Getting a VA Home Loan

For veterans and active duty service members, a VA home loan can be an excellent option for purchasing a home. Here are some key points to consider when getting a VA home loan:

Benefits of VA Home Loans:

- No down payment required

- No private mortgage insurance (PMI) required

- Competitive interest rates

- Easier qualification requirements compared to conventional loans

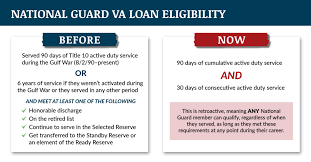

Eligibility Requirements:

To qualify for a VA home loan, you must meet certain eligibility requirements, including:

- Served in the military for a certain period of time

- Received an honorable discharge

- Meet specific service requirements based on your branch of service

Applying for a VA Home Loan:

To apply for a VA home loan, you will need to obtain a Certificate of Eligibility (COE) from the Department of Veterans Affairs. You can then work with a lender who participates in the VA loan program to complete the application process.

Using Your VA Home Loan Benefits:

Once approved for a VA home loan, you can use it to purchase a primary residence, refinance an existing mortgage, or make improvements to your current home.

Conclusion:

A VA home loan is a valuable benefit that can help veterans and active duty service members achieve their dream of homeownership. If you meet the eligibility requirements, consider exploring the option of getting a VA home loan for your next home purchase.

Top 8 Frequently Asked Questions About VA Home Loans

- What are the benefits of a VA home loan?

- Am I eligible for a VA home loan?

- How do I apply for a VA home loan?

- What documents do I need to apply for a VA home loan?

- Do I need a down payment for a VA home loan?

- What are the interest rates for VA home loans?

- Can I use a VA home loan more than once?

- How long does it take to get approved for a VA home loan?

What are the benefits of a VA home loan?

One of the most frequently asked questions about getting a VA home loan is, “What are the benefits of a VA home loan?” VA home loans offer several advantages for veterans and active duty service members, including no down payment requirement, no private mortgage insurance (PMI) needed, competitive interest rates, and easier qualification requirements compared to conventional loans. These benefits make VA home loans an attractive option for those who have served in the military and are looking to purchase a home.

Am I eligible for a VA home loan?

Determining eligibility for a VA home loan is a common question among veterans and active duty service members. To be eligible for a VA home loan, individuals must meet specific criteria, including having served in the military for a certain period of time, receiving an honorable discharge, and meeting service requirements based on their branch of service. Obtaining a Certificate of Eligibility (COE) from the Department of Veterans Affairs is also necessary to apply for a VA home loan. By understanding and meeting these eligibility requirements, veterans and active duty service members can take advantage of the benefits offered by the VA home loan program to achieve their homeownership goals.

How do I apply for a VA home loan?

To apply for a VA home loan, the first step is to obtain a Certificate of Eligibility (COE) from the Department of Veterans Affairs. This document verifies your eligibility for a VA home loan based on your military service record. Once you have your COE, you can work with a lender who participates in the VA loan program to complete the application process. The lender will review your financial information, credit history, and other relevant details to determine your eligibility for a VA home loan. It’s important to gather all necessary documents and information to streamline the application process and increase your chances of approval.

What documents do I need to apply for a VA home loan?

When applying for a VA home loan, you will need to gather several key documents to complete the application process successfully. Commonly required documents include proof of income such as pay stubs or tax returns, employment verification, bank statements, identification documents like driver’s license or passport, Certificate of Eligibility (COE) from the Department of Veterans Affairs, and details about your military service history. Having these documents ready will help streamline the application process and ensure a smoother approval for your VA home loan.

Do I need a down payment for a VA home loan?

When it comes to getting a VA home loan, one of the most frequently asked questions is whether a down payment is required. The great advantage of VA home loans is that they typically do not require a down payment. This benefit sets VA loans apart from many other types of mortgages, making homeownership more accessible to veterans and active duty service members. Not having to come up with a large down payment can be a significant relief for those looking to purchase a home, allowing them to save money for other expenses or investments.

What are the interest rates for VA home loans?

When it comes to VA home loans, one frequently asked question is about the interest rates. VA home loans typically offer competitive interest rates compared to conventional loans. The specific interest rate you qualify for will depend on various factors, including your credit score, the current market conditions, and the lender you work with. It’s important to shop around and compare offers from different lenders to ensure you get the best possible interest rate for your VA home loan.

Can I use a VA home loan more than once?

For those wondering about using a VA home loan more than once, the answer is yes. Veterans and active duty service members who have paid off a previous VA loan or sold the property can typically reuse their VA home loan benefit for another home purchase. As long as they meet the eligibility requirements and have restored their entitlement, they can apply for a new VA home loan. This flexibility allows veterans to take advantage of the benefits of VA loans multiple times throughout their lives, making homeownership more accessible and affordable for those who have served our country.

How long does it take to get approved for a VA home loan?

The timeline for getting approved for a VA home loan can vary depending on several factors. Generally, the approval process for a VA home loan can take anywhere from 30 to 45 days, but it may be shorter or longer based on individual circumstances. Factors that can impact the approval timeline include the lender’s workload, the complexity of your application, and any additional documentation required. It is important to work closely with your lender and provide all necessary information promptly to help expedite the approval process for your VA home loan.