A VA loan is a mortgage loan that is guaranteed by the United States Department of Veterans Affairs (VA). This type of loan is available to active-duty military personnel, veterans, and their families. VA loans are designed to help service members and their families become homeowners by providing them with affordable financing options.

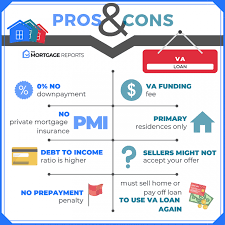

One of the main benefits of a VA loan is that it does not require a down payment. This means that eligible borrowers can purchase a home with no money down. Additionally, VA loans offer competitive interest rates and do not require private mortgage insurance (PMI), which can save borrowers thousands of dollars over the life of the loan.

Another advantage of a VA loan is that it has more flexible credit requirements than conventional loans. Borrowers with less-than-perfect credit may still be eligible for a VA loan, as long as they meet other eligibility requirements.

To qualify for a VA loan, borrowers must meet certain eligibility criteria. This includes having served on active duty for at least 90 consecutive days during wartime or 181 days during peacetime. Veterans who were discharged due to a service-connected disability may also be eligible for a VA loan.

In addition to helping veterans become homeowners, VA loans can also be used for other purposes. For example, borrowers can use a VA loan to refinance an existing mortgage or to make home improvements.

Overall, VA loans are an excellent option for eligible service members and their families who want to achieve the dream of homeownership. With no down payment required and competitive interest rates, these loans offer an affordable way to purchase a home or refinance an existing mortgage. If you are considering applying for a VA loan, it’s important to speak with a qualified lender who can guide you through the process and help you determine if this type of loan is right for you.

Answers to Top 5 VA Loan Questions: Qualification, Benefits, Borrowing Limits & Requirements Explained

- What is a VA loan?

- How do I qualify for a VA loan?

- What are the benefits of a VA loan?

- How much can I borrow with a VA loan?

- What are the requirements for getting a VA loan?

What is a VA loan?

A VA loan is a type of mortgage loan that is guaranteed by the United States Department of Veterans Affairs (VA). This type of loan is available to active-duty military personnel, veterans, and their families. The purpose of a VA loan is to help service members and their families become homeowners by providing them with affordable financing options.

One of the main benefits of a VA loan is that it does not require a down payment. This means that eligible borrowers can purchase a home with no money down. Additionally, VA loans offer competitive interest rates and do not require private mortgage insurance (PMI), which can save borrowers thousands of dollars over the life of the loan.

Another advantage of a VA loan is that it has more flexible credit requirements than conventional loans. Borrowers with less-than-perfect credit may still be eligible for a VA loan, as long as they meet other eligibility requirements.

To qualify for a VA loan, borrowers must meet certain eligibility criteria. This includes having served on active duty for at least 90 consecutive days during wartime or 181 days during peacetime. Veterans who were discharged due to a service-connected disability may also be eligible for a VA loan.

In addition to helping veterans become homeowners, VA loans can also be used for other purposes. For example, borrowers can use a VA loan to refinance an existing mortgage or to make home improvements.

Overall, VA loans offer eligible service members and their families an affordable way to achieve the dream of homeownership. If you are considering applying for a VA loan, it’s important to speak with a qualified lender who can guide you through the process and help you determine if this type of loan is right for you.

How do I qualify for a VA loan?

To qualify for a VA loan, you must meet certain eligibility requirements. Here are the general guidelines:

- Military Service: You must be a veteran, active-duty service member, or a surviving spouse of a veteran who died while on active duty or as a result of a service-connected disability.

- Length of Service: You must have served at least 90 consecutive days during wartime or 181 days during peacetime.

- Credit Score: While there is no minimum credit score required to qualify for a VA loan, most lenders prefer borrowers with a credit score of at least 620.

- Income and Employment: You must have stable income and employment history to show that you can afford to repay the loan.

- Certificate of Eligibility (COE): To prove your eligibility for a VA loan, you need to obtain a COE from the VA. This document shows that you meet the eligibility requirements for the program.

Once you have determined that you meet the eligibility criteria, it’s important to find an approved lender who specializes in VA loans. They will guide you through the application process and help you determine how much you can afford to borrow based on your income and other financial factors.

Keep in mind that while VA loans offer many benefits, they also come with some restrictions. For example, there are limits on how much you can borrow with a VA loan, depending on where you live and whether it’s your first time using the program. Additionally, there may be specific property requirements that must be met in order to qualify for financing.

Overall, if you are eligible for a VA loan and are interested in buying or refinancing a home, this program can be an excellent option to consider.

What are the benefits of a VA loan?

There are several benefits of a VA loan, which is a mortgage loan guaranteed by the United States Department of Veterans Affairs (VA). Here are some of the key benefits:

- No down payment required: One of the most significant benefits of a VA loan is that eligible borrowers can purchase a home with no down payment. This can be a major advantage for service members and their families who may not have saved up enough money for a traditional down payment.

- Competitive interest rates: VA loans typically offer competitive interest rates that are lower than those of conventional loans. This can save borrowers thousands of dollars over the life of the loan.

- No private mortgage insurance (PMI) required: Unlike many conventional loans, VA loans do not require borrowers to pay for private mortgage insurance (PMI). This can save borrowers hundreds or even thousands of dollars per year.

- More flexible credit requirements: VA loans have more flexible credit requirements than many conventional loans, which means that borrowers with less-than-perfect credit may still be eligible for a VA loan.

- No prepayment penalty: Borrowers who want to pay off their VA loan early will not be charged a prepayment penalty, which can save them money in interest charges.

- Refinancing options: Borrowers with an existing VA loan may be able to refinance their loan through the VA’s Interest Rate Reduction Refinance Loan (IRRRL) program, which can help them lower their monthly payments or shorten the term of their loan.

Overall, VA loans offer several advantages over traditional mortgage loans, including no down payment requirement, competitive interest rates, and more flexible credit requirements. If you are an eligible service member or veteran who is considering purchasing or refinancing a home, it’s worth exploring your options for obtaining a VA loan.

How much can I borrow with a VA loan?

The amount you can borrow with a VA loan depends on several factors, including your credit score, debt-to-income ratio, and the appraised value of the property you want to purchase.

In general, there is no maximum loan amount for VA loans. However, there are limits on how much the VA will guarantee. In most parts of the country, the VA will guarantee up to 25% of the loan amount, up to a maximum of $548,250 in 2021. This means that if you default on your loan, the VA will reimburse your lender for up to 25% of the loan amount.

It’s important to note that just because you are eligible for a certain loan amount does not mean that you should borrow that much. You should only borrow what you can comfortably afford to repay based on your income and expenses.

To determine how much you can borrow with a VA loan, you will need to apply with a qualified lender who can review your financial situation and provide you with an estimate of how much you may be able to borrow. The lender will consider factors such as your credit score, income, and debt-to-income ratio when determining how much you can borrow.

Keep in mind that while VA loans offer many benefits, they are still subject to certain fees and closing costs. You should also be aware that if you do not make timely payments on your VA loan, it could impact your credit score and make it more difficult for you to obtain credit in the future.

Overall, if you are eligible for a VA loan and considering purchasing a home or refinancing an existing mortgage, it’s important to work with a qualified lender who can help guide you through the process and ensure that you obtain financing that meets your needs and budget.

What are the requirements for getting a VA loan?

To be eligible for a VA loan, you must meet certain requirements set by the Department of Veterans Affairs. Here are the basic eligibility requirements:

- Military Service: You must have served on active duty for at least 90 consecutive days during wartime or 181 days during peacetime. If you are currently on active duty, you may be eligible after 90 days of service.

- Discharge Status: You must have been discharged under conditions other than dishonorable.

- Certificate of Eligibility (COE): To prove your eligibility, you must obtain a COE from the VA. This document verifies your military service and confirms that you meet the eligibility requirements.

- Credit Score: While there is no minimum credit score requirement for VA loans, most lenders will require a score of at least 620.

- Income and Employment: You must have a stable income and employment history to show that you can afford to make your mortgage payments.

- Property Requirements: The property being purchased with a VA loan must meet certain requirements, including being in good condition and meeting minimum property standards set by the VA.

It’s important to note that these are just the basic eligibility requirements for a VA loan. There may be additional requirements depending on your specific circumstances, such as if you’re using your VA loan benefits for the first time or if you’re purchasing a multi-unit property.

If you’re interested in obtaining a VA loan, it’s best to speak with a qualified lender who can guide you through the process and help determine if you meet all of the eligibility requirements.