Understanding Multiple VA Loans

For veterans who are eligible for VA loans, the option of obtaining multiple VA loans can be a valuable benefit. However, there are specific guidelines and limitations that govern the use of multiple VA loans.

One important aspect to note is that veterans can have more than one VA loan at a time, but in most cases, they can only have one active VA loan at a time. This means that if a veteran wants to purchase another home using a VA loan while still having an existing VA loan, they may need to meet certain requirements.

In general, if a veteran wants to obtain a second VA loan while still having an active one, they will need to prove that they have sufficient income and meet credit requirements to support both loans. Additionally, the new loan amount combined with the existing loan cannot exceed the maximum guarantee amount set by the Department of Veterans Affairs.

It’s important for veterans considering multiple VA loans to consult with a knowledgeable lender who is experienced in handling these types of transactions. A lender familiar with VA loan guidelines can help veterans navigate the process and ensure that all requirements are met.

In conclusion, while it is possible for veterans to have multiple VA loans, there are specific rules and criteria that must be followed. By understanding these guidelines and working with a qualified lender, veterans can make informed decisions about utilizing their VA loan benefits for multiple home purchases.

6 Essential Tips for Navigating Multiple VA Loans Successfully

- Understand the eligibility requirements for multiple VA loans.

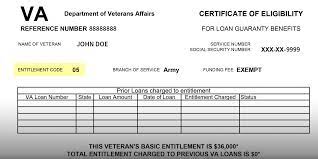

- Consider your entitlement amount when applying for a second VA loan.

- Be aware of the funding fee for subsequent VA loans.

- Ensure you meet lender requirements for multiple VA loans.

- Keep track of your remaining VA loan entitlement.

- Consult with a VA loan specialist for guidance on multiple VA loans.

Understand the eligibility requirements for multiple VA loans.

It is crucial to thoroughly comprehend the eligibility requirements for multiple VA loans before pursuing this option. Veterans should be aware of the specific criteria they need to meet in order to qualify for more than one VA loan simultaneously. Understanding these requirements will help veterans determine if they are eligible for multiple VA loans and guide them in making informed decisions about their home purchasing options.

Consider your entitlement amount when applying for a second VA loan.

When considering applying for a second VA loan, it is crucial to carefully evaluate your entitlement amount. Your entitlement amount is the maximum guarantee from the Department of Veterans Affairs that they will provide on your VA loan. Understanding your entitlement amount is essential because it determines how much you can borrow without a down payment. By taking into account your entitlement amount before applying for a second VA loan, you can ensure that you are utilizing your benefits effectively and within the guidelines set forth by the VA.

Be aware of the funding fee for subsequent VA loans.

It is crucial for veterans considering multiple VA loans to be mindful of the funding fee associated with subsequent VA loans. The funding fee is a one-time payment required by the Department of Veterans Affairs to help offset the cost of the VA loan program. For subsequent VA loans, the funding fee may vary depending on factors such as the down payment amount and whether it is the veteran’s first or subsequent use of their VA loan benefit. Being aware of this fee and factoring it into financial planning can help veterans make informed decisions about pursuing multiple VA loans.

Ensure you meet lender requirements for multiple VA loans.

To successfully navigate the process of obtaining multiple VA loans, it is crucial to ensure that you meet all lender requirements. Lenders have specific criteria that must be met in order to qualify for multiple VA loans, such as demonstrating sufficient income and meeting credit standards. By working closely with a knowledgeable lender who is well-versed in VA loan guidelines, you can ensure that you are prepared to meet all necessary requirements and increase your chances of securing multiple VA loans for your home purchases.

Keep track of your remaining VA loan entitlement.

It is crucial for veterans considering multiple VA loans to keep track of their remaining VA loan entitlement. By monitoring their available entitlement, veterans can better understand how much of their benefit they have used and how much they have left for future home purchases. This information is essential in determining eligibility for additional VA loans and ensuring that veterans can make informed decisions about utilizing their VA loan benefits effectively.

Consult with a VA loan specialist for guidance on multiple VA loans.

For those considering multiple VA loans, it is highly recommended to seek guidance from a VA loan specialist. Consulting with a professional who is well-versed in the intricacies of VA loan regulations can provide valuable insight and assistance in navigating the process of obtaining multiple VA loans. A VA loan specialist can offer personalized advice tailored to individual circumstances, ensuring that veterans understand their options and meet all necessary requirements when seeking to utilize their VA loan benefits for multiple home purchases.