The Benefits of a Second VA Loan

For veterans who have already used their VA loan benefit to purchase a home, the option of obtaining a second VA loan can provide additional opportunities and benefits. A second VA loan, also known as a subsequent use VA loan, allows eligible veterans to use their home loan benefit again to buy another home or refinance an existing mortgage.

One of the key advantages of a second VA loan is that it typically offers more favorable terms and conditions compared to traditional loans. Veterans can often secure lower interest rates, reduced closing costs, and no requirement for private mortgage insurance (PMI), making it an attractive financing option.

Additionally, veterans can use a second VA loan to purchase a new primary residence even if they still have an outstanding VA loan on their current home. This flexibility allows veterans to relocate or upgrade their housing situation without having to sell their existing property first.

It’s important for veterans considering a second VA loan to be aware of the entitlement they have remaining, as this will impact the amount they can borrow without making a down payment. The entitlement is the amount the VA will guarantee on the veteran’s behalf, which influences the maximum loan amount that can be obtained.

Overall, a second VA loan provides veterans with a valuable opportunity to access affordable financing for another home purchase or refinance. By leveraging their VA home loan benefit multiple times, veterans can continue to enjoy the benefits and advantages that come with this unique program.

8 Advantages of a Second VA Loan for Veterans and Military Personnel

- Lower interest rates compared to traditional loans

- Reduced or no requirement for private mortgage insurance (PMI)

- Ability to purchase a new primary residence without selling current home

- Flexible eligibility criteria for veterans and active duty military personnel

- Opportunity to refinance an existing mortgage with favorable terms

- No down payment required for many borrowers due to VA guarantee

- Potential for higher loan limits based on remaining entitlement

- Access to VA resources and support throughout the loan process

7 Drawbacks to Consider Before Taking Out a Second VA Loan

- Reduction in available entitlement limits the amount that can be borrowed without a down payment.

- Potential for higher funding fees compared to first-time VA loans.

- Interest rates on second VA loans may be slightly higher than initial VA loan rates.

- Additional paperwork and documentation required for subsequent use VA loans.

- Limited eligibility for veterans who have already used their VA loan benefit once.

- Restrictions on the types of properties that can be financed with a second VA loan.

- Possible delays in loan processing due to increased scrutiny of multiple VA loan applications.

Lower interest rates compared to traditional loans

One significant advantage of obtaining a second VA loan is the opportunity to secure lower interest rates compared to traditional loans. Veterans can benefit from more favorable borrowing terms, resulting in potential savings over the life of the loan. With reduced interest rates, veterans can enjoy lower monthly payments, making homeownership more affordable and accessible. This cost-saving benefit of lower interest rates underscores the value and financial advantages that a second VA loan can offer to eligible veterans seeking to purchase a new home or refinance their existing mortgage.

Reduced or no requirement for private mortgage insurance (PMI)

One significant advantage of obtaining a second VA loan is the reduced or complete absence of the requirement for private mortgage insurance (PMI). Unlike conventional loans, where borrowers are typically required to pay for PMI if they make a down payment of less than 20%, VA loans do not mandate PMI. This can result in substantial cost savings for veterans, allowing them to secure financing for a second home without the additional financial burden of PMI premiums.

Ability to purchase a new primary residence without selling current home

One significant advantage of a second VA loan is the ability for veterans to purchase a new primary residence without the need to sell their current home. This flexibility allows veterans to explore new housing options, relocate for work or personal reasons, or upgrade their living situation without the stress of having to sell their existing property first. By leveraging their VA home loan benefit for a second time, veterans can seamlessly transition to a new home while maintaining ownership of their current residence, providing them with greater control over their housing decisions and financial stability.

Flexible eligibility criteria for veterans and active duty military personnel

One significant advantage of a second VA loan is the flexible eligibility criteria it offers to veterans and active duty military personnel. Unlike traditional mortgage loans, VA loans have less stringent requirements, making it easier for veterans to qualify for financing. This flexibility allows more veterans and active duty military personnel to access the benefits of a second VA loan, providing them with opportunities to purchase a new home or refinance their existing mortgage with greater ease and convenience.

Opportunity to refinance an existing mortgage with favorable terms

One significant advantage of a second VA loan is the opportunity it provides to refinance an existing mortgage with favorable terms. Veterans can take advantage of lower interest rates, reduced closing costs, and the absence of private mortgage insurance (PMI) when refinancing with a second VA loan. This can result in substantial savings over the life of the loan, making it an attractive option for veterans looking to improve their financial situation and secure more advantageous terms on their mortgage.

No down payment required for many borrowers due to VA guarantee

One significant advantage of obtaining a second VA loan is that many borrowers are not required to make a down payment, thanks to the VA guarantee. This feature can greatly reduce the upfront costs associated with purchasing a home, making homeownership more accessible and affordable for veterans. By eliminating the need for a down payment, veterans can preserve their savings and still benefit from favorable loan terms and conditions, ultimately making the dream of owning a home a reality for many borrowers.

Potential for higher loan limits based on remaining entitlement

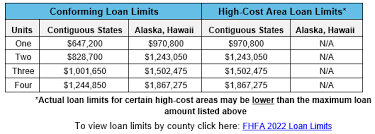

One significant advantage of obtaining a second VA loan is the potential for higher loan limits based on the remaining entitlement of the veteran. The remaining entitlement represents the amount that the VA will guarantee on behalf of the veteran, which directly influences the maximum loan amount that can be borrowed without requiring a down payment. By leveraging their remaining entitlement, veterans have the opportunity to access larger loan amounts, enabling them to purchase a more expensive home or secure additional funds for refinancing purposes. This flexibility in loan limits can provide veterans with greater purchasing power and financial options when considering their housing needs.

Access to VA resources and support throughout the loan process

One significant advantage of obtaining a second VA loan is the access to VA resources and support throughout the loan process. Veterans can benefit from the guidance and assistance provided by the Department of Veterans Affairs, ensuring a smoother and more streamlined experience when securing financing for their home purchase or refinance. From expert advice on eligibility requirements to personalized assistance with paperwork and documentation, veterans can rely on the VA’s support to navigate the loan process with confidence and ease. This valuable resource helps veterans make informed decisions and ensures that they fully leverage their VA loan benefits to achieve their homeownership goals.

Reduction in available entitlement limits the amount that can be borrowed without a down payment.

One drawback of obtaining a second VA loan is that the reduction in available entitlement limits the amount that can be borrowed without a down payment. As veterans use their entitlement for previous VA loans, the remaining entitlement decreases, impacting the maximum loan amount they can qualify for without having to make a down payment. This reduction in available entitlement may require veterans to consider alternative financing options or contribute a down payment to meet the lender’s requirements for loan approval.

Potential for higher funding fees compared to first-time VA loans.

One drawback of obtaining a second VA loan is the potential for higher funding fees compared to first-time VA loans. When using the VA home loan benefit for the second time, veterans may face increased funding fees, which can add to the overall cost of borrowing. These fees are typically higher for subsequent use VA loans as compared to first-time loans, and veterans should carefully consider this factor when deciding whether to pursue a second VA loan. It’s important for veterans to weigh the benefits of a second VA loan against the potential increase in funding fees to make an informed decision that aligns with their financial goals.

Interest rates on second VA loans may be slightly higher than initial VA loan rates.

One potential drawback of obtaining a second VA loan is that the interest rates on these subsequent loans may be slightly higher than the rates offered on initial VA loans. This means that veterans considering a second VA loan may end up paying more in interest over the life of the loan compared to their first VA loan. While VA loans typically offer competitive interest rates compared to conventional loans, it’s important for veterans to carefully weigh the potential increase in interest costs when deciding whether to pursue a second VA loan.

Additional paperwork and documentation required for subsequent use VA loans.

One drawback of obtaining a second VA loan is the increased amount of paperwork and documentation that is typically required. Veterans seeking a subsequent use VA loan may find themselves having to provide additional financial records, such as updated income verification, bank statements, and other documentation to support their loan application. This can create a more time-consuming and potentially stressful process compared to a traditional loan application. The need for extra paperwork can be a deterrent for some veterans considering a second VA loan, as it adds an extra layer of complexity to the borrowing process.

Limited eligibility for veterans who have already used their VA loan benefit once.

One significant drawback of obtaining a second VA loan is the limited eligibility for veterans who have already used their VA loan benefit once. Veterans who have utilized their VA loan benefit may find it challenging to qualify for a subsequent use VA loan due to the restrictions on entitlement remaining. This limitation can hinder veterans from accessing the favorable terms and benefits associated with VA loans, making it more difficult for them to secure financing for another home purchase or refinance.

Restrictions on the types of properties that can be financed with a second VA loan.

One potential drawback of obtaining a second VA loan is the restrictions on the types of properties that can be financed. Unlike the flexibility offered by conventional loans, VA loans have specific guidelines regarding the properties that qualify for financing. For example, certain types of investment properties, vacation homes, and fixer-uppers may not meet the VA’s requirements for a second loan. This limitation can restrict veterans’ options when it comes to using their VA loan benefit for certain property types, potentially limiting their ability to invest in certain real estate opportunities.

Possible delays in loan processing due to increased scrutiny of multiple VA loan applications.

One potential drawback of obtaining a second VA loan is the possibility of experiencing delays in the loan processing timeline. This can occur due to the increased scrutiny that multiple VA loan applications may face from lenders and the Department of Veterans Affairs. Lenders may take more time to review and approve applications for second VA loans, as they need to ensure that the veteran meets all eligibility requirements and has sufficient remaining entitlement. The additional steps involved in verifying a veteran’s entitlement and financial stability for a second loan could lead to delays in the approval process, potentially prolonging the time it takes to secure financing for a new home purchase or refinance.