The Benefits of VA Backed Home Loans for Veterans

For many veterans, the dream of owning a home can seem out of reach due to financial constraints. However, the U.S. Department of Veterans Affairs (VA) offers a valuable benefit that can help make homeownership a reality – VA backed home loans.

VA backed home loans are mortgage loans provided by private lenders such as banks and mortgage companies but are guaranteed by the VA. This guarantee reduces the risk for lenders, allowing them to offer more favorable terms to veterans, active duty service members, and eligible surviving spouses.

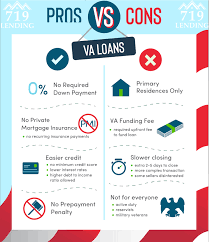

One of the key benefits of VA backed home loans is that they often require no down payment or private mortgage insurance (PMI). This can significantly lower the upfront costs associated with buying a home, making it easier for veterans to become homeowners.

In addition to requiring no down payment, VA backed home loans also have competitive interest rates compared to conventional mortgages. This can result in lower monthly payments and overall savings over the life of the loan.

Another advantage of VA backed home loans is that they have more flexible credit requirements than conventional loans. Veterans with less-than-perfect credit may still qualify for a VA loan, providing them with an opportunity to achieve their homeownership goals.

Furthermore, VA backed home loans do not have prepayment penalties, allowing veterans to pay off their mortgage early without incurring additional fees. This flexibility can help veterans save money on interest and build equity in their homes faster.

In conclusion, VA backed home loans offer numerous benefits for veterans looking to purchase a home. From no down payment and competitive interest rates to flexible credit requirements and no prepayment penalties, these loans provide valuable support to those who have served our country. If you are a veteran interested in buying a home, exploring the option of a VA backed loan may be a wise decision.

Understanding VA Backed Home Loans: Top 8 Frequently Asked Questions

- What is a VA backed home loan?

- Who is eligible for a VA backed home loan?

- How do I apply for a VA backed home loan?

- What are the benefits of a VA backed home loan?

- Do I need a down payment for a VA backed home loan?

- Are there any fees associated with a VA backed home loan?

- Can I use a VA backed home loan more than once?

- What happens if I default on a VA backed home loan?

What is a VA backed home loan?

A VA backed home loan is a mortgage loan program offered by the U.S. Department of Veterans Affairs (VA) that provides a guarantee to private lenders, enabling them to offer favorable terms to veterans, active duty service members, and eligible surviving spouses. This guarantee reduces the risk for lenders, allowing them to provide loans with benefits such as no down payment or private mortgage insurance (PMI), competitive interest rates, flexible credit requirements, and no prepayment penalties. VA backed home loans make homeownership more accessible to veterans by lowering upfront costs and offering financial advantages that can help them achieve their housing goals.

Who is eligible for a VA backed home loan?

To be eligible for a VA backed home loan, individuals must meet specific criteria set by the U.S. Department of Veterans Affairs. Generally, veterans who have served on active duty for a certain period of time, as specified by the VA, are eligible for this benefit. Active duty service members, National Guard and Reserve members, and certain categories of surviving spouses may also qualify for a VA backed home loan. It is important to note that each case is unique, and eligibility requirements may vary based on factors such as length of service, discharge status, and other considerations outlined by the VA. Prospective applicants are encouraged to consult with a VA-approved lender or visit the official VA website for detailed information on eligibility criteria for VA backed home loans.

How do I apply for a VA backed home loan?

To apply for a VA backed home loan, eligible veterans, active duty service members, and certain surviving spouses can start by obtaining a Certificate of Eligibility (COE) from the VA. This document verifies their eligibility for the VA loan program. Next, applicants can choose a lender that participates in the VA loan program and submit their loan application along with the necessary financial documentation. The lender will then review the application, assess the applicant’s creditworthiness, and determine if they qualify for a VA backed home loan. If approved, the applicant can proceed with the home buying process with the support of their lender and the VA to secure their dream home.

What are the benefits of a VA backed home loan?

One of the key benefits of a VA backed home loan is the ability for eligible veterans, active duty service members, and eligible surviving spouses to potentially purchase a home with no down payment. This feature can significantly lower the financial barrier to homeownership, making it more accessible to those who have served our country. Additionally, VA backed home loans often come with competitive interest rates, which can result in lower monthly payments and long-term savings. The flexibility in credit requirements and the absence of private mortgage insurance are other advantages that make VA loans an attractive option for those looking to buy a home.

Do I need a down payment for a VA backed home loan?

When it comes to VA backed home loans, one of the most frequently asked questions is whether a down payment is required. The good news is that, in many cases, no down payment is needed for a VA backed home loan. This benefit sets VA loans apart from conventional mortgages and can make homeownership more accessible to veterans and active duty service members. By eliminating the need for a down payment, VA loans reduce the upfront costs associated with buying a home, making it easier for qualified individuals to achieve their dream of homeownership.

Are there any fees associated with a VA backed home loan?

Yes, there are fees associated with a VA backed home loan, but they are typically lower compared to conventional mortgages. One of the primary fees is the VA funding fee, which helps offset the cost of the loan program to taxpayers. The amount of the funding fee can vary based on factors such as the type of service member, down payment amount, and whether it’s a first-time or subsequent use of the benefit. However, one advantage is that this fee can be rolled into the loan amount rather than paid upfront. Additionally, while there may be other customary closing costs involved in obtaining a VA backed home loan, veterans are often able to negotiate with sellers to cover some or all of these expenses.

Can I use a VA backed home loan more than once?

Yes, veterans can indeed use a VA backed home loan more than once, as long as they meet certain eligibility requirements. The VA loan benefit is reusable and does not expire, allowing veterans to use it multiple times throughout their lifetime. However, there are limitations on the amount of entitlement that can be used at once, based on the loan limits set by the VA. Veterans who have paid off a previous VA loan in full may be able to restore their entitlement and use it again for a new home purchase. It’s important for veterans to consult with lenders or VA representatives to understand their specific eligibility and entitlement options when considering using a VA backed home loan more than once.

What happens if I default on a VA backed home loan?

If you default on a VA backed home loan, the consequences can be serious. The VA guarantee on the loan protects the lender from financial loss in case of default, but it does not absolve you of your responsibility to repay the debt. If you default on a VA backed home loan, the lender may initiate foreclosure proceedings to recover the remaining balance of the loan. This can result in the loss of your home and have a negative impact on your credit score. It is important to communicate with your lender if you are facing financial difficulties to explore options such as loan modification or repayment plans to avoid defaulting on your VA backed home loan.