relief for borrowers.

To qualify for an FHA VA loan, individuals must meet certain eligibility requirements set by both programs. These requirements include serving a minimum period of active duty or being a current member of the military. Additionally, there may be specific credit score and income criteria that applicants must meet.

In summary, FHA VA loans combine the benefits of both FHA and VA loan programs to provide affordable financing options for veterans, active duty military personnel, and their families. With features such as minimal or no down payment requirements, no PMI, competitive interest rates, and flexible qualification criteria, FHA VA loans aim to make homeownership more attainable for those who have served our country. If you are a veteran or active duty military personnel dreaming of owning a home, exploring the benefits of FHA VA loans could be a valuable step towards achieving that goal.

Can you go FHA to VA?

Yes, it is possible to refinance an existing FHA loan into a VA loan. This process is commonly known as an FHA to VA refinance or streamline refinance. However, it’s important to note that the eligibility criteria and requirements for the VA loan program must be met in order to proceed with this type of refinancing.

To qualify for an FHA to VA refinance, you must be eligible for a VA loan. This typically requires having served a minimum period of active duty or being a current member of the military. Additionally, you will need to meet the credit and income requirements set by the Department of Veterans Affairs.

The purpose of refinancing from an FHA loan to a VA loan is often to take advantage of the benefits offered by the VA program, such as potentially lower interest rates, no private mortgage insurance (PMI) requirement, and more flexible qualification standards. By switching from an FHA loan to a VA loan, borrowers may be able to save money on their monthly mortgage payments and overall interest costs.

It’s important to consult with a knowledgeable lender or mortgage professional who specializes in both FHA and VA loans. They can guide you through the process, assess your eligibility, and help determine if refinancing from an FHA loan into a VA loan is the right option for your specific circumstances.

Remember that each individual’s situation is unique, so it’s crucial to thoroughly evaluate the benefits and potential costs associated with refinancing before making any decisions.

Is VA more strict than FHA?

When comparing the VA (Veterans Affairs) loan program to the FHA (Federal Housing Administration) loan program, it’s important to note that each has its own unique set of guidelines and requirements. However, in general, the VA loan program tends to have more flexible qualification standards compared to FHA loans.

One key difference is that the VA loan program is specifically designed for veterans, active duty military personnel, and their eligible family members. To qualify for a VA loan, applicants must meet certain service requirements such as serving a minimum period of active duty or being a current member of the military. These requirements are not applicable to FHA loans.

In terms of credit score requirements, the VA loan program may be more forgiving than FHA loans. While both programs consider credit history as part of the qualification process, VA loans typically have lower minimum credit score requirements. This can be beneficial for veterans with less-than-perfect credit scores who may still be eligible for favorable terms and conditions.

Additionally, when it comes to down payments, VA loans often offer more flexibility. In most cases, VA loans require no down payment at all. On the other hand, FHA loans generally require a minimum down payment of 3.5% of the purchase price.

It’s worth noting that both programs have certain eligibility criteria and specific documentation requirements that must be met. Lenders who specialize in VA or FHA loans can provide detailed information about these programs and guide borrowers through the application process.

In summary, while both the VA and FHA loan programs have their own sets of guidelines and requirements, the VA loan program typically offers more flexibility in terms of qualification standards and down payment options compared to FHA loans. However, it is always advisable to consult with lenders or mortgage professionals who specialize in these programs for accurate and up-to-date information based on your specific circumstances.