VA Home Loan Qualifications: A Path to Homeownership for Veterans

For many veterans, the dream of owning a home can seem out of reach. However, thanks to the U.S. Department of Veterans Affairs (VA) Home Loan program, homeownership is within grasp for those who have served our country. The VA Home Loan program offers numerous benefits and flexible qualifications that make it an attractive option for veterans looking to buy a home.

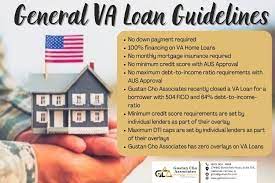

One of the primary advantages of a VA Home Loan is that it does not require a down payment. Traditional mortgages often demand a substantial down payment, which can be a significant barrier for many prospective homebuyers. With a VA loan, eligible veterans can finance up to 100% of the purchase price, making homeownership more accessible and affordable.

In addition to the no-down-payment benefit, VA Home Loans also offer competitive interest rates. These rates are typically lower than those offered by conventional loans, helping veterans save money over the life of their mortgage. The savings from lower interest rates can make a significant difference in monthly payments and long-term financial planning.

To qualify for a VA Home Loan, veterans must meet specific eligibility requirements established by the VA. Generally, individuals who have served on active duty for at least 90 consecutive days during wartime or 181 days during peacetime are eligible. National Guard members and reservists may also qualify after completing six years of service or meeting certain other criteria.

Another crucial qualification factor is obtaining a Certificate of Eligibility (COE) from the VA. This document verifies that an individual meets the necessary service requirements to be considered eligible for a VA loan. Veterans can apply for their COE online through the eBenefits portal or work with an approved lender who can assist in obtaining this essential document.

While credit score requirements vary among lenders, having good credit is generally beneficial when applying for any type of loan. However, one advantage of VA loans is that they are often more forgiving when it comes to credit history. Veterans with less-than-perfect credit may still be eligible for a VA Home Loan, as the program takes into account the unique circumstances that military service can present.

It’s worth noting that VA Home Loans also have certain occupancy requirements. The property being purchased must serve as the veteran’s primary residence, ensuring that these loans are used for personal housing needs rather than investment purposes.

In conclusion, VA Home Loans provide a valuable opportunity for veterans to achieve their homeownership dreams. The program’s benefits, such as no down payment and competitive interest rates, make it an appealing option for those who have served our country. With flexible qualifications and support from approved lenders, veterans can navigate the path to homeownership with confidence and ease. If you’re a veteran looking to buy a home, exploring the possibilities of a VA Home Loan is certainly worth considering.

5 Advantages of VA Home Loan Qualifications in the US

- Low interest rates

- No down payment

- Streamlined refinance process

- Flexible credit requirements

- No prepayment penalty

Challenges to Consider with VA Home Loan Qualifications: Strict Eligibility, Borrowing Limits, and Higher Closing Costs

- Eligibility requirements are strict and may be difficult to meet

- The maximum amount that can be borrowed is limited

- Closing costs are often higher than with other loans

Low interest rates

Low Interest Rates: A Key Advantage of VA Home Loan Qualifications

When it comes to purchasing a home, one of the most significant factors to consider is the interest rate on your mortgage. Luckily, for veterans exploring their homeownership options, VA Home Loans offer a standout advantage: competitive and low interest rates.

Compared to conventional loans, VA Home Loans often come with lower interest rates. This can result in substantial savings over the life of the loan. With a lower interest rate, veterans can enjoy reduced monthly mortgage payments, allowing them to allocate their hard-earned money towards other essential expenses or savings goals.

The lower interest rates offered by VA Home Loans are made possible by the unique nature of these loans. The U.S. Department of Veterans Affairs guarantees a portion of each VA loan, which provides added security for lenders. This guarantee encourages lenders to offer more favorable terms, including lower interest rates, as they face less risk compared to traditional mortgages.

For veterans considering homeownership, these low interest rates can make a significant difference in their financial well-being. By securing a lower rate, veterans have the opportunity to save thousands of dollars over the course of their loan repayment period.

Additionally, lower interest rates can also increase affordability and expand housing options for veterans. With reduced monthly payments resulting from lower rates, veterans may be able to afford homes that would otherwise be out of reach with higher interest mortgages.

It’s important for veterans exploring their home loan options to consider the long-term financial implications and benefits that come with low interest rates. By taking advantage of this pro offered by VA Home Loan qualifications, veterans can achieve their homeownership dreams while enjoying more favorable financial terms.

In conclusion, one significant advantage of VA Home Loan qualifications is the opportunity for veterans to secure competitive and low interest rates. These favorable terms can lead to substantial savings over time and make homeownership more affordable and attainable for those who have served our country. If you’re a veteran looking to purchase a home, exploring the benefits of VA Home Loans and their low interest rates is a wise choice.

No down payment

No Down Payment: A Game-Changer for Veterans Seeking Homeownership

For veterans dreaming of owning a home, the financial burden of a down payment can often feel like an insurmountable obstacle. However, the VA Home Loan program offers a significant advantage that sets it apart from other loan options: no down payment requirement. This pro of VA loan qualifications has the potential to save veterans thousands of dollars upfront when purchasing their dream home.

Traditionally, most mortgage lenders require borrowers to make a down payment as a percentage of the home’s purchase price. This upfront cost can be a significant barrier for many individuals, especially those who have recently completed their military service and may not have accumulated substantial savings.

However, with a VA Home Loan, eligible veterans can finance up to 100% of the purchase price without having to make any down payment. This means that veterans can secure homeownership without needing to gather substantial funds for an initial payment. The financial relief provided by this benefit is invaluable and opens doors for many veterans who may have thought homeownership was out of reach.

Additionally, unlike conventional loans, VA loans do not require private mortgage insurance (PMI). PMI is typically required by lenders when borrowers make a down payment below 20% of the purchase price. By eliminating this requirement, VA loans save veterans even more money in monthly payments.

The absence of both down payment and PMI requirements not only eases the financial burden on veterans but also accelerates their path towards homeownership. Without having to allocate funds towards a down payment or pay additional insurance premiums, veterans can use their resources more effectively and focus on settling into their new homes.

The no-down-payment benefit offered by VA loans empowers veterans to invest in their future without delay. It allows them to turn their dreams of homeownership into reality while preserving their hard-earned savings for other essential needs or future investments.

In conclusion, the absence of a down payment requirement is a game-changer for veterans seeking homeownership. The VA Home Loan program’s commitment to eliminating this financial barrier demonstrates its dedication to supporting those who have served our country. By saving veterans thousands of dollars upfront, this benefit enables them to embark on their homeownership journey with confidence and financial stability. If you’re a veteran considering buying a home, exploring the advantages of a VA loan and its no-down-payment benefit is undoubtedly worth your attention.

Streamlined refinance process

Streamlined Refinance Process: Simplifying Your Mortgage Refinancing Journey with a VA Loan

Refinancing a mortgage can be a complex and time-consuming process, but for veterans considering a VA Home Loan, the good news is that refinancing is made much easier. One significant advantage of VA Home Loan qualifications is the streamlined refinance process, which sets it apart from other types of loans and reduces the burden of paperwork.

When refinancing with a VA loan, veterans can benefit from a simplified application and documentation process. Compared to traditional refinancing options, the VA loan program requires limited paperwork and documentation. This streamlined approach not only saves time but also reduces stress for veterans who are looking to take advantage of lower interest rates or change the terms of their existing mortgage.

The simplified paperwork requirements are made possible by the unique features of VA loans. Since the Department of Veterans Affairs guarantees these loans, lenders have more confidence in approving applications and may require less extensive documentation. This means that veterans can avoid some of the hassle typically associated with refinancing, such as providing excessive financial statements or undergoing extensive credit checks.

The streamlined refinance process also includes an appraisal waiver option under certain circumstances. If you’re looking to refinance your mortgage with a VA loan and your current loan is already guaranteed by the VA, you may be eligible for an appraisal waiver. This means that you won’t need to go through another home appraisal process, saving both time and money.

Furthermore, veterans who opt for a streamline refinance, known as an Interest Rate Reduction Refinance Loan (IRRRL), may not need to verify their income or employment status again. This allows for a quicker approval process since income verification can often be one of the more time-consuming steps in refinancing.

By offering a streamlined approach to refinancing, the VA Home Loan program aims to make it easier for veterans to take advantage of better interest rates or adjust their mortgage terms according to their needs. This benefit is a testament to the VA’s commitment to supporting veterans in achieving their financial goals, including saving money on their monthly mortgage payments.

If you’re a veteran considering refinancing your existing mortgage, the streamlined process and limited paperwork requirements of a VA loan can make the journey much smoother. Take advantage of this pro of VA Home Loan qualifications and explore how refinancing with a VA loan can help you achieve your financial objectives more efficiently and with less stress.

Flexible credit requirements

Flexible Credit Requirements: Opening Doors for Veterans to Homeownership

When it comes to obtaining a mortgage, credit score requirements can often be a significant hurdle for many prospective homebuyers. However, one of the key advantages of VA Home Loan qualifications is the flexibility they offer in terms of credit requirements. Unlike other types of mortgages, VA loans are more lenient and may accept credit scores as low as 580 for some borrowers.

For veterans who may have faced financial challenges or setbacks during their military service or transition back to civilian life, this flexibility can make all the difference in achieving their dream of homeownership. Traditional lenders often set high credit score thresholds, making it difficult for individuals with less-than-perfect credit histories to secure a loan.

The VA recognizes that military service can bring unique circumstances that may impact a veteran’s creditworthiness. As a result, they have designed their loan program to consider these factors and provide opportunities for veterans with lower credit scores.

By accepting lower credit scores, VA loans enable veterans to access affordable financing options that would otherwise be out of reach. This flexibility not only opens doors to homeownership but also helps veterans establish or rebuild their credit history by responsibly managing their mortgage payments.

It’s important to note that while VA loans are more forgiving when it comes to credit requirements, individual lenders may still have their own standards and criteria. Some lenders may require higher credit scores depending on other factors such as income, debt-to-income ratio, or employment history. Therefore, it’s advisable for veterans interested in utilizing a VA loan to shop around and compare different lenders to find the best fit for their specific situation.

Having flexible credit requirements is just one more reason why VA Home Loan qualifications are highly regarded among veterans seeking homeownership opportunities. By recognizing the unique circumstances faced by those who have served our country, the VA provides an avenue for veterans with lower credit scores to secure affordable financing and achieve their homeownership goals.

If you’re a veteran with a credit score below the threshold set by traditional lenders, don’t be discouraged. Explore the possibilities offered by VA loans and connect with approved lenders who specialize in working with veterans. You may find that the flexibility of VA Home Loan credit requirements can help you turn your homeownership dreams into reality.

No prepayment penalty

No Prepayment Penalty: Unlocking Financial Freedom with VA Home Loan Qualifications

One of the many advantages of VA Home Loan qualifications is the freedom it provides to veterans when it comes to paying off their loans. Unlike some traditional mortgages, VA loans do not come with prepayment penalties. This means that veterans have the flexibility to pay off their loans early without incurring any additional fees or penalties.

This pro of VA Home Loan qualifications can be particularly beneficial for those who are looking to build equity faster in their homes. By making extra payments or paying off the loan ahead of schedule, veterans can reduce the overall interest paid over the life of the loan and potentially save thousands of dollars.

Paying off a mortgage early can also provide a sense of financial security and freedom. Without having to worry about monthly mortgage payments, veterans can allocate those funds towards other financial goals or investments. Whether it’s saving for retirement, starting a business, or pursuing further education, eliminating mortgage debt allows for greater flexibility and opportunities.

Additionally, paying off a VA loan early can help homeowners build equity at an accelerated pace. Equity is the difference between the market value of a property and the outstanding balance on the mortgage. By reducing that balance faster, homeowners increase their equity stake in the property. This can be advantageous when considering future home upgrades, refinancing options, or even selling the property.

The absence of prepayment penalties in VA Home Loans reflects the government’s commitment to supporting veterans’ financial well-being. It recognizes that veterans should have the freedom to manage their finances and make choices that align with their goals and aspirations.

If you are a veteran considering a home purchase using a VA loan, remember that this unique benefit allows you to pay off your loan early without any additional fees or penalties. Take advantage of this opportunity to build equity faster in your home while enjoying greater financial freedom and security.

In conclusion, no prepayment penalty is an exceptional pro of VA Home Loan qualifications. This benefit empowers veterans to pay off their loans early, saving money on interest and gaining financial flexibility. If you’re a veteran looking to make the most of your VA loan, consider the advantages of paying off your mortgage ahead of schedule and building equity faster in your home.

Eligibility requirements are strict and may be difficult to meet

The Strict Eligibility Requirements of VA Home Loan Qualifications

While the VA Home Loan program offers numerous benefits and opportunities for veterans to achieve homeownership, it is important to acknowledge that there are some potential drawbacks as well. One con of VA home loan qualifications is the strict eligibility requirements that applicants must meet.

To qualify for a VA home loan, individuals must have served in the military or be an eligible surviving spouse. This requirement means that not everyone will be able to benefit from this program. While it is understandable that the VA aims to provide assistance specifically to those who have served our country, it does limit the pool of potential applicants.

Furthermore, meeting certain income requirements is another criterion for eligibility. The VA sets income limits based on geographic location and family size. These limits are in place to ensure that the program benefits those who truly need financial assistance. However, these income requirements may pose a challenge for some veterans who may fall just above the threshold and find themselves ineligible for a VA home loan.

It’s important for prospective borrowers to understand these eligibility requirements before pursuing a VA home loan. It’s advisable to gather all necessary documentation and consult with approved lenders or VA representatives who can provide guidance on meeting these qualifications.

Despite these strict requirements, it’s crucial to remember that the purpose of these guidelines is to ensure that limited resources are allocated appropriately and reach those who need them most. The intent behind the program is commendable: providing support and opportunities for veterans and their families in achieving homeownership.

In conclusion, while there are cons associated with the strict eligibility requirements of VA home loan qualifications, it’s essential to consider them within the context of the program’s overall purpose. By serving those who have served our country, the program aims to provide a path towards homeownership for deserving individuals. Aspiring borrowers should thoroughly assess their eligibility status and seek guidance from experts in order to determine if they meet the necessary criteria for a VA home loan.

The maximum amount that can be borrowed is limited

The Limitation of VA Home Loan Qualifications: Maximum Borrowing Amount

While the VA Home Loan program offers numerous advantages, it’s important to be aware of its limitations as well. One significant drawback is the maximum amount that can be borrowed, which is capped by law at $424,100 for most counties in the United States.

For veterans looking to purchase homes in high-cost areas, this borrowing limit may pose a challenge. In regions where housing prices are considerably higher than the national average, the maximum loan amount may fall short of what is needed to afford a suitable home. This limitation can restrict veterans from purchasing properties that meet their specific needs or desires.

However, it’s worth noting that in certain high-cost counties or metropolitan areas where housing prices are significantly higher, the VA loan limit may be adjusted to reflect local market conditions. This allows veterans in those areas to access larger loan amounts that align with the cost of housing in their specific region.

Additionally, it’s important to remember that the maximum loan amount is not necessarily indicative of how much a veteran can afford to borrow. Lenders typically assess an individual’s financial situation and ability to repay when determining loan eligibility and amount. Veterans with strong credit histories and stable incomes may still qualify for larger loan amounts through other mortgage programs or by considering alternative financing options.

Moreover, it’s essential for veterans interested in purchasing higher-priced homes to explore additional financing avenues beyond the VA Home Loan program. Conventional loans or jumbo loans may offer more flexibility when it comes to borrowing larger amounts for luxury properties or homes located in expensive markets.

In summary, while the maximum borrowing limit imposed by law on VA Home Loans may restrict some veterans from purchasing homes in certain high-cost areas, it’s crucial to understand that there are alternative financing options available. Veterans should consult with approved lenders who can provide guidance on various mortgage programs and help them explore alternatives if they require larger loan amounts. By understanding the limitations and exploring all available options, veterans can make informed decisions about their homebuying journey.

Closing costs are often higher than with other loans

Understanding the Drawback: Higher Closing Costs with VA Home Loans

VA Home Loans offer numerous benefits and opportunities for veterans to achieve homeownership. However, it’s important to consider all aspects of these loans, including potential drawbacks. One such drawback is that VA loans often come with higher closing costs compared to other types of mortgages.

Closing costs are expenses incurred during the final stages of the homebuying process, typically paid at the time of closing. They encompass various fees, including appraisal fees, loan origination fees, title insurance, and more. While VA loans do not require a down payment, these additional costs can add up and impact a veteran’s budget.

The reason behind higher closing costs with VA loans lies in the unique nature of these mortgages. The Department of Veterans Affairs requires certain fees to be paid by either the seller or the buyer, which can include appraisal fees and compliance inspections. Additionally, some lenders may charge origination fees or points on VA loans to compensate for potential risks associated with offering no-down-payment mortgages.

It’s important for veterans considering a VA loan to carefully assess their financial situation and determine if they have sufficient funds to cover these higher closing costs. While there are options available to negotiate with sellers or lenders for assistance with closing costs or explore lender credits, it’s essential to factor in these additional expenses when budgeting for a home purchase.

Despite the higher closing costs associated with VA Home Loans, it’s crucial not to overlook their many advantages. The ability to secure a mortgage without a down payment and access competitive interest rates can significantly outweigh the initial financial burden of closing costs.

To navigate this con effectively and make an informed decision about pursuing a VA loan, veterans should consult with approved lenders who specialize in VA Home Loans. These professionals can provide valuable insights into available options for managing closing costs and guide veterans through the entire loan process.

In conclusion, while it is true that VA loans often entail higher closing costs compared to other types of mortgages, it’s essential to consider the bigger picture. By weighing the benefits and drawbacks, veterans can make an informed decision about whether a VA Home Loan aligns with their financial goals and homeownership aspirations. With proper planning and guidance from knowledgeable professionals, veterans can still leverage the advantages of a VA loan while effectively managing the associated closing costs.