The Second Tier Entitlement: A Powerful Benefit of VA Loans

For veterans and active duty military personnel, the dream of homeownership is made more attainable through the availability of VA loans. These loans, provided by the U.S. Department of Veterans Affairs, offer numerous advantages such as no down payment requirements and lower interest rates. But what many may not be aware of is an additional benefit known as the second tier entitlement.

The second tier entitlement is a provision within VA loans that allows eligible veterans to obtain a second VA loan while still having an existing VA loan. This means that if you have already used your entitlement to purchase a home with a VA loan, you can still utilize this powerful benefit to secure another mortgage.

One of the primary advantages of the second tier entitlement is its potential to provide flexibility and options for veterans who have outgrown their current homes or wish to invest in additional properties. For example, if you purchased a home with a VA loan but now find yourself needing more space due to a growing family or changing circumstances, you can use your second tier entitlement to obtain financing for a new home without having to sell your existing property first.

Furthermore, the second tier entitlement can also be utilized by veterans who wish to keep their current property as an investment while purchasing another home. This allows veterans to take advantage of potential real estate opportunities or secure rental income from their existing property.

It’s important to note that there are certain eligibility requirements and guidelines for utilizing the second tier entitlement. Veterans must meet specific criteria related to their previous use of their initial entitlement and demonstrate sufficient income and creditworthiness for both mortgages.

To apply for a second-tier entitlement, veterans will need to work with an approved lender who specializes in VA loans. These lenders have extensive knowledge about the intricacies of this benefit and can guide applicants through the process, ensuring all necessary documentation is provided and requirements are met.

The second-tier entitlement is just one of the many ways that VA loans support veterans in achieving their homeownership goals. By offering the opportunity to obtain multiple VA loans, this benefit provides veterans with the flexibility and financial support they need to adapt to changing circumstances and pursue their dreams of owning a home.

In conclusion, the second-tier entitlement is a valuable benefit within VA loans that allows eligible veterans to secure a second mortgage while still having an existing VA loan. This provision offers flexibility and options for veterans who wish to upgrade their homes or invest in additional properties. If you are a veteran considering homeownership or looking to expand your real estate portfolio, exploring the possibilities provided by the second-tier entitlement can be a game-changer.

8 Essential Tips for Using Second Tier Entitlement with a VA Loan

- Make sure you meet the eligibility requirements for a VA loan, such as having served in the military or being the surviving spouse of a veteran.

- Understand how second tier entitlement works and what it means for your VA loan.

- Get pre-approved by an experienced lender to determine how much home you can afford with your second tier entitlement amount.

- Shop around for the best interest rate and terms that fit your budget and needs.

- Consider all costs associated with purchasing a home, including closing costs, taxes, insurance, and more when budgeting for a VA loan with second tier entitlement.

- Know that lenders may require additional documentation if you are using second tier entitlement to purchase a home in certain states or counties where prices are higher than average median values (AMV).

- Be aware of any restrictions on what type of property you can purchase with your second tier entitlement VA loan amount—for example, some loans don’t cover manufactured homes or multi-unit dwellings such as duplexes or triplexes..

- Work closely with an experienced realtor who is knowledgeable about VA loans and their associated rules to ensure everything runs smoothly during the process of purchasing your new home!

Make sure you meet the eligibility requirements for a VA loan, such as having served in the military or being the surviving spouse of a veteran.

Unlocking the Power of the Second Tier Entitlement: Ensure Your Eligibility for a VA Loan

If you’re a veteran or the surviving spouse of a veteran, the second tier entitlement can be an incredible tool when it comes to obtaining a VA loan. However, before diving into the world of this powerful benefit, it’s crucial to ensure that you meet the eligibility requirements set forth by the U.S. Department of Veterans Affairs.

The first step in determining your eligibility is verifying your military service. To qualify for a VA loan, you must have served in the military for a specific period of time as outlined by the VA. This includes active duty service members, veterans who have been honorably discharged, and certain National Guard and Reserve members.

Additionally, if you are the surviving spouse of a veteran who died in service or as a result of a service-related disability, you may also be eligible for a VA loan through the second tier entitlement.

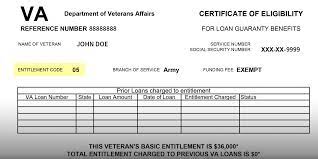

Once you’ve confirmed your eligibility based on military service or being a surviving spouse, it’s essential to gather all necessary documentation to support your application. This typically includes your Certificate of Eligibility (COE), which verifies your entitlement to obtain a VA loan.

To obtain your COE, you can submit an application online through the VA’s eBenefits portal or work with an approved lender who can assist you in acquiring this important document. Your COE serves as proof to lenders that you meet the eligibility criteria for a VA loan and are entitled to utilize the second tier entitlement if applicable.

When applying for a VA loan with second tier entitlement, it’s also crucial to ensure that you meet other requirements such as demonstrating sufficient income and creditworthiness. Lenders will assess these factors to determine your ability to repay the mortgage and manage any additional financial obligations associated with owning multiple properties.

By taking these steps and confirming your eligibility for a VA loan through proper documentation and meeting all necessary criteria, you can confidently navigate the process of utilizing the second tier entitlement. This will help you unlock the full potential of this benefit and make the most informed decisions when it comes to homeownership or real estate investments.

In conclusion, before delving into the world of second tier entitlement within VA loans, it’s vital to verify your eligibility. Whether you served in the military or are a surviving spouse, ensuring that you meet the requirements set by the U.S. Department of Veterans Affairs is key to taking advantage of this powerful benefit. By doing so, you can embark on your journey towards homeownership with confidence and peace of mind.

Understand how second tier entitlement works and what it means for your VA loan.

Understanding How Second Tier Entitlement Works for Your VA Loan

If you’re a veteran or active duty military personnel considering a VA loan, it’s important to familiarize yourself with the concept of second tier entitlement. This valuable benefit can have a significant impact on your ability to secure multiple VA loans and expand your homeownership opportunities.

The second tier entitlement is a provision within VA loans that allows eligible veterans to obtain a second mortgage while still having an existing VA loan. This means that even if you’ve already used your initial entitlement to purchase a home with a VA loan, you can still tap into this powerful benefit to finance another property.

One of the key advantages of the second tier entitlement is the flexibility it provides. For example, let’s say you currently have a home financed through a VA loan, but you need more space due to changing circumstances or an expanding family. With the second tier entitlement, you can explore options for securing financing for a new home without having to sell your current property first.

Additionally, the second tier entitlement can be beneficial for veterans interested in real estate investments. If you wish to keep your current property as an investment while purchasing another home, this provision allows you to do so. By leveraging your second tier entitlement, you can take advantage of potential real estate opportunities or generate rental income from your existing property.

To make the most of this benefit, it’s crucial to understand the eligibility requirements and guidelines associated with the second tier entitlement. Veterans must meet specific criteria related to their previous use of their initial entitlement and demonstrate sufficient income and creditworthiness for both mortgages.

To navigate this process effectively, it’s highly recommended that you work with an approved lender experienced in handling VA loans. These professionals possess in-depth knowledge about how the second tier entitlement works and can guide you through each step of the application process. They will ensure that all necessary documentation is provided and help you meet all requirements for utilizing this valuable benefit.

In conclusion, understanding how the second tier entitlement works is essential for maximizing the benefits of your VA loan. By familiarizing yourself with this provision, you can explore opportunities for additional homeownership or real estate investments. Remember to consult with an approved lender who specializes in VA loans to ensure you fully comprehend the requirements and make informed decisions regarding your financial future.

Get pre-approved by an experienced lender to determine how much home you can afford with your second tier entitlement amount.

Unlock the Power of Your Second Tier Entitlement: Get Pre-Approved for a VA Loan

If you’re a veteran or active duty military personnel considering utilizing the second tier entitlement for a VA loan, there’s a crucial step you should take before starting your home search. Getting pre-approved by an experienced lender can provide valuable insights into how much home you can afford with your second tier entitlement amount.

Obtaining pre-approval is an essential part of the homebuying process, regardless of whether it’s your first or second VA loan. However, when it comes to utilizing the second tier entitlement, it becomes even more critical. Here’s why:

- Determine Your Buying Power: By getting pre-approved, you’ll have a clear understanding of how much financing you qualify for based on your income, creditworthiness, and the specific guidelines associated with utilizing the second tier entitlement. This knowledge will help you narrow down your home search and ensure that you focus on properties within your budget.

- Streamline Your Home Search: Armed with a pre-approval letter, you’ll have an advantage when searching for homes in competitive markets. Sellers often prioritize buyers who have already been pre-approved since it shows that they are serious and financially capable of making an offer.

- Avoid Disappointment: There’s nothing worse than finding your dream home only to discover later that it’s out of reach financially. By getting pre-approved upfront, you can avoid disappointment and focus on properties that align with your budget and entitlement amount.

To get started with the pre-approval process, reach out to an experienced lender who specializes in VA loans. They will guide you through the necessary steps and help determine how much home you can afford based on your unique financial situation and the potential use of your second tier entitlement.

During the pre-approval process, be prepared to provide documentation such as proof of income, employment history, credit history, and any other relevant financial information. The lender will review this information to assess your eligibility and provide you with a pre-approval letter stating the maximum loan amount you qualify for.

Remember, the pre-approval process is not a commitment to lend, but rather an essential tool that empowers you as a homebuyer. It sets you on the right path by giving you a realistic understanding of your financial capabilities and allows you to make informed decisions throughout your homebuying journey.

So, whether you’re upgrading to a larger home or exploring real estate investments, don’t underestimate the importance of getting pre-approved for a VA loan utilizing your second tier entitlement. Take advantage of this valuable tip and start your homebuying journey with confidence!

Shop around for the best interest rate and terms that fit your budget and needs.

Getting the Best Interest Rate and Terms for Your Second Tier Entitlement VA Loan

When utilizing the second tier entitlement within a VA loan, it’s crucial to shop around for the best interest rate and terms that align with your budget and needs. This simple tip can potentially save you thousands of dollars over the course of your loan.

Interest rates play a significant role in determining the overall cost of your mortgage. Even a small difference in interest rates can have a substantial impact on your monthly payments and the total amount you repay over time. Therefore, it’s essential to compare offers from different lenders to find the most favorable rate available.

Start by reaching out to multiple approved lenders who specialize in VA loans. Each lender may offer different interest rates based on various factors such as market conditions, their own lending policies, and your unique financial profile. By obtaining quotes from several lenders, you can compare their offers side by side and identify the most competitive rate.

While interest rates are undoubtedly important, it’s also crucial to consider the terms of the loan. Look beyond just the interest rate and evaluate other aspects such as closing costs, origination fees, and any potential penalties or restrictions associated with early repayment or refinancing. These factors can significantly impact the overall affordability of your loan.

Additionally, take into account any special programs or incentives that lenders may offer specifically for veterans utilizing their second tier entitlement. Some lenders may have special promotions or discounts that could further enhance your borrowing experience.

Remember that shopping around doesn’t mean solely focusing on big banks or national lenders. Local credit unions or community banks may also offer competitive rates and personalized service tailored to veterans’ needs. Don’t hesitate to explore all available options before making a decision.

To streamline this process, consider working with a reputable mortgage broker who can assist you in comparing multiple offers from various lenders. They have access to a wide range of loan products and can help negotiate better terms on your behalf.

In summary, when using the second tier entitlement within a VA loan, it’s essential to shop around for the best interest rate and terms that suit your financial situation. By comparing offers from different lenders, you can secure a loan with lower costs and more favorable conditions. Remember to consider not only the interest rate but also other factors that impact the overall affordability of your mortgage. With careful research and due diligence, you can make an informed decision that saves you money and helps you achieve your homeownership goals.

Consider all costs associated with purchasing a home, including closing costs, taxes, insurance, and more when budgeting for a VA loan with second tier entitlement.

When utilizing the second tier entitlement of a VA loan, it’s important to consider all costs associated with purchasing a home. While the benefits of a VA loan, such as no down payment requirements and lower interest rates, are enticing, it’s crucial to budget for additional expenses.

Closing costs are one significant expense to factor in. These costs can include appraisal fees, title insurance, attorney fees, and loan origination fees. It’s advisable to obtain estimates from multiple lenders to get an accurate idea of what your closing costs might be.

Taxes and insurance are other crucial elements to consider. Property taxes vary depending on the location of the home you’re purchasing. Research local tax rates and assess how they will impact your monthly expenses. Additionally, homeowners insurance is essential for protecting your investment. Obtain quotes from different insurance providers to determine the cost that best fits your budget.

Furthermore, don’t forget about potential maintenance and repair costs. Owning a home means taking responsibility for upkeep and unforeseen repairs. It’s wise to set aside funds for these expenses so that you’re prepared when the need arises.

Lastly, keep in mind any homeowner association (HOA) fees if applicable. Some neighborhoods or condominiums require homeowners to pay monthly or annual HOA fees for shared community amenities or maintenance services.

By considering all these factors when budgeting for a VA loan with second tier entitlement, you’ll have a more accurate understanding of the overall financial commitment involved in homeownership. This knowledge will help you make informed decisions and ensure that you can comfortably afford not only the mortgage but also all associated costs.

Remember, working closely with an experienced lender who specializes in VA loans can provide valuable guidance throughout this process. They can help you estimate these additional expenses and create a comprehensive budget that aligns with your financial goals.

In conclusion, while the second tier entitlement of a VA loan offers great opportunities for veterans looking to purchase another home or invest in real estate, it’s crucial to consider all costs associated with homeownership. By factoring in closing costs, taxes, insurance, maintenance expenses, and potential HOA fees, you’ll be better prepared to budget for a VA loan with second tier entitlement and ensure a successful and sustainable homeownership experience.

Know that lenders may require additional documentation if you are using second tier entitlement to purchase a home in certain states or counties where prices are higher than average median values (AMV).

Navigating the Second Tier Entitlement: Understanding Additional Documentation Requirements in High-Value Areas

If you’re a veteran utilizing the second tier entitlement to purchase a home in certain states or counties where prices exceed the average median values (AMV), it’s crucial to be aware that lenders may require additional documentation. This extra step ensures that your loan application complies with the specific guidelines set for high-value areas.

In areas where property prices are higher than the average, lenders exercise caution to mitigate potential financial risks. By requesting additional documentation, they can better assess your ability to handle the financial responsibilities of homeownership in these high-value regions.

So, what kind of documentation might lenders require? While requirements may vary slightly between lenders, here are some common documents you may need to provide:

- Proof of Sufficient Income: Lenders will want to see evidence of stable and consistent income that demonstrates your ability to afford a home in a high-value area. This can include pay stubs, tax returns, and bank statements.

- Detailed Financial Statements: Expect to provide a comprehensive overview of your assets and liabilities. This includes information about your savings accounts, investments, outstanding debts, and any other financial obligations.

- Property Appraisal: Given the higher property values in these areas, lenders may request an appraisal from a certified professional to determine the accurate value of the home you intend to purchase.

- Verification of Employment: Lenders often require verification from your employer as part of their due diligence process. This helps confirm your employment status and income stability.

It’s important to note that these additional documentation requirements are not meant to discourage or burden veterans seeking homeownership in high-value areas. Rather, they aim to ensure responsible lending practices and protect both borrowers and lenders from potentially risky financial situations.

To streamline this process and ensure compliance with lender requirements, it’s advisable to work closely with an experienced VA loan specialist who understands the intricacies of the second tier entitlement and the documentation necessary for high-value areas. They can guide you through the process, helping you gather the required paperwork and navigate any potential challenges that may arise.

By being prepared and aware of these additional documentation requirements, veterans can confidently pursue homeownership in high-value areas using their second tier entitlement. Remember, this extra step is a testament to responsible lending practices and serves to safeguard your financial well-being throughout the homebuying process.

In conclusion, if you are utilizing the second tier entitlement to purchase a home in areas with higher-than-average property values, be prepared for potential additional documentation requirements from lenders. By understanding these expectations and working with knowledgeable professionals, you can ensure a smoother loan application process and increase your chances of securing your dream home in these desirable locations.

Be aware of any restrictions on what type of property you can purchase with your second tier entitlement VA loan amount—for example, some loans don’t cover manufactured homes or multi-unit dwellings such as duplexes or triplexes..

Understanding Property Restrictions with Second Tier Entitlement VA Loans

When utilizing the second tier entitlement within VA loans, it’s essential to be aware of any restrictions that may apply to the type of property you can purchase. While this benefit allows veterans to obtain a second VA loan while still having an existing one, certain property types may not be covered under this entitlement.

One common restriction is related to manufactured homes. Some VA loans do not extend coverage for the purchase of manufactured or mobile homes. It’s important to check with your lender and understand their specific guidelines regarding these types of properties. If you have your heart set on a manufactured home, alternative financing options may need to be explored.

Additionally, multi-unit dwellings such as duplexes or triplexes may also have restrictions when it comes to using the second tier entitlement. While VA loans generally allow for the purchase of multi-unit properties, it’s crucial to confirm with your lender if these types of dwellings are eligible under your specific loan terms.

Being aware of these restrictions can help you set realistic expectations and avoid any surprises during the home buying process. By understanding what is covered and what is not, you can make informed decisions about the type of property you wish to purchase using your second tier entitlement.

It’s worth noting that even if certain property types are not covered under the second tier entitlement, there are still other financing options available for veterans who wish to pursue those specific properties. For example, FHA loans or conventional mortgages might be viable alternatives for purchasing manufactured homes or multi-unit dwellings.

To navigate through these restrictions and explore all available options, it’s recommended to work closely with an experienced VA-approved lender who can provide guidance tailored to your unique circumstances. They will have in-depth knowledge about property eligibility and can help you find suitable financing solutions based on your preferences and goals.

In conclusion, when utilizing the second tier entitlement within VA loans, it’s crucial to understand any restrictions on the type of property you can purchase. Manufactured homes and multi-unit dwellings such as duplexes or triplexes may have limitations under this entitlement. By being aware of these restrictions and seeking guidance from a knowledgeable lender, you can make informed decisions and explore alternative financing options if needed.

Work closely with an experienced realtor who is knowledgeable about VA loans and their associated rules to ensure everything runs smoothly during the process of purchasing your new home!

Navigating the Second Tier Entitlement: The Importance of a Knowledgeable Realtor

When it comes to utilizing the second tier entitlement within VA loans, working with an experienced realtor who understands the intricacies of VA loans and their associated rules is crucial. Their expertise can make all the difference in ensuring a smooth and successful process as you purchase your new home.

A knowledgeable realtor will have a deep understanding of the unique requirements and guidelines that come with utilizing the second tier entitlement. They can provide valuable insights into how to maximize this benefit and help you make informed decisions throughout the homebuying journey.

One of the key advantages of having a realtor well-versed in VA loans is their ability to identify properties that meet VA loan requirements. They can help you narrow down your search to homes that are eligible for financing through a VA loan, saving you time and effort. Moreover, they can guide you through negotiations, ensuring that any necessary repairs or modifications are addressed before closing on your new home.

Additionally, an experienced realtor can assist in coordinating with lenders and other parties involved in the transaction. They understand the importance of timely communication and documentation submission, which is essential for a smooth loan approval process. By working closely with your realtor, you can ensure that everything stays on track and avoid any potential delays or complications.

Furthermore, a knowledgeable realtor can provide valuable advice on market trends, property values, and potential investment opportunities. They can help you assess whether utilizing the second tier entitlement is indeed the best option for your specific circumstances. Their expertise will give you confidence in making informed decisions regarding your real estate investments.

To find a realtor who specializes in VA loans and has experience with second tier entitlements, consider reaching out to local veteran organizations or asking for recommendations from fellow veterans who have successfully navigated this process before. Look for someone who demonstrates not only knowledge but also genuine dedication to helping veterans achieve their homeownership goals.

In conclusion, when utilizing the second tier entitlement within VA loans, it is crucial to work closely with a realtor who has experience and knowledge in this area. Their expertise can streamline the homebuying process, ensuring that you find a suitable property, navigate negotiations successfully, and meet all necessary requirements. By partnering with a knowledgeable realtor, you can confidently pursue your dream of homeownership while taking full advantage of the benefits provided by the second tier entitlement.