The Benefits of VA Home Loans for Veterans

VA home loans offer a range of benefits specifically designed to help veterans and their families achieve the dream of homeownership. These loans are provided by private lenders, such as banks and mortgage companies, but are guaranteed by the U.S. Department of Veterans Affairs (VA).

Key Benefits of VA Home Loans:

- No Down Payment: One of the most significant advantages of VA home loans is that eligible veterans can purchase a home with no down payment. This can make homeownership more accessible for those who may not have substantial savings for a down payment.

- Lower Interest Rates: VA loans often have lower interest rates compared to conventional mortgages, which can result in lower monthly payments and overall savings over the life of the loan.

- No Private Mortgage Insurance (PMI): Unlike many conventional loans, VA loans do not require borrowers to pay for private mortgage insurance, which can save borrowers money each month.

- Favorable Terms and Flexibility: VA loans typically offer more flexible and favorable terms, such as competitive interest rates, limited closing costs, and the ability to refinance without re-qualifying for eligibility.

- Assistance in Times of Financial Hardship: The VA also provides assistance programs for veterans facing financial difficulties, such as repayment plans and loan modifications to help them stay in their homes.

If you are a veteran or an active duty service member considering buying a home, exploring the benefits of a VA home loan could be a smart financial decision. These loans are designed to support those who have served our country in achieving homeownership with favorable terms and conditions.

Contact your nearest VA regional office or speak with a qualified lender specializing in VA loans to learn more about how you can take advantage of these valuable benefits.

Unlocking the Benefits: 9 Essential Tips for Maximizing Your VA Home Loan

- 1. VA home loans often require no down payment, making homeownership more accessible.

- 2. VA loans do not require private mortgage insurance (PMI), potentially saving borrowers money each month.

- 3. The VA loan program offers competitive interest rates compared to conventional loans.

- 4. Borrowers with a VA loan may have more flexibility with credit requirements compared to other loan types.

- 5. Veterans, active-duty service members, and some surviving spouses may be eligible for a VA home loan.

- 6. There is no prepayment penalty for paying off a VA loan early, allowing borrowers to save on interest costs.

- 7. The VA may provide assistance if you experience financial hardship and struggle to make your mortgage payments.

- 8. VA loans can be used to purchase a primary residence or refinance an existing home loan.

- 9. Veterans with disabilities related to their service may qualify for additional benefits when obtaining a VA loan.

1. VA home loans often require no down payment, making homeownership more accessible.

VA home loans offer a significant advantage by often requiring no down payment, which can make homeownership more accessible to eligible veterans. This benefit eliminates the need for a substantial upfront payment, allowing veterans to purchase a home without the financial burden of saving for a traditional down payment. By removing this barrier, VA home loans open doors for veterans and their families to achieve the dream of owning their own home with greater ease and affordability.

2. VA loans do not require private mortgage insurance (PMI), potentially saving borrowers money each month.

One key advantage of VA home loans is that they do not require borrowers to pay for private mortgage insurance (PMI). This can result in significant savings for borrowers each month, as they are not burdened with an additional insurance premium on top of their mortgage payment. By eliminating the need for PMI, VA loans make homeownership more affordable and accessible for eligible veterans and active duty service members, allowing them to enjoy lower monthly payments and potentially save money over the life of the loan.

3. The VA loan program offers competitive interest rates compared to conventional loans.

The VA loan program stands out for offering competitive interest rates in comparison to conventional loans. This benefit can result in lower monthly payments and significant savings over the life of the loan for eligible veterans and their families. By providing access to more favorable interest rates, the VA loan program aims to make homeownership more affordable and attainable for those who have served our country.

4. Borrowers with a VA loan may have more flexibility with credit requirements compared to other loan types.

Borrowers utilizing a VA home loan may benefit from greater flexibility in credit requirements when compared to other types of loans. This means that individuals with varying credit histories or scores may still qualify for a VA loan, providing an opportunity for more veterans and active duty service members to secure financing for their dream home. The relaxed credit requirements associated with VA loans make them a compelling option for those who may have faced challenges with credit in the past but are now looking to become homeowners.

5. Veterans, active-duty service members, and some surviving spouses may be eligible for a VA home loan.

Veterans, active-duty service members, and certain surviving spouses have the opportunity to benefit from a VA home loan. This program extends its support to those who have served in the military and their families, providing them with a valuable opportunity to secure financing for their dream home. By offering eligibility to a broader range of individuals, including surviving spouses, the VA home loan program aims to honor and assist those who have made sacrifices in service to our country.

6. There is no prepayment penalty for paying off a VA loan early, allowing borrowers to save on interest costs.

One of the key advantages of VA home loans is that there is no prepayment penalty for paying off the loan early. This means that borrowers have the flexibility to make extra payments or pay off the loan in full without incurring any additional fees. By taking advantage of this benefit, borrowers can save on interest costs and potentially pay off their mortgage sooner, ultimately saving money in the long run.

7. The VA may provide assistance if you experience financial hardship and struggle to make your mortgage payments.

For veterans utilizing VA home loans, it’s crucial to be aware that the VA offers support in times of financial hardship. If you encounter difficulties making your mortgage payments, the VA has assistance programs in place to help you navigate through challenging times. This safety net ensures that veterans facing financial struggles have options available to them, such as repayment plans and loan modifications, to help them stay on track with their mortgage obligations and remain in their homes.

8. VA loans can be used to purchase a primary residence or refinance an existing home loan.

One key benefit of VA home loans is their versatility in usage. Veterans can utilize VA loans not only to purchase a primary residence but also to refinance an existing home loan. This flexibility allows veterans to take advantage of favorable terms and conditions offered by VA loans, whether they are looking to buy a new home or refinance their current mortgage. By providing options for both purchasing and refinancing, VA loans cater to the diverse needs of veterans and offer valuable support in achieving homeownership goals.

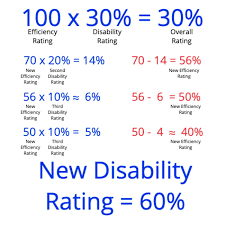

9. Veterans with disabilities related to their service may qualify for additional benefits when obtaining a VA loan.

Veterans with disabilities related to their service may be eligible for additional benefits when applying for a VA home loan. These benefits can include exemptions from the VA funding fee, which can result in significant cost savings for the veteran. Additionally, veterans with service-related disabilities may qualify for special considerations during the loan approval process, such as a lower minimum credit score requirement. These additional benefits aim to provide extra support and assistance to veterans who have sacrificed for their country and may need extra help in achieving homeownership.