Army House Loan: Supporting Military Personnel in Home Ownership

For many military personnel, owning a home can seem like a distant dream due to frequent relocations and financial constraints. However, the Army offers various housing loan programs to support service members in achieving their homeownership goals.

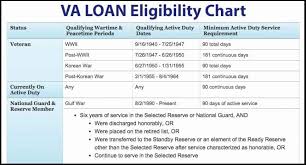

One of the most popular programs is the VA Home Loan program, which is available to eligible veterans, active duty service members, and certain surviving spouses. This program offers competitive interest rates, no down payment requirement, and limited closing costs, making it easier for military personnel to secure financing for their dream home.

In addition to the VA Home Loan program, there are other housing loan options specifically tailored for Army personnel. These loans may offer special benefits such as lower interest rates, flexible repayment terms, and assistance with closing costs.

Furthermore, Army house loans often come with additional support services such as financial counseling, homebuyer education programs, and resources for transitioning from military to civilian life. These services aim to empower military personnel with the knowledge and tools needed to make informed decisions about homeownership.

By providing access to affordable housing loans and comprehensive support services, the Army is committed to helping military personnel achieve stability and security through homeownership. These programs not only benefit individual service members and their families but also contribute to building stronger communities and promoting financial well-being among military families.

If you are a member of the Army seeking assistance with purchasing a home, explore the various housing loan programs available to you. Take advantage of these resources designed to support your journey towards owning a place you can call your own.

Top 5 Advantages of Army Home Loans: Affordable and Accessible Homeownership for Military Personnel

- Low to no down payment requirement, making homeownership more accessible for military personnel.

- Competitive interest rates compared to traditional mortgage loans.

- Limited closing costs, reducing the upfront expenses associated with buying a home.

- Special benefits and support services tailored specifically for Army personnel.

- Opportunities for financial counseling and education programs to help service members make informed decisions.

5 Drawbacks of Army Home Loans: Eligibility, Delays, and Limitations

- Strict eligibility requirements may limit access to the loan program for some military personnel.

- Potential delays in loan approval process due to extensive documentation and verification procedures.

- Limited flexibility in terms of property types and locations that qualify for the loan program.

- Interest rates on army house loans may be higher compared to conventional mortgage loans.

- Restrictions on loan amount and property value may impact the ability to purchase a desired home.

Low to no down payment requirement, making homeownership more accessible for military personnel.

One significant advantage of Army house loans is the low to no down payment requirement, which greatly enhances accessibility to homeownership for military personnel. By eliminating the need for a substantial upfront payment, these loans make it easier for service members to fulfill their dream of owning a home without the financial burden typically associated with traditional mortgages. This pro not only reduces financial barriers but also allows military personnel to allocate their resources towards other essential needs, fostering stability and security for themselves and their families.

Competitive interest rates compared to traditional mortgage loans.

One significant advantage of Army house loans is the competitive interest rates they offer in comparison to traditional mortgage loans. This benefit can result in lower monthly payments and overall savings for military personnel seeking to purchase a home. By providing access to favorable interest rates, Army house loans make homeownership more affordable and attainable for service members, helping them secure a stable and financially sound future for themselves and their families.

Limited closing costs, reducing the upfront expenses associated with buying a home.

One significant advantage of Army house loans is the limited closing costs they offer, which help reduce the upfront expenses associated with purchasing a home. By minimizing the financial burden of closing costs, military personnel can save money and allocate their resources more effectively towards other essential needs during the home buying process. This benefit not only makes homeownership more accessible for service members but also eases the financial strain often experienced when transitioning to a new residence.

Special benefits and support services tailored specifically for Army personnel.

One significant advantage of Army house loans is the provision of special benefits and support services specifically designed to cater to the unique needs of military personnel. These tailored benefits may include lower interest rates, flexible repayment terms, and assistance with closing costs, making homeownership more accessible to Army members. Additionally, the support services offered alongside these loans, such as financial counseling, homebuyer education programs, and resources for transitioning from military to civilian life, aim to empower Army personnel with the knowledge and tools necessary to navigate the home buying process successfully. By providing these specialized benefits and support services, Army house loans demonstrate a commitment to assisting military personnel in achieving their homeownership goals while ensuring their financial stability and well-being.

Opportunities for financial counseling and education programs to help service members make informed decisions.

The Army house loan program offers valuable opportunities for financial counseling and education programs to assist service members in making informed decisions about homeownership. These resources provide military personnel with the knowledge and tools needed to navigate the complexities of the home buying process, understand their financial options, and plan for long-term stability. By offering access to financial expertise and educational programs, the Army empowers service members to make sound decisions that align with their individual goals and circumstances, ultimately fostering greater financial well-being within the military community.

Strict eligibility requirements may limit access to the loan program for some military personnel.

Strict eligibility requirements associated with army house loans may pose a significant challenge for some military personnel seeking financial assistance for homeownership. These stringent criteria could potentially exclude certain individuals from accessing the loan program, thereby limiting their ability to secure affordable housing financing. As a result, those who do not meet the specific eligibility criteria may face barriers in obtaining the support they need to purchase a home, highlighting a notable drawback of army house loans in terms of accessibility and inclusivity for all military personnel.

Potential delays in loan approval process due to extensive documentation and verification procedures.

One significant drawback of Army house loans is the potential for delays in the loan approval process due to extensive documentation and verification procedures. Military personnel may experience frustration and setbacks as they navigate through the rigorous requirements for providing detailed paperwork and undergoing thorough verification processes. These delays can prolong the time it takes to secure financing for a home, causing added stress and uncertainty for service members seeking to achieve homeownership.

Limited flexibility in terms of property types and locations that qualify for the loan program.

One significant drawback of army house loans is the limited flexibility in terms of property types and locations that qualify for the loan program. Military personnel may find themselves restricted in their choices of homes, as certain property types or locations may not meet the eligibility criteria set forth by the loan program. This limitation can pose a challenge for service members who have specific preferences or needs regarding the type or location of their desired home, potentially leading to frustration and constraints in finding suitable housing options that align with their individual circumstances.

Interest rates on army house loans may be higher compared to conventional mortgage loans.

One significant drawback of army house loans is that the interest rates may be higher compared to conventional mortgage loans. This higher interest rate can result in increased long-term costs for military personnel seeking to purchase a home. It may make it more challenging for service members to afford their monthly mortgage payments and could potentially limit the amount of home they can purchase within their budget. As a result, military personnel should carefully consider the implications of higher interest rates when exploring housing loan options and weigh the potential financial impact over the life of the loan.

Restrictions on loan amount and property value may impact the ability to purchase a desired home.

One significant drawback of army house loans is the restrictions placed on loan amount and property value, which can potentially limit the ability of military personnel to purchase their desired home. These limitations may result in service members having to settle for a property that does not fully meet their preferences or needs, leading to compromises in terms of location, size, or amenities. The strict guidelines on loan amounts and property values can pose challenges for military families who aspire to own a home that aligns with their lifestyle and requirements, highlighting a key limitation of army house loans in accommodating individual housing preferences.