The VA Home Loan Certificate of Eligibility (COE): Unlocking Benefits for Veterans

For veterans and active-duty military personnel, the dream of owning a home can become a reality with the help of the VA Home Loan program. One essential component of this program is the VA Home Loan Certificate of Eligibility (COE). In this article, we will explore what the COE is, its significance, and how to obtain it.

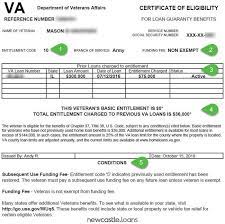

The COE is an official document issued by the Department of Veterans Affairs (VA) that verifies a veteran’s eligibility for a VA-backed home loan. It serves as proof to lenders that you meet the requirements to participate in this beneficial program. Whether you are purchasing a new home or refinancing an existing mortgage, having a COE is crucial.

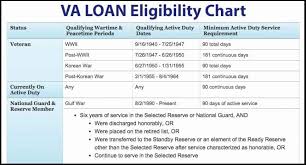

To be eligible for a VA Home Loan COE, you must meet certain criteria. Generally, veterans who served at least 90 consecutive days during wartime or 181 days during peacetime are eligible. National Guard and Reserve members may also qualify after serving for at least six years. Spouses of service members who died in the line of duty or as a result of a service-related disability may be eligible as well.

Obtaining your COE is a relatively straightforward process. There are three primary ways to apply: through an approved lender, online through the eBenefits portal, or by mail using VA Form 26-1880. Working with an approved lender is often the most convenient option since they can assist you in gathering the necessary documents and submitting your application efficiently.

When applying for your COE, you will need to provide documentation such as your DD Form 214 (Certificate of Release or Discharge from Active Duty), proof of current military service if still on active duty, and other supporting documents depending on your circumstances. The lender or VA will review your application and verify your eligibility.

Once you receive your COE, it’s essential to keep it safe as you will need it throughout the home loan process. Lenders will request a copy of your COE when you apply for a VA-backed home loan, and it will also be required during the underwriting process.

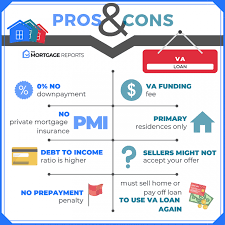

The VA Home Loan program offers numerous advantages, including no down payment requirements, competitive interest rates, no private mortgage insurance (PMI), and flexible credit requirements. These benefits are made possible by the government’s guarantee to reimburse lenders for a portion of the loan in case of default.

In conclusion, the VA Home Loan Certificate of Eligibility is a crucial document for veterans and active-duty military personnel interested in utilizing the VA Home Loan program. It serves as proof of eligibility and unlocks a range of benefits that can make homeownership more accessible and affordable. If you are a veteran or an active-duty service member dreaming of owning a home, take the necessary steps to obtain your COE and explore the possibilities that await you through this exceptional program.

6 Essential Tips for Obtaining a VA Home Loan COE

- Make sure you meet all the eligibility requirements for a VA home loan COE, such as having served in the military or being the spouse of a veteran.

- Gather all necessary documents that will be required to apply for a VA home loan COE, such as your DD-214 discharge papers and other financial information.

- Apply for your Certificate of Eligibility (COE) through the Department of Veterans Affairs website or by mail.

- Compare different lenders and rates to find the best deal on a VA home loan COE before signing any contracts or agreements.

- Make sure you understand all of the terms and conditions associated with your VA home loan COE before signing any paperwork or making any payments to lenders or brokers involved in the process.

- Keep copies of all documents related to your VA home loan COE so that you can refer back to them if there are ever any questions about terms, conditions, or payments made during the process.

Make sure you meet all the eligibility requirements for a VA home loan COE, such as having served in the military or being the spouse of a veteran.

Ensuring Eligibility: A Crucial Step for Obtaining a VA Home Loan COE

If you are considering applying for a VA home loan, one of the first steps you should take is to ensure that you meet all the eligibility requirements for a VA Home Loan Certificate of Eligibility (COE). This document serves as proof of your eligibility for this beneficial program and is essential for obtaining a VA-backed home loan.

The primary requirement for obtaining a VA home loan COE is having served in the military. Veterans who have served at least 90 consecutive days during wartime or 181 days during peacetime generally meet this criterion. National Guard and Reserve members may also qualify after serving for at least six years. Additionally, spouses of service members who died in the line of duty or as a result of a service-related disability may be eligible.

It is crucial to thoroughly review the eligibility requirements to ensure that you qualify before proceeding with your application. By doing so, you can save time and avoid potential disappointments along the way. The Department of Veterans Affairs (VA) provides detailed information on their website regarding eligibility criteria, so it’s worth taking some time to familiarize yourself with these guidelines.

If you believe that you meet the eligibility requirements, it’s time to gather the necessary documentation to support your application. This typically includes your DD Form 214 (Certificate of Release or Discharge from Active Duty), proof of current military service if still on active duty, and any other supporting documents specific to your circumstances.

Once you have gathered all the required documentation, you can apply for your COE through an approved lender, online via the eBenefits portal, or by mail using VA Form 26-1880. Working with an approved lender can be particularly helpful as they can guide you through the application process and assist in ensuring that all necessary documents are included.

Remember, meeting all the eligibility requirements is crucial when seeking a VA home loan COE. By ensuring your eligibility upfront, you can save time and streamline the process of obtaining this essential document. Take the time to review the eligibility criteria provided by the VA, gather the necessary documentation, and consider seeking assistance from an approved lender. Armed with your COE, you’ll be one step closer to unlocking the benefits of a VA-backed home loan and achieving your dream of homeownership.

Gather all necessary documents that will be required to apply for a VA home loan COE, such as your DD-214 discharge papers and other financial information.

Gathering Essential Documents for Your VA Home Loan COE Application

If you’re considering applying for a VA home loan and obtaining your Certificate of Eligibility (COE), it’s crucial to gather all the necessary documents beforehand. Having these documents readily available will streamline the application process and help you move closer to achieving your homeownership goals. Here’s a quick guide on the essential documents you’ll need to gather.

First and foremost, obtaining a copy of your DD-214 discharge papers is vital. This document serves as proof of your military service and is required when applying for your COE. The DD-214 provides details about your dates of service, character of discharge, and any awards or commendations received during your time in the military.

In addition to the DD-214, you may also need to provide other financial information when applying for your COE. This can include bank statements, pay stubs, tax returns, and W-2 forms. These documents help lenders assess your financial stability and determine your ability to repay the loan.

It’s important to gather all relevant financial information from the past two years. This includes documentation related to any additional sources of income such as retirement benefits or disability compensation. Providing comprehensive financial records will give lenders a clear picture of your financial standing and increase your chances of securing a VA home loan.

Organizing these documents ahead of time can save you valuable time during the application process. Consider creating a dedicated folder or digital file where you can keep all these essential documents together. This way, when it comes time to apply for your COE, everything will be readily accessible.

Remember that each individual’s circumstances may vary slightly, so it’s always a good idea to consult with an approved lender or contact the Department of Veterans Affairs directly for specific guidance on which documents are required in your situation.

By proactively gathering all necessary documents before applying for a VA home loan COE, you demonstrate preparedness and ensure a smoother application process. Taking the time to gather these documents will help you move closer to achieving your dream of homeownership and accessing the benefits offered through the VA home loan program.

Apply for your Certificate of Eligibility (COE) through the Department of Veterans Affairs website or by mail.

Applying for your VA Home Loan Certificate of Eligibility (COE): A Convenient Process

If you are a veteran or an active-duty military personnel looking to take advantage of the VA Home Loan program, one crucial step is obtaining your Certificate of Eligibility (COE). Thankfully, applying for your COE has become more convenient than ever before. You can now apply online through the Department of Veterans Affairs website or by mail, making the process hassle-free.

Applying online through the Department of Veterans Affairs website is a quick and straightforward method. The eBenefits portal allows you to complete your application conveniently from the comfort of your own home. The system will guide you through the necessary steps, requesting information such as your military service history and personal details. Once submitted, you can track the progress of your application online and receive updates on its status.

For those who prefer a more traditional approach, applying by mail is still an option. By completing VA Form 26-1880 and submitting it along with any required supporting documents, you can initiate the process. Be sure to include documents such as your DD Form 214 or proof of current military service if applicable. Mail your application to the appropriate regional VA loan center based on your state.

Whichever method you choose, it’s important to ensure that all required documentation is included and that the information provided is accurate and up-to-date. This will help expedite the processing time and prevent unnecessary delays in receiving your COE.

Once approved, you will receive your COE via mail or electronically if applied online. Keep this document safe as it will be required throughout the home loan process. Lenders will request a copy when you apply for a VA-backed home loan, and it will also be necessary during underwriting.

Obtaining your COE is an essential step towards accessing the benefits offered by the VA Home Loan program. By applying through the Department of Veterans Affairs website or by mail, you can easily initiate the process and set yourself on the path to homeownership. Remember to gather all the necessary documents and provide accurate information to ensure a smooth application experience.

If you are a veteran or an active-duty military personnel looking to utilize the VA Home Loan program, take advantage of the convenience offered by applying for your COE online or by mail. This small step can lead to significant benefits, making your dream of owning a home a reality.

Compare different lenders and rates to find the best deal on a VA home loan COE before signing any contracts or agreements.

Finding the Best Deal on a VA Home Loan COE: Why Comparing Lenders and Rates is Essential

When it comes to obtaining a VA Home Loan Certificate of Eligibility (COE), it’s crucial to remember that not all lenders are created equal. As a veteran or active-duty military personnel, taking the time to compare different lenders and rates can make a significant difference in securing the best deal for your VA home loan COE.

One of the most common mistakes borrowers make is assuming that all lenders offer the same terms and rates for VA home loans. In reality, each lender has its own policies, fees, and interest rates. By comparing multiple lenders, you can ensure you’re getting the most favorable terms possible.

Start by researching reputable lenders who specialize in VA home loans. Look for those with experience working with veterans and active-duty military personnel, as they are more likely to understand your unique needs and offer tailored solutions. Read reviews, seek recommendations from fellow veterans, and consider consulting with a mortgage broker who can provide insights into various lenders’ offerings.

Once you have identified several potential lenders, request loan estimates from each of them. These estimates will provide detailed information about interest rates, closing costs, loan terms, and any other fees associated with obtaining your VA home loan COE. Carefully review these estimates side by side to compare the overall costs associated with each lender.

While interest rates are an essential factor to consider, don’t overlook other fees such as origination fees or discount points that may impact your final loan amount. Additionally, pay attention to any prepayment penalties or adjustable rate structures that could affect your long-term financial plans.

Comparing different lenders and rates not only helps you find the best deal on your VA home loan COE but also empowers you to negotiate with potential lenders. Armed with multiple offers, you can leverage one lender’s terms against another to secure more favorable conditions or potentially lower interest rates.

Remember, signing any contracts or agreements without thoroughly comparing lenders and rates could lead to missed opportunities and higher costs over the life of your loan. Take the time to do your due diligence, ask questions, and seek clarification on any terms or conditions that are unclear.

By putting in the effort to compare different lenders and rates for your VA home loan COE, you can ensure that you are making an informed decision that aligns with your financial goals. Don’t settle for the first offer that comes your way – explore your options, negotiate when possible, and find the best possible deal on your VA home loan COE.

Make sure you understand all of the terms and conditions associated with your VA home loan COE before signing any paperwork or making any payments to lenders or brokers involved in the process.

Understanding the Terms and Conditions of Your VA Home Loan COE: A Crucial Step in the Homebuying Process

When it comes to obtaining a VA Home Loan Certificate of Eligibility (COE), it’s essential to fully comprehend all the terms and conditions associated with this document. Before signing any paperwork or making payments to lenders or brokers involved in the process, take the time to educate yourself about what you’re agreeing to. This small but crucial step can save you from potential pitfalls down the road.

The COE is a valuable document that verifies your eligibility for a VA-backed home loan, allowing you to access favorable terms and benefits. However, it’s important to remember that obtaining your COE is just one part of the overall homebuying journey. To ensure a smooth experience, it’s crucial to understand how your COE works in conjunction with other aspects of the loan process.

Start by carefully reviewing all documents related to your VA home loan, including those provided by lenders or brokers. Pay close attention to details such as interest rates, repayment terms, fees, and any potential penalties or charges associated with late payments or early loan payoffs.

If there are any terms or conditions that you don’t fully understand, don’t hesitate to seek clarification from professionals who specialize in VA home loans. Lenders or brokers should be able to explain any confusing aspects and address your concerns before proceeding further.

Additionally, take advantage of resources available through the Department of Veterans Affairs (VA) website or consult with a trusted housing counselor who can provide guidance on understanding the fine print and ensuring that you are making informed decisions.

Remember that knowledge is power when it comes to navigating the complexities of homeownership. By taking the time to comprehend all aspects of your VA home loan COE and associated terms and conditions, you can confidently move forward in securing your dream home without unexpected surprises along the way.

In conclusion, make sure you thoroughly understand all the terms and conditions associated with your VA home loan COE before committing to any agreements or financial obligations. By doing so, you can protect yourself, make informed decisions, and set yourself up for a successful and rewarding homebuying experience.

Keep copies of all documents related to your VA home loan COE so that you can refer back to them if there are ever any questions about terms, conditions, or payments made during the process.

A Handy Tip for VA Home Loan COE: Keep Your Documents Safe

When it comes to navigating the VA Home Loan Certificate of Eligibility (COE) process, organization is key. One valuable tip to ensure a smooth experience is to keep copies of all documents related to your COE. By doing so, you’ll have a reliable reference point for any questions that may arise regarding terms, conditions, or payments made during the process.

Obtaining a VA Home Loan COE is an important step towards realizing your dream of homeownership as a veteran or active-duty military personnel. It serves as proof of your eligibility for the VA-backed home loan program and provides access to its numerous benefits. However, the COE is not just a one-time document you obtain and forget about; it plays an ongoing role throughout the loan process.

By keeping copies of all COE-related documents in a secure location, such as a designated folder or digital file, you can easily refer back to them whenever necessary. This includes any correspondence with lenders, loan agreements, payment receipts, or other relevant paperwork. Having these documents readily available can save you time and effort if questions arise in the future.

Maintaining organized records can be particularly helpful during situations like refinancing or selling your home. If you decide to refinance your VA-backed loan or sell your property at some point down the line, having access to your COE-related documents will make the transition smoother. You’ll be able to provide accurate information and address any inquiries promptly.

Additionally, keeping copies of your COE-related documents can help in case there are ever any discrepancies or misunderstandings regarding loan terms or payments made. It provides a clear record that you can refer back to when discussing matters with lenders or other parties involved in the loan process.

Remember that protecting sensitive personal information is crucial when storing physical copies of documents. Consider using a secure filing cabinet or safe deposit box for hard copies, and for digital copies, ensure they are stored in a password-protected and encrypted location.

In summary, keeping copies of all documents related to your VA Home Loan COE is a smart practice that can save you time and provide peace of mind. By having these records readily available, you can easily refer back to them if questions arise about loan terms, conditions, or payments made during the process. Stay organized and keep your homeownership journey on track!