VA Home Loan for National Guard Members

The VA home loan program is a valuable benefit offered to eligible service members, veterans, and their families. For National Guard members, this benefit can provide a pathway to homeownership with favorable terms and conditions.

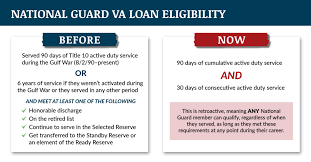

As a National Guard member, you may be eligible for a VA home loan if you meet the service requirements set forth by the Department of Veterans Affairs. Typically, National Guard members become eligible after completing six years of service in the Guard or Reserve.

One of the key advantages of a VA home loan is that it does not require a down payment, making it easier for National Guard members to purchase a home without having to save up a large sum of money upfront. Additionally, VA loans often have lower interest rates compared to conventional loans, saving borrowers money over the life of the loan.

Another benefit of VA loans is that they do not require private mortgage insurance (PMI), which can result in significant savings over time. This can make homeownership more affordable for National Guard members who may not have substantial savings or income.

It’s important for National Guard members considering a VA home loan to understand the eligibility requirements and application process. Working with a lender experienced in VA loans can help streamline the process and ensure that you take full advantage of this valuable benefit.

In conclusion, the VA home loan program offers National Guard members an excellent opportunity to achieve their dream of homeownership. With its attractive terms and benefits, this program can make buying a home more accessible and affordable for those who have served our country in the National Guard.

7 Essential Tips for National Guard Members to Secure a VA Home Loan

- Verify your eligibility as a National Guard member for a VA home loan.

- Understand the specific requirements and benefits of VA loans for National Guard members.

- Maintain a good credit score to increase your chances of approval for a VA loan.

- Save up for a down payment, even though it’s not always required for VA loans.

- Explore different lenders to find the best terms and rates for your VA loan.

- Consider attending homeownership education programs to better understand the home buying process.

- Consult with a financial advisor or housing counselor if you have any questions or need guidance.

Verify your eligibility as a National Guard member for a VA home loan.

It is crucial for National Guard members considering a VA home loan to verify their eligibility before proceeding with the application process. Ensuring that you meet the service requirements set by the Department of Veterans Affairs is essential to take full advantage of this valuable benefit. By confirming your eligibility as a National Guard member for a VA home loan, you can streamline the application process and avoid any potential delays or complications. It is recommended to thoroughly review the eligibility criteria and seek guidance from experienced lenders specializing in VA loans to make the most of this opportunity for homeownership.

Understand the specific requirements and benefits of VA loans for National Guard members.

It is crucial for National Guard members to thoroughly understand the specific requirements and benefits of VA loans tailored to them. By familiarizing themselves with the unique eligibility criteria and advantageous terms offered through VA loans for National Guard members, individuals can make informed decisions when pursuing homeownership. Being well-informed about these specialized loan options ensures that National Guard members can maximize the benefits available to them and navigate the home loan process with confidence and clarity.

Maintain a good credit score to increase your chances of approval for a VA loan.

Maintaining a good credit score is crucial when applying for a VA home loan as a National Guard member. A strong credit score not only increases the likelihood of approval for a VA loan but also plays a significant role in determining the interest rate you may receive. Lenders typically look at credit scores to assess the borrower’s creditworthiness and ability to repay the loan. By keeping your credit score in good standing, you demonstrate financial responsibility and improve your chances of securing a VA loan with favorable terms and conditions, ultimately making homeownership more achievable for National Guard members.

Save up for a down payment, even though it’s not always required for VA loans.

Saving up for a down payment, even though it’s not mandatory for VA loans, can still be a wise financial strategy for National Guard members considering homeownership. Having a down payment can help reduce the overall loan amount, potentially lowering monthly payments and long-term interest costs. Additionally, having some savings set aside can provide a financial cushion for unexpected expenses or home maintenance costs after purchasing a home. By saving up for a down payment, National Guard members can put themselves in a stronger financial position and make the most of their VA home loan benefit.

Explore different lenders to find the best terms and rates for your VA loan.

When considering a VA home loan as a National Guard member, it is advisable to explore different lenders to find the best terms and rates that suit your financial needs. By comparing offers from various lenders, you can ensure that you are getting the most favorable terms and rates for your VA loan. This proactive approach can help you save money in the long run and make the home buying process more affordable and streamlined.

Consider attending homeownership education programs to better understand the home buying process.

Consider attending homeownership education programs to better understand the home buying process when utilizing a VA home loan as a National Guard member. These programs can provide valuable insights into the various aspects of homeownership, including budgeting, mortgage options, and maintaining a home. By educating yourself through these programs, you can make informed decisions and navigate the home buying process with confidence.

Consult with a financial advisor or housing counselor if you have any questions or need guidance.

For National Guard members interested in utilizing the VA home loan benefit, it is advisable to consult with a financial advisor or housing counselor for expert guidance and assistance. These professionals can provide valuable insights, answer any questions you may have, and help you navigate the complexities of the home buying process. Seeking advice from a knowledgeable advisor can ensure that you make informed decisions and maximize the benefits available to you through the VA home loan program.