Types of VA Loans

VA loans are a valuable benefit offered to veterans, active duty service members, and certain eligible spouses. These loans are provided by private lenders, such as banks and mortgage companies, but are guaranteed by the U.S. Department of Veterans Affairs. VA loans offer several types to suit the diverse needs of those who have served in the military.

Purchase Loans

Purchase loans are the most common type of VA loan and are designed to help veterans buy a home at a competitive interest rate without requiring a down payment or private mortgage insurance. This type of loan can be used to purchase a primary residence.

Interest Rate Reduction Refinance Loan (IRRRL)

An IRRRL, also known as a VA Streamline Refinance Loan, allows veterans with existing VA loans to refinance at a lower interest rate with minimal paperwork and no appraisal required. This type of loan can help borrowers save money on their monthly mortgage payments.

Cash-Out Refinance Loan

A Cash-Out Refinance Loan allows eligible borrowers to refinance their existing mortgage for more than they currently owe and receive the difference in cash. This type of loan can be used for various purposes, such as home improvements or debt consolidation.

Native American Direct Loan (NADL)

The NADL program helps eligible Native American veterans finance the purchase, construction, or improvement of homes on federal trust land. This loan is similar to the VA’s standard home loan program but tailored specifically for Native American veterans.

These are just a few examples of the types of VA loans available to veterans and their families. Each type serves a specific purpose and offers unique benefits to help make homeownership more accessible for those who have served our country.

Top 5 Advantages of VA Loans for Veterans and Service Members

- No down payment required for most VA loans, making homeownership more accessible for veterans.

- Competitive interest rates offered on VA loans, helping borrowers save money over the life of the loan.

- VA loans do not require private mortgage insurance (PMI), reducing monthly mortgage payments for borrowers.

- Flexible eligibility criteria for VA loans, including active duty service members, veterans, and certain eligible spouses.

- Various types of VA loans available to suit different needs, such as purchase loans, refinance options, and specialized programs like NADL.

Top 5 Drawbacks of VA Loans: Eligibility, Costs, and Restrictions

- Limited eligibility criteria restrict who can qualify for VA loans.

- VA funding fee may be required, adding to the overall cost of the loan.

- Strict appraisal requirements may limit the types of properties that can be financed with a VA loan.

- Potential longer processing times compared to conventional loans.

- Restrictions on loan limits may not cover higher-priced homes in certain areas.

No down payment required for most VA loans, making homeownership more accessible for veterans.

One significant advantage of VA loans is that most of them do not require a down payment, making homeownership more attainable for veterans. This benefit eliminates the financial barrier of having to save up for a substantial down payment, allowing veterans to purchase a home with more ease and flexibility. By removing this upfront cost, VA loans empower veterans to achieve their homeownership goals and secure a stable living environment for themselves and their families.

Competitive interest rates offered on VA loans, helping borrowers save money over the life of the loan.

One significant advantage of VA loans is the competitive interest rates they offer, which can help borrowers save money over the life of the loan. These favorable rates make homeownership more affordable for veterans and their families, allowing them to enjoy lower monthly mortgage payments and potentially significant long-term savings. By securing a VA loan with a competitive interest rate, borrowers can better manage their finances and build equity in their homes more efficiently. This pro of VA loans underscores the valuable financial benefits that come with utilizing this beneficial program designed to support those who have served our country.

VA loans do not require private mortgage insurance (PMI), reducing monthly mortgage payments for borrowers.

One significant advantage of VA loans is that they do not require private mortgage insurance (PMI), unlike many conventional loans. This absence of PMI helps to reduce monthly mortgage payments for borrowers, making homeownership more affordable and accessible for veterans, active duty service members, and eligible spouses. By eliminating the need for PMI, VA loans can save borrowers a significant amount of money over the life of the loan, allowing them to allocate those funds towards other essential expenses or savings goals.

Flexible eligibility criteria for VA loans, including active duty service members, veterans, and certain eligible spouses.

One significant advantage of VA loans is their flexible eligibility criteria, which extend to active duty service members, veterans, and certain eligible spouses. This inclusivity allows a broader range of individuals with military connections to access the benefits of VA loans. The flexibility in eligibility criteria demonstrates the commitment to supporting those who have served or are currently serving in the military, as well as their families. This pro of VA loans ensures that more individuals can benefit from favorable terms and assistance in achieving homeownership.

Various types of VA loans available to suit different needs, such as purchase loans, refinance options, and specialized programs like NADL.

One significant advantage of VA loans is the variety of options available to cater to different needs. Whether a veteran is looking to purchase a home, refinance an existing loan, or take advantage of specialized programs like the Native American Direct Loan (NADL), there is a VA loan type that can meet their specific requirements. This flexibility ensures that veterans, active duty service members, and eligible spouses have access to affordable and tailored financing solutions that align with their individual circumstances and goals.

Limited eligibility criteria restrict who can qualify for VA loans.

One significant drawback of VA loans is the limited eligibility criteria that restrict who can qualify for these beneficial loan programs. To be eligible for a VA loan, individuals must meet specific requirements related to their military service, discharge status, and length of service. This limitation can exclude certain veterans, active duty service members, and eligible spouses who may not meet the criteria set forth by the U.S. Department of Veterans Affairs. As a result, many deserving individuals who have served our country may find themselves unable to access the benefits of VA loans due to these strict eligibility requirements.

VA funding fee may be required, adding to the overall cost of the loan.

One drawback of VA loans is that a VA funding fee may be required, which adds to the overall cost of the loan. The funding fee is a one-time payment that helps offset the cost of the VA loan program to taxpayers. While this fee allows veterans to secure a loan without a down payment or private mortgage insurance, it can increase the upfront expenses associated with obtaining a VA loan. Veterans should consider this additional cost when evaluating their financing options and budgeting for their home purchase.

Strict appraisal requirements may limit the types of properties that can be financed with a VA loan.

One drawback of VA loans is the strict appraisal requirements, which can limit the types of properties that can be financed with this type of loan. The VA has specific guidelines for property appraisals to ensure that the home being purchased meets certain standards of safety, structural integrity, and overall condition. This can sometimes make it challenging for veterans to finance properties that may not meet these stringent requirements, such as fixer-uppers or unique properties. As a result, some veterans may find their options limited when it comes to choosing a home to purchase using a VA loan.

Potential longer processing times compared to conventional loans.

One significant drawback of VA loans is the potential for longer processing times when compared to conventional loans. Due to the additional steps involved in verifying a borrower’s military service and eligibility for VA benefits, as well as the VA’s appraisal process, the approval and funding process for VA loans can sometimes take longer than traditional mortgage loans. This extended processing time may lead to delays in closing on a home purchase or refinancing, which can be frustrating for borrowers seeking a quick and efficient loan approval process.

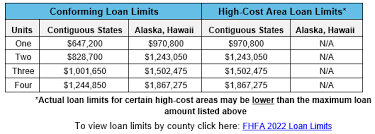

Restrictions on loan limits may not cover higher-priced homes in certain areas.

One significant drawback of VA loans is that the restrictions on loan limits may not cover higher-priced homes in certain areas. This limitation can make it challenging for veterans and service members looking to purchase homes in more expensive real estate markets. In such cases, borrowers may need to cover the price difference with a down payment or explore alternative financing options, which can add complexity to the home buying process. The loan limits set by the VA may not always align with the cost of housing in certain regions, making it important for borrowers to carefully consider their options and financial capabilities when seeking a VA loan for a higher-priced property.