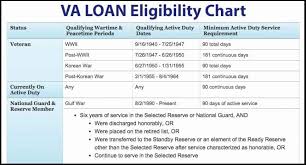

If you are a veteran or an active duty military member, you may be eligible for a VA home loan. This type of loan is designed to help veterans and their families purchase homes with little or no down payment. If you are interested in applying for a VA home loan, it is important to find a lender that can help you navigate the process.

One way to find VA home loan lenders near you is to use the VA’s online lender search tool. This tool allows you to search for lenders in your area that specialize in VA home loans. You can also search by lender name or state.

Another option is to ask for recommendations from other veterans or military members who have used VA home loans in the past. They may be able to provide valuable insights into the lending process and recommend lenders who were particularly helpful.

It is also important to do your own research on potential lenders before making a decision. Look for reviews and ratings online, and check with organizations like the Better Business Bureau to ensure that the lender has a good reputation.

When choosing a VA home loan lender, it is important to consider factors like interest rates, fees, and customer service. You want to find a lender who offers competitive rates and fees, but who also provides excellent customer service throughout the lending process.

Overall, finding a VA home loan lender near you requires some research and effort, but it can pay off in the long run by helping you secure financing for your dream home. Don’t hesitate to reach out to multiple lenders and compare their offerings before making a decision. With some diligence and patience, you can find the right lender for your needs.

Answers to Top 4 Questions about VA Home Loan Lenders Near You

- What is the best place to get a VA loan?

- Who is the #1 VA lender?

- What is the minimum credit score for a VA loan?

- Can any bank do a VA home loan?

What is the best place to get a VA loan?

Determining the best place to get a VA loan depends on your individual needs and preferences. There are many lenders that offer VA loans, including banks, credit unions, and online lenders. Here are some factors to consider when choosing a lender:

- Interest rates: Compare interest rates from different lenders to find the best deal. Keep in mind that interest rates can vary based on your credit score, loan amount, and other factors.

- Fees: Look for a lender that charges reasonable fees for origination, appraisal, and other services.

- Customer service: Choose a lender with good customer service that is responsive to your questions and concerns.

- Experience with VA loans: Look for a lender with experience in working with VA loans specifically.

- Online tools and resources: Consider a lender that offers online tools and resources to help you manage your loan application process.

It’s important to shop around and compare offers from multiple lenders before making a decision. You can use online comparison tools or work with a mortgage broker who can help you find the best deal based on your specific needs and circumstances. Ultimately, the best place to get a VA loan is one that offers competitive rates, low fees, excellent customer service, and an easy application process tailored to your unique situation.

Who is the #1 VA lender?

The #1 VA lender in the United States is currently Veterans United Home Loans. According to the Department of Veterans Affairs, Veterans United Home Loans originated the most VA loans in fiscal year 2020, with over 53,000 loans for a total of $14.5 billion. They have consistently been one of the top VA lenders in recent years and have a strong reputation for customer service and support for veterans and their families. However, it is important to note that there are many reputable VA lenders out there, and it is always wise to do your own research and compare multiple lenders before making a decision on which one to work with.

What is the minimum credit score for a VA loan?

The Department of Veterans Affairs (VA) does not have a minimum credit score requirement for VA loans. However, most VA lenders do have their own credit score requirements that borrowers must meet in order to qualify for a VA loan.

Generally, most VA lenders require a credit score of at least 620 or higher. However, some lenders may be willing to work with borrowers who have lower credit scores if they can demonstrate other factors that make them a good candidate for a VA loan, such as a stable income and employment history.

It is important to note that while the VA does not have a minimum credit score requirement, they do require lenders to review the borrower’s credit history and make sure they have demonstrated a willingness and ability to repay their debts on time.

If you are interested in applying for a VA loan but are concerned about your credit score, it is important to speak with multiple lenders and compare their requirements. You may also want to consider working on improving your credit score before applying for a loan. This could involve paying down debt, making payments on time, and disputing any errors on your credit report.

Can any bank do a VA home loan?

No, not every bank can do a VA home loan. VA home loans are guaranteed by the Department of Veterans Affairs (VA), but they are provided by private lenders such as banks, credit unions, and mortgage companies. However, not all lenders offer VA home loans.

In order to offer VA home loans, a lender must be approved by the VA and meet certain eligibility requirements. These requirements include having a good reputation in the industry, meeting financial stability standards, and having experience with mortgage lending.

To find out if a particular lender offers VA home loans, you can check their website or contact them directly. You can also use the VA’s online lender search tool to find approved lenders in your area.

It is important to note that even if a lender offers VA home loans, they may have different interest rates, fees, and requirements than other lenders. It is always a good idea to shop around for multiple quotes from different lenders before choosing one for your VA home loan. This can help you find the best deal and ensure that you are getting the most favorable terms for your situation.