The Benefits of VA Insured Loans for Veterans

VA insured loans are a valuable benefit offered to veterans, active duty service members, and eligible surviving spouses. These loans are provided by private lenders, such as banks and mortgage companies, but are backed by the Department of Veterans Affairs (VA). This backing reduces the risk for lenders, making it easier for veterans to qualify for home loans.

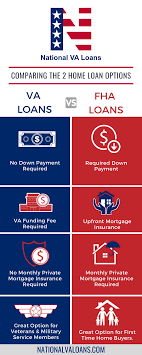

One of the key benefits of VA insured loans is that they often require no down payment or private mortgage insurance. This can significantly lower the upfront costs associated with buying a home. Additionally, VA loans typically have competitive interest rates compared to conventional loans.

Another advantage of VA insured loans is that they have more flexible credit requirements than conventional loans. This can make it easier for veterans with less-than-perfect credit to qualify for a loan. Additionally, VA loans do not have a prepayment penalty, allowing borrowers to pay off their loan early without incurring extra fees.

For veterans who may struggle to meet the down payment and credit score requirements of conventional loans, VA insured loans can be a lifeline. These loans provide an opportunity for veterans to achieve homeownership and secure stable housing for themselves and their families.

In conclusion, VA insured loans offer numerous benefits for veterans, including no down payment requirements, competitive interest rates, flexible credit requirements, and no prepayment penalties. If you are a veteran or active duty service member considering buying a home, exploring the option of a VA insured loan may be a wise choice.

Top 7 Benefits of VA Insured Loans: Why They’re a Smart Choice for Borrowers

- No down payment required for most borrowers

- Competitive interest rates compared to conventional loans

- Flexible credit requirements make it easier to qualify

- No private mortgage insurance (PMI) required

- No prepayment penalty, allowing early loan payoff without fees

- Assistance available for struggling borrowers through VA programs

- Lower closing costs compared to conventional loans

Three Drawbacks of VA Insured Loans: Funding Fee, Property Requirements, and Loan Limits

No down payment required for most borrowers

One significant advantage of VA insured loans is that they typically do not require a down payment for most borrowers. This feature can greatly reduce the financial burden on veterans and active duty service members looking to purchase a home. By eliminating the need for a down payment, VA loans make homeownership more accessible and attainable for those who may not have substantial savings or resources for a traditional down payment. This benefit allows veterans to move into their new homes with minimal upfront costs, providing them with a valuable opportunity to secure stable housing without the financial strain of a large down payment.

Competitive interest rates compared to conventional loans

One significant advantage of VA insured loans is the competitive interest rates they offer compared to conventional loans. Veterans and active duty service members can benefit from lower interest rates, which can result in substantial savings over the life of the loan. This feature makes VA insured loans an attractive option for those looking to purchase a home while keeping their long-term financial well-being in mind.

Flexible credit requirements make it easier to qualify

One significant advantage of VA insured loans is their flexible credit requirements, which make it easier for veterans to qualify for home loans. Unlike conventional loans that may have strict credit score thresholds, VA loans are more accommodating to individuals with varying credit histories. This flexibility can be a game-changer for veterans who may have faced financial challenges in the past but are now looking to secure a home loan. By offering more lenient credit requirements, VA insured loans open up opportunities for veterans to achieve homeownership and fulfill their housing aspirations.

No private mortgage insurance (PMI) required

One significant advantage of VA insured loans is the absence of private mortgage insurance (PMI) requirements. Unlike conventional loans that often mandate PMI for borrowers who put down less than 20% of the home’s purchase price, VA loans do not impose this additional cost. This means that veterans and eligible service members can save money each month by not having to pay for PMI, making homeownership more affordable and accessible for those who have served our country.

No prepayment penalty, allowing early loan payoff without fees

One significant advantage of VA insured loans is the absence of a prepayment penalty, which enables borrowers to pay off their loan ahead of schedule without incurring any additional fees. This flexibility empowers veterans to manage their finances more effectively and potentially save money on interest payments over the life of the loan. The freedom to make early payments without penalty provides a valuable opportunity for veterans to achieve financial stability and homeownership on their own terms.

Assistance available for struggling borrowers through VA programs

One significant advantage of VA insured loans is the assistance available for struggling borrowers through VA programs. Veterans facing financial difficulties or challenges in making their mortgage payments can benefit from the support and resources provided by the VA. These programs offer options such as loan modification, repayment plans, and foreclosure avoidance assistance to help veterans stay in their homes and overcome financial obstacles. The availability of these supportive programs underscores the VA’s commitment to ensuring that veterans have access to the help they need to maintain homeownership and financial stability.

Lower closing costs compared to conventional loans

One significant advantage of VA insured loans is the lower closing costs they offer compared to conventional loans. With VA loans, veterans can benefit from reduced closing costs, which can result in substantial savings during the homebuying process. This cost savings can make homeownership more accessible and affordable for veterans, helping them achieve their housing goals with less financial burden.

Funding Fee

One notable downside of VA insured loans is the funding fee that is typically required. This fee can increase the upfront costs associated with obtaining the loan, potentially making it more challenging for veterans to afford. While the funding fee helps offset the cost of the VA loan program to taxpayers, it is an additional expense that borrowers must consider when deciding on a VA loan. It’s important for veterans to carefully weigh the benefits of a VA insured loan against the costs, including the funding fee, to determine if it is the right option for their individual financial situation.

Property Requirements

One potential drawback of VA insured loans is the stricter property requirements that may limit the types of properties that can be financed. Unlike conventional loans, VA loans have specific standards that the property must meet in order to qualify for financing. This can sometimes restrict veterans from purchasing certain types of properties, such as fixer-uppers or investment properties, which may not meet the VA’s stringent guidelines. It’s important for veterans considering a VA loan to be aware of these property requirements and ensure that the home they are interested in meets all necessary criteria to avoid any potential issues during the loan approval process.

Loan Limits

One significant drawback of VA insured loans is the limitation on borrowing amounts. These loan limits may prove insufficient for veterans looking to purchase homes in high-cost housing markets. In such areas where real estate prices are notably elevated, veterans may find themselves constrained by the maximum loan amount allowed under the VA program. This restriction could potentially hinder their ability to afford a home that meets their needs and preferences, forcing them to seek alternative financing options or consider properties outside their desired location.