The VA Loan Disability Benefit: A Guide for Veterans

For veterans with disabilities, the VA loan disability benefit can be a valuable resource when it comes to purchasing a home. This benefit is designed to help veterans with service-related disabilities achieve homeownership with favorable loan terms.

One of the key advantages of the VA loan disability benefit is that eligible veterans may be exempt from paying the VA funding fee, which can result in significant cost savings. Additionally, veterans with disabilities may qualify for a waiver of the VA loan funding fee if they are receiving compensation for a service-connected disability.

Another important aspect of the VA loan disability benefit is that it allows for greater flexibility in qualifying for a home loan. Veterans with disabilities may still be eligible for a VA loan even if they have a lower credit score or higher debt-to-income ratio than traditional mortgage lenders typically allow.

It’s crucial for veterans with disabilities to understand their eligibility requirements and how to apply for the VA loan disability benefit. By working with knowledgeable lenders who specialize in VA loans, veterans can navigate the process more smoothly and take advantage of this valuable benefit.

In conclusion, the VA loan disability benefit is a valuable resource that can help disabled veterans achieve their dream of homeownership. By taking advantage of this benefit, veterans can access favorable loan terms and greater flexibility in qualifying for a home loan. If you are a veteran with a service-related disability, be sure to explore your options and see if you qualify for this beneficial program.

Understanding VA Loan Disability Benefits: Eligibility, Requirements, and Assistance for Veterans

- What is the VA loan disability benefit?

- Who is eligible for the VA loan disability benefit?

- How does the VA loan disability benefit help veterans with disabilities?

- What are the requirements for qualifying for the VA loan disability benefit?

- Are there any fees associated with the VA loan disability benefit?

What is the VA loan disability benefit?

The VA loan disability benefit is a valuable program designed to assist veterans with service-related disabilities in achieving homeownership. This benefit offers eligible veterans exemptions from paying the VA funding fee and provides favorable loan terms to make purchasing a home more accessible. Veterans with disabilities may also qualify for waivers of the VA loan funding fee if they are receiving compensation for a service-connected disability. This benefit offers greater flexibility in qualifying for a home loan, allowing veterans with disabilities to access homeownership opportunities that may otherwise be challenging to obtain through traditional mortgage lenders.

Who is eligible for the VA loan disability benefit?

To be eligible for the VA loan disability benefit, veterans must have a service-related disability that is recognized by the Department of Veterans Affairs. This includes veterans who are receiving compensation for a service-connected disability. Additionally, surviving spouses of veterans who died as a result of a service-connected disability may also qualify for this benefit. It’s important for eligible individuals to understand the specific requirements and documentation needed to apply for the VA loan disability benefit in order to take advantage of this valuable resource for achieving homeownership.

How does the VA loan disability benefit help veterans with disabilities?

The VA loan disability benefit provides valuable assistance to veterans with disabilities by offering favorable loan terms and financial benefits that can help them achieve homeownership. Eligible veterans may be exempt from paying the VA funding fee, resulting in cost savings. This benefit also allows for greater flexibility in qualifying for a home loan, accommodating lower credit scores or higher debt-to-income ratios. By providing exemptions and accommodations tailored to the unique circumstances of disabled veterans, the VA loan disability benefit aims to make homeownership more accessible and attainable for those who have served our country.

What are the requirements for qualifying for the VA loan disability benefit?

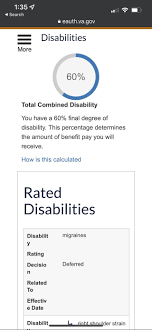

To qualify for the VA loan disability benefit, veterans must meet certain requirements. One key requirement is that the veteran must have a service-connected disability as determined by the Department of Veterans Affairs (VA). The disability must be related to their military service and be recognized by the VA through the disability compensation program. Additionally, veterans seeking this benefit should have a Certificate of Eligibility (COE) from the VA confirming their eligibility for a VA home loan. Meeting these criteria is essential for veterans to access the benefits and advantages offered by the VA loan disability program.

Are there any fees associated with the VA loan disability benefit?

Yes, there are fees associated with the VA loan disability benefit, but eligible veterans with service-related disabilities may qualify for exemptions or waivers. One of the significant benefits is that veterans receiving compensation for a service-connected disability may be exempt from paying the VA funding fee, resulting in cost savings. Additionally, veterans with disabilities may still need to pay other standard closing costs associated with the loan, such as appraisal fees and credit report fees. It’s essential for veterans to understand the fee structure and potential exemptions available to them when utilizing the VA loan disability benefit.