The Benefits of Veterans Affairs Home Loan

For veterans and active duty military personnel, the Veterans Affairs (VA) home loan program offers a valuable opportunity to achieve the dream of homeownership. This program, established by the U.S. Department of Veterans Affairs, provides eligible veterans with access to mortgage loans with favorable terms and benefits.

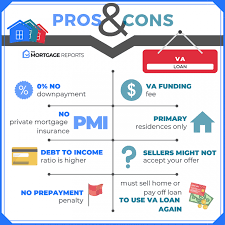

One of the key advantages of a VA home loan is that it typically requires no down payment, making homeownership more accessible for those who may not have significant savings. Additionally, VA loans often have lower interest rates compared to conventional mortgages, saving borrowers money over the life of the loan.

Another benefit of VA home loans is that they do not require private mortgage insurance (PMI), which can result in substantial savings for borrowers. The program also offers flexibility in terms of credit requirements, making it easier for veterans with less-than-perfect credit to qualify for a loan.

VA loans can be used to purchase a primary residence, refinance an existing mortgage, or make home improvements. The program also allows for refinancing options that can help veterans lower their monthly payments or shorten the term of their loan.

In addition to these financial benefits, VA home loans provide peace of mind for borrowers by offering protections against foreclosure and providing assistance in times of financial hardship. The VA also works with lenders to ensure that veterans are treated fairly and receive the support they need throughout the loan process.

In conclusion, the Veterans Affairs home loan program is a valuable resource for veterans and active duty military personnel looking to achieve homeownership. With its favorable terms, low costs, and comprehensive support services, VA loans make it easier for those who have served our country to secure a place to call their own.

9 Essential Tips for Navigating Veterans Affairs Home Loans

- Understand the eligibility requirements before applying.

- Take advantage of the benefits, such as no down payment and no private mortgage insurance.

- Shop around for lenders that specialize in VA loans for competitive rates.

- Consider getting pre-approved to strengthen your offer when house hunting.

- Be aware of the funding fee that may apply, but can be included in the loan.

- Utilize the VA appraisal process to ensure the property meets safety and livability standards.

- Stay informed about changes in VA loan limits and regulations.

- Explore options for refinancing with a VA loan if interest rates drop significantly.

- Seek guidance from a VA loan specialist or counselor if you have any questions or need assistance.

Understand the eligibility requirements before applying.

Before applying for a Veterans Affairs home loan, it is crucial to understand the eligibility requirements. Veterans and active duty military personnel need to meet specific criteria set by the VA to qualify for this beneficial program. By familiarizing yourself with these requirements beforehand, you can ensure that you meet the necessary qualifications and increase your chances of approval. Taking the time to understand the eligibility criteria will help streamline the application process and avoid any potential setbacks along the way.

Take advantage of the benefits, such as no down payment and no private mortgage insurance.

Veterans looking to purchase a home should take full advantage of the benefits offered by the Veterans Affairs home loan program, including the opportunity to secure a mortgage with no down payment required and no need for private mortgage insurance. These advantages can significantly reduce the upfront costs associated with buying a home and make homeownership more accessible for veterans and their families. By leveraging these benefits, veterans can save money in the long run and enjoy the financial flexibility that comes with a VA home loan.

Shop around for lenders that specialize in VA loans for competitive rates.

When considering a Veterans Affairs home loan, it is advisable to shop around for lenders that specialize in VA loans to secure competitive rates. By seeking out lenders with expertise in VA loans, veterans and active duty military personnel can potentially access better terms and rates tailored to their unique needs. These specialized lenders understand the intricacies of VA loans and can offer valuable insights and guidance throughout the loan process, ultimately helping borrowers make informed decisions that align with their financial goals.

Consider getting pre-approved to strengthen your offer when house hunting.

When searching for a home using a Veterans Affairs home loan, it’s wise to consider getting pre-approved. By obtaining pre-approval for your VA loan, you can strengthen your offer when house hunting. Pre-approval demonstrates to sellers that you are a serious and qualified buyer, potentially giving you an edge in competitive housing markets. It also helps you determine your budget and streamline the homebuying process by identifying any potential issues early on. Overall, getting pre-approved for a VA home loan can be a strategic move to make your offer more attractive and increase your chances of securing the home of your dreams.

Be aware of the funding fee that may apply, but can be included in the loan.

When considering a Veterans Affairs home loan, it is important to be aware of the funding fee that may apply. This fee helps offset the cost of the VA loan program to taxpayers and varies depending on factors such as military service history and down payment amount. However, one key advantage is that the funding fee can typically be included in the loan amount, allowing borrowers to finance it over time rather than paying it upfront. By understanding and planning for this fee, veterans can make informed decisions about their home loan options while taking advantage of the benefits provided by the VA program.

Utilize the VA appraisal process to ensure the property meets safety and livability standards.

When utilizing a Veterans Affairs home loan, it is crucial to take advantage of the VA appraisal process to guarantee that the property meets safety and livability standards. The VA appraisal helps ensure that the home is in good condition and meets the minimum property requirements set by the Department of Veterans Affairs. By going through this process, veterans can have peace of mind knowing that the property they are purchasing is safe and suitable for living, protecting their investment and well-being in the long run.

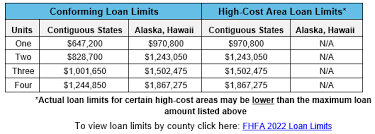

Stay informed about changes in VA loan limits and regulations.

It is crucial for veterans considering a VA home loan to stay informed about any changes in VA loan limits and regulations. By staying up-to-date on these updates, veterans can ensure they are taking full advantage of the benefits available to them and make informed decisions about their home financing options. Being aware of any changes in loan limits and regulations can help veterans plan effectively and maximize the benefits of their VA loan eligibility.

Explore options for refinancing with a VA loan if interest rates drop significantly.

When considering a Veterans Affairs home loan, it is essential for veterans and active duty military personnel to explore options for refinancing if interest rates drop significantly. Refinancing with a VA loan can offer the opportunity to lower monthly payments, reduce the overall cost of the loan, or even shorten the term of the mortgage. By taking advantage of favorable interest rate changes, borrowers can potentially save money and improve their financial situation in the long run. It is important to stay informed about market trends and consult with lenders to determine if refinancing with a VA loan is a beneficial option based on individual circumstances.

Seek guidance from a VA loan specialist or counselor if you have any questions or need assistance.

Seeking guidance from a VA loan specialist or counselor is crucial when navigating the complexities of the Veterans Affairs home loan process. These experts have the knowledge and experience to address any questions or concerns you may have, ensuring that you fully understand your options and make informed decisions. Whether you need assistance with eligibility requirements, loan terms, or any other aspect of the VA home loan program, a specialist or counselor can provide valuable support to help you successfully secure the benefits you deserve.