The DVA TPI Pension: A Comprehensive Guide

For veterans in Australia who have suffered a severe injury or illness as a result of their service, the Totally and Permanently Incapacitated (TPI) Pension provided by the Department of Veterans’ Affairs (DVA) offers crucial financial support and assistance.

What is the DVA TPI Pension?

The DVA TPI Pension is designed to provide ongoing financial support to veterans who are deemed totally and permanently incapacitated due to a service-related injury or illness. This pension is tax-free and aims to help eligible veterans meet their daily living expenses and medical needs.

Eligibility Criteria

To qualify for the DVA TPI Pension, veterans must meet specific eligibility criteria set by the Department of Veterans’ Affairs. This may include having a severe service-related injury or illness that prevents them from working or engaging in everyday activities.

Benefits of the DVA TPI Pension

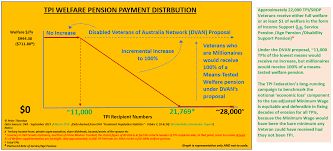

Receiving the DVA TPI Pension can provide veterans with financial stability, access to healthcare services, and support for their families. The pension amount is determined based on individual circumstances and may be supplemented with additional allowances.

How to Apply

Veterans interested in applying for the DVA TPI Pension should contact the Department of Veterans’ Affairs for guidance on the application process. It is essential to provide accurate information about your medical condition, service history, and any supporting documentation required.

Conclusion

The DVA TPI Pension plays a vital role in supporting veterans who have sacrificed their health in service to their country. By offering financial assistance and access to essential services, this pension helps improve the quality of life for those who need it most.

Understanding the DVA TPI Pension: Eligibility, Application Process, Benefits, Taxation, and Family Support FAQs

- What is the DVA TPI Pension?

- Am I eligible for the DVA TPI Pension?

- How do I apply for the DVA TPI Pension?

- What benefits does the DVA TPI Pension provide?

- Is the DVA TPI Pension taxable?

- Can family members receive support through the DVA TPI Pension?

What is the DVA TPI Pension?

The DVA TPI Pension, short for Totally and Permanently Incapacitated Pension provided by the Department of Veterans’ Affairs, is a vital form of financial support for veterans in Australia who have sustained severe service-related injuries or illnesses that render them totally and permanently incapacitated. This tax-free pension aims to assist eligible veterans in meeting their daily living expenses and medical needs, providing them with crucial financial stability and support as they navigate the challenges brought on by their incapacitation.

Am I eligible for the DVA TPI Pension?

If you are wondering about your eligibility for the DVA TPI Pension, it is essential to consider specific criteria set by the Department of Veterans’ Affairs. Eligibility typically revolves around having a severe service-related injury or illness that renders you totally and permanently incapacitated. To determine your eligibility accurately, it is advisable to reach out to the Department of Veterans’ Affairs for personalized guidance and assistance with the application process. Providing detailed information about your medical condition and service history will help assess your eligibility for this crucial financial support.

How do I apply for the DVA TPI Pension?

To apply for the DVA TPI Pension, veterans can start by contacting the Department of Veterans’ Affairs for detailed guidance on the application process. It is important to provide accurate and thorough information about your medical condition, service history, and any supporting documentation required. The DVA will assess your eligibility based on the criteria set forth and will guide you through the necessary steps to complete your application. Seeking assistance from DVA representatives can help streamline the application process and ensure that all necessary information is submitted for consideration.

What benefits does the DVA TPI Pension provide?

The DVA TPI Pension offers a range of benefits to eligible veterans who are deemed totally and permanently incapacitated due to a service-related injury or illness. These benefits include financial assistance in the form of a tax-free pension to help cover daily living expenses and medical needs. Additionally, recipients of the DVA TPI Pension may receive supplementary allowances based on their individual circumstances. This pension aims to provide veterans with the necessary support and resources to improve their quality of life and ensure they have access to essential services for their well-being.

Is the DVA TPI Pension taxable?

The DVA TPI Pension is not taxable in Australia. This pension is considered a tax-free benefit provided by the Department of Veterans’ Affairs to support veterans who are totally and permanently incapacitated due to a service-related injury or illness. Eligible recipients can rely on this financial support without the burden of taxation, allowing them to focus on their health and well-being without additional financial concerns.

Can family members receive support through the DVA TPI Pension?

Family members of veterans who receive the DVA TPI Pension may also be eligible for support through additional benefits and allowances provided by the Department of Veterans’ Affairs. While the primary focus of the pension is on the veteran’s needs, there are provisions in place to assist family members who play a significant role in caring for or supporting the veteran. These additional supports aim to ensure that the veteran’s family members have access to resources that can help alleviate financial burdens and provide necessary assistance in their caregiving responsibilities.