The Military VA Home Loan: A Benefit Worth Knowing About

For many military service members and veterans, the dream of homeownership can seem out of reach due to financial constraints. However, the Department of Veterans Affairs (VA) offers a valuable benefit that can make this dream a reality – the VA home loan program.

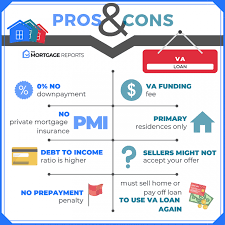

Unlike traditional home loans, VA home loans are backed by the VA, which allows eligible service members and veterans to secure favorable terms and conditions. One of the key advantages of a VA home loan is that it typically does not require a down payment, making homeownership more accessible for those who may not have substantial savings.

Additionally, VA home loans often have lower interest rates compared to conventional mortgages, which can result in significant long-term savings for borrowers. The program also does not require private mortgage insurance (PMI), further reducing the overall cost of homeownership.

Another appealing feature of VA home loans is that they are more flexible when it comes to credit requirements. While traditional lenders may have strict credit score criteria, VA loans are known for being more forgiving, making them an attractive option for borrowers with less-than-perfect credit histories.

Furthermore, VA home loans do not have prepayment penalties, allowing borrowers to pay off their mortgages early without incurring additional fees. This can be particularly beneficial for service members who may relocate frequently due to military assignments.

It’s important for service members and veterans to understand the eligibility requirements for VA home loans. Generally, active duty service members, veterans with honorable discharges, and certain surviving spouses may qualify for this benefit. Applicants will need to obtain a Certificate of Eligibility (COE) from the VA to demonstrate their eligibility.

In conclusion, the military VA home loan program is a valuable benefit that can help service members and veterans achieve their homeownership goals. With its favorable terms and conditions, including no down payment requirement and competitive interest rates, the VA home loan is definitely worth considering for those who have served our country.

7 Essential Tips for Navigating Military VA Home Loans

- Understand the eligibility requirements for a VA home loan.

- Obtain your Certificate of Eligibility (COE) before applying for a VA home loan.

- Compare interest rates and terms from different lenders offering VA loans.

- Consider the benefits of a VA loan, such as no down payment requirement.

- Be aware of the funding fee associated with VA loans and factor it into your budget.

- Work with a real estate agent or lender experienced in handling VA home loans.

- Ensure you fully understand the terms and conditions of the VA loan before signing any documents.

Understand the eligibility requirements for a VA home loan.

It is crucial to understand the eligibility requirements for a VA home loan before applying. Generally, active duty service members, veterans with honorable discharges, and certain surviving spouses may qualify for this benefit. Obtaining a Certificate of Eligibility (COE) from the VA is necessary to demonstrate eligibility. By familiarizing yourself with the specific criteria and documentation needed, you can ensure a smoother application process and increase your chances of securing a VA home loan successfully.

Obtain your Certificate of Eligibility (COE) before applying for a VA home loan.

It is crucial to obtain your Certificate of Eligibility (COE) before applying for a VA home loan. The COE serves as proof of your eligibility for the VA loan program and provides essential information to lenders about your military service history. By obtaining your COE in advance, you can streamline the loan application process and ensure that you are fully prepared to take advantage of this valuable benefit. Additionally, having your COE ready demonstrates your commitment to the homebuying process and can help expedite the approval of your VA home loan application.

Compare interest rates and terms from different lenders offering VA loans.

When considering a military VA home loan, it is crucial to compare interest rates and terms from various lenders that offer VA loans. By shopping around and comparing different offers, service members and veterans can ensure they are getting the most favorable terms possible. Each lender may have slightly different rates and conditions, so taking the time to research and compare options can potentially result in significant savings over the life of the loan. It is important to weigh factors such as interest rates, closing costs, and repayment terms to find the best VA loan option that fits individual financial needs and goals.

Consider the benefits of a VA loan, such as no down payment requirement.

When exploring the option of a military VA home loan, it’s crucial to consider the significant benefits it offers, such as the absence of a down payment requirement. This feature can make homeownership more attainable for service members and veterans who may not have substantial savings set aside for a traditional down payment. By taking advantage of the VA loan’s no down payment benefit, eligible borrowers can move closer to their dream of owning a home without the financial burden of a large upfront payment.

Be aware of the funding fee associated with VA loans and factor it into your budget.

When considering a military VA home loan, it is important to be aware of the funding fee associated with VA loans and factor it into your budget. The funding fee is a one-time payment required by the VA to help offset the cost of the loan program. While this fee can vary depending on factors such as the type of service member and whether it’s a first-time or subsequent use of the benefit, it is essential to account for it when planning your home purchase. By understanding and budgeting for the funding fee, you can ensure that you are fully prepared for all costs associated with obtaining a VA home loan.

Work with a real estate agent or lender experienced in handling VA home loans.

When navigating the process of securing a Military VA Home Loan, it is highly recommended to work with a real estate agent or lender who has experience in handling VA home loans. These professionals have the expertise and knowledge to guide you through the specific requirements and nuances of the VA loan program, ensuring a smoother and more efficient experience. By partnering with experts familiar with VA loans, you can benefit from their insights, advice, and support to make the most of this valuable benefit and achieve your homeownership goals with confidence.

Ensure you fully understand the terms and conditions of the VA loan before signing any documents.

It is crucial to thoroughly comprehend the terms and conditions of the VA loan before signing any paperwork. By taking the time to familiarize yourself with the specifics of the loan, including interest rates, fees, repayment terms, and any potential penalties, you can make informed decisions that align with your financial goals. Ensuring a clear understanding of the VA loan terms will help you avoid any surprises down the road and enable you to maximize the benefits of this valuable military benefit.