SBA Loans for Veterans

Small Business Administration (SBA) loans offer a valuable opportunity for veterans looking to start or expand their own businesses. These loans provide financial assistance and support to veterans who have served our country and are now seeking to pursue entrepreneurship.

One of the key advantages of SBA loans for veterans is the favorable terms they offer, including lower interest rates and flexible repayment options. This can make it easier for veterans to secure the funding they need to launch or grow their businesses.

Additionally, SBA loans often require less collateral than traditional bank loans, making them more accessible to veterans who may not have significant assets to put up as security. This can be particularly beneficial for veterans who are transitioning from military service to civilian life and may not have a long credit history or substantial savings.

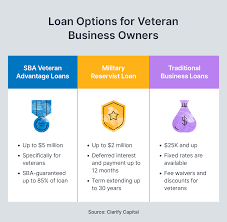

There are several types of SBA loans available to veterans, including the SBA Express Loan program, which provides expedited processing for loan applications under a certain amount. Veterans can also take advantage of the SBA Patriot Express Loan initiative, specifically designed to meet the financing needs of military personnel and their families.

Overall, SBA loans present a valuable opportunity for veterans to access the capital they need to achieve their entrepreneurial dreams. By taking advantage of these specialized loan programs, veterans can take important steps towards building successful businesses and contributing to their communities.

6 Essential Tips for Veterans Applying for SBA Loans

- 1. Veterans should take advantage of SBA loan programs specifically designed for them, such as the Patriot Express Loan Initiative.

- 2. Ensure that you meet the eligibility requirements for SBA loans as a veteran, which may include having an honorable discharge.

- 3. Seek assistance from organizations that specialize in helping veterans navigate the SBA loan application process.

- 4. Prepare a solid business plan and financial projections to increase your chances of securing an SBA loan.

- 5. Explore other resources available to veteran entrepreneurs, such as mentoring programs and networking opportunities.

- 6. Be proactive in researching different types of SBA loans to find the one that best suits your business needs.

1. Veterans should take advantage of SBA loan programs specifically designed for them, such as the Patriot Express Loan Initiative.

Veterans looking to start or expand their businesses should make sure to explore and utilize SBA loan programs tailored to their needs, such as the Patriot Express Loan Initiative. This specialized program offers veterans and their families streamlined access to funding, with benefits including lower interest rates and reduced collateral requirements. By taking advantage of initiatives like the Patriot Express Loan, veterans can tap into valuable resources that can help turn their entrepreneurial aspirations into reality.

2. Ensure that you meet the eligibility requirements for SBA loans as a veteran, which may include having an honorable discharge.

It is crucial for veterans seeking SBA loans to ensure they meet the eligibility requirements, which often include having an honorable discharge from military service. This requirement underscores the importance of veterans’ service records in accessing financial support for their entrepreneurial endeavors. By meeting these criteria, veterans can position themselves to take advantage of the benefits and opportunities that SBA loans offer, paving the way for successful business ventures and economic empowerment.

3. Seek assistance from organizations that specialize in helping veterans navigate the SBA loan application process.

For veterans looking to navigate the SBA loan application process, seeking assistance from organizations that specialize in helping veterans can be invaluable. These specialized organizations have the knowledge and expertise to guide veterans through the complexities of applying for SBA loans, ensuring that they understand the requirements and procedures involved. By tapping into this specialized support, veterans can increase their chances of successfully securing the funding they need to start or grow their businesses.

4. Prepare a solid business plan and financial projections to increase your chances of securing an SBA loan.

To increase your chances of securing an SBA loan as a veteran, it is crucial to prepare a solid business plan and financial projections. A well-thought-out business plan demonstrates to lenders that you have a clear vision for your business and a strategic roadmap for success. Including detailed financial projections in your plan shows that you have carefully considered the financial aspects of your business and have a realistic understanding of its potential profitability. By investing time and effort into creating a comprehensive business plan, veterans can significantly enhance their credibility and improve their chances of obtaining an SBA loan to support their entrepreneurial endeavors.

5. Explore other resources available to veteran entrepreneurs, such as mentoring programs and networking opportunities.

Veteran entrepreneurs looking to maximize their success with SBA loans should consider exploring additional resources tailored to their needs. Mentoring programs and networking opportunities specifically designed for veteran entrepreneurs can provide invaluable support, guidance, and connections. By tapping into these resources, veterans can gain access to experienced mentors who can offer valuable insights and advice, as well as connect with a network of like-minded individuals who understand the unique challenges and opportunities facing veteran-owned businesses. Leveraging these additional resources can enhance the overall success and sustainability of veteran entrepreneurs utilizing SBA loans for their ventures.

6. Be proactive in researching different types of SBA loans to find the one that best suits your business needs.

To maximize your chances of securing the right funding for your business as a veteran, it is crucial to take a proactive approach in researching the various types of SBA loans available. By exploring and understanding the different loan options offered by the Small Business Administration, you can identify the one that aligns best with your specific business needs and goals. Being well-informed about the different types of SBA loans will empower you to make a strategic decision that sets your business on a path to success.